Zscaler (NASDAQ:ZS - Get Free Report) had its target price boosted by research analysts at Royal Bank Of Canada from $315.00 to $335.00 in a report issued on Wednesday,Benzinga reports. The brokerage currently has an "outperform" rating on the stock. Royal Bank Of Canada's price target points to a potential upside of 26.70% from the stock's current price.

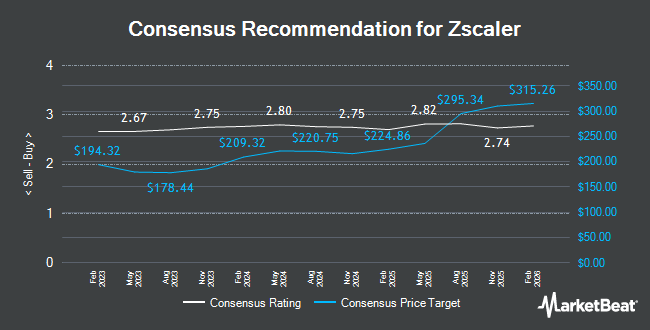

Several other equities analysts have also recently weighed in on the company. Cantor Fitzgerald reaffirmed an "overweight" rating and set a $340.00 target price on shares of Zscaler in a research note on Wednesday. Bank of America increased their price objective on Zscaler from $285.00 to $340.00 and gave the stock a "buy" rating in a report on Monday, June 9th. Wells Fargo & Company upgraded Zscaler from an "equal weight" rating to an "overweight" rating and increased their price objective for the stock from $260.00 to $385.00 in a report on Friday, June 13th. Loop Capital increased their price objective on Zscaler from $250.00 to $260.00 and gave the stock a "hold" rating in a report on Friday, May 30th. Finally, Susquehanna increased their price objective on Zscaler from $320.00 to $340.00 and gave the stock a "positive" rating in a report on Wednesday. One research analyst has rated the stock with a Strong Buy rating, twenty-nine have given a Buy rating and seven have given a Hold rating to the company's stock. According to MarketBeat, the stock presently has an average rating of "Moderate Buy" and a consensus target price of $305.91.

Check Out Our Latest Research Report on Zscaler

Zscaler Trading Down 3.7%

NASDAQ:ZS traded down $10.16 on Wednesday, hitting $264.41. 2,142,495 shares of the company's stock traded hands, compared to its average volume of 2,135,269. Zscaler has a 1 year low of $153.45 and a 1 year high of $318.46. The firm has a 50-day moving average price of $287.86 and a 200-day moving average price of $249.96. The company has a market cap of $41.17 billion, a PE ratio of -1,016.19, a price-to-earnings-growth ratio of 259.58 and a beta of 1.05.

Zscaler (NASDAQ:ZS - Get Free Report) last released its earnings results on Tuesday, September 2nd. The company reported $0.89 earnings per share for the quarter, beating the consensus estimate of $0.80 by $0.09. Zscaler had a negative return on equity of 0.59% and a negative net margin of 1.52%.The company had revenue of $719.23 million for the quarter, compared to analysts' expectations of $707.15 million. During the same quarter in the previous year, the business posted $0.88 EPS. The business's revenue for the quarter was up 21.3% on a year-over-year basis. Zscaler has set its FY 2026 guidance at 3.640-3.680 EPS. Q1 2026 guidance at 0.850-0.860 EPS. On average, research analysts forecast that Zscaler will post -0.1 EPS for the current fiscal year.

Insider Activity at Zscaler

In other Zscaler news, major shareholder Ajay Mangal sold 120,000 shares of the stock in a transaction that occurred on Monday, June 9th. The stock was sold at an average price of $300.89, for a total transaction of $36,106,800.00. Following the transaction, the insider owned 2,550,210 shares in the company, valued at $767,332,686.90. This trade represents a 4.49% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available at the SEC website. Also, EVP Raj Judge sold 2,957 shares of the stock in a transaction that occurred on Tuesday, June 17th. The shares were sold at an average price of $303.70, for a total value of $898,040.90. Following the completion of the sale, the executive vice president directly owned 76,289 shares of the company's stock, valued at $23,168,969.30. This represents a 3.73% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 143,305 shares of company stock valued at $43,199,936. 18.10% of the stock is owned by company insiders.

Institutional Investors Weigh In On Zscaler

Several hedge funds have recently modified their holdings of the business. Parcion Private Wealth LLC boosted its position in shares of Zscaler by 3.3% in the second quarter. Parcion Private Wealth LLC now owns 1,200 shares of the company's stock valued at $377,000 after acquiring an additional 38 shares during the period. Secure Asset Management LLC boosted its position in shares of Zscaler by 1.8% in the second quarter. Secure Asset Management LLC now owns 2,436 shares of the company's stock valued at $765,000 after acquiring an additional 43 shares during the period. Tlwm boosted its position in shares of Zscaler by 1.0% in the second quarter. Tlwm now owns 4,649 shares of the company's stock valued at $1,460,000 after acquiring an additional 44 shares during the period. Sepio Capital LP boosted its position in shares of Zscaler by 0.6% in the second quarter. Sepio Capital LP now owns 8,209 shares of the company's stock valued at $2,577,000 after acquiring an additional 45 shares during the period. Finally, Smartleaf Asset Management LLC boosted its position in shares of Zscaler by 7.5% in the second quarter. Smartleaf Asset Management LLC now owns 648 shares of the company's stock valued at $204,000 after acquiring an additional 45 shares during the period. 46.45% of the stock is owned by institutional investors.

Zscaler Company Profile

(

Get Free Report)

Zscaler, Inc operates as a cloud security company worldwide. The company offers Zscaler Internet Access solution that provides users, workloads, IoT, and OT devices secure access to externally managed applications, including software-as-a-service (SaaS) applications and internet destinations; and Zscaler Private Access solution, which is designed to provide access to managed applications hosted internally in data centers, and private or public clouds.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Zscaler, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zscaler wasn't on the list.

While Zscaler currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.