You may wonder where all this money goes since it is a part of daily life for a commuter. It is worth knowing which companies are getting your hard-earned money and how much of it. You can also profit from rising gas prices if you learn how to invest in oil stocks. By the end of this article, you can learn how to buy oil stocks.

Why Invest in Oil?

With so many different sectors and industries to choose from, what makes oil and gas stocks so attractive to investors?

They can offer outsized upside potential and a steady dividend income if you buy stock in oil. The world's oil supply is shrinking. While electrification grows, most cars run on oil and an internal combustion engine. Prices increase as oil demand grows against a dwindling supply, which drives oil stocks higher. Oil stocks can rise even as crude oil prices fall if a geopolitical event threatens the world's oil supply, like the Russia-Ukraine war.

Blue-chip oil companies have been paying dividends consistently for decades. Oil tends to march to its drummer, as do oil stocks, which enables investors to diversify their portfolio by having an uncorrelated investment that can sometimes act as a hedge against a falling stock market. A hedge occurs when you take a position in an inversely correlated asset to the portfolio. As the portfolio falls in value, the hedged asset simultaneously rises to offset some or all losses. This proved the case in 2022 as oil stocks gained as a hedge against the falling stock market.

Overview of the Oil Industry

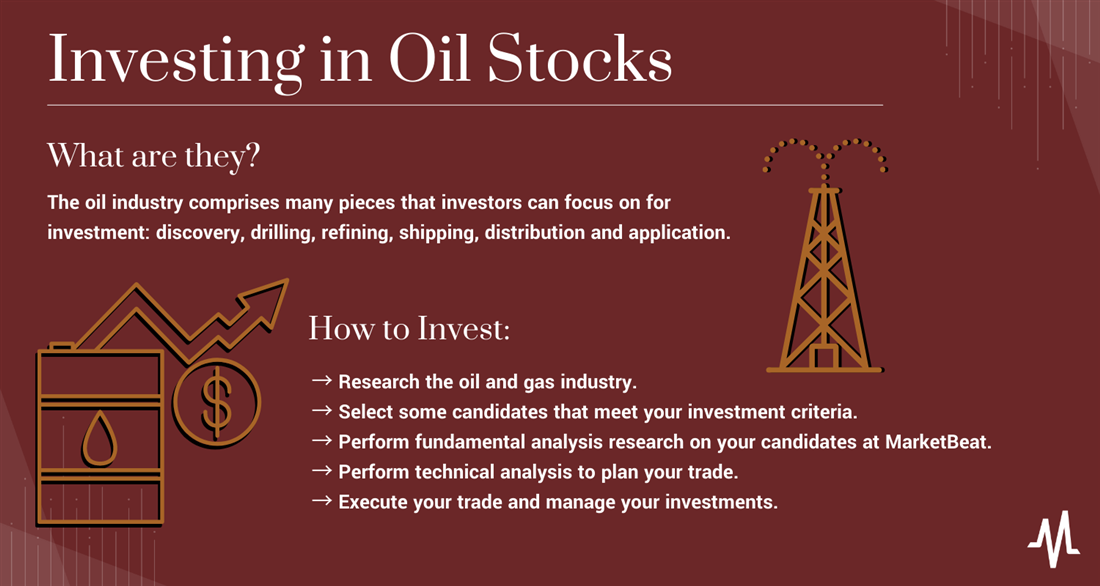

The oil industry comprises many pieces that investors can focus on for investment. Consider the discovery, drilling, refining, shipping, distribution and application processes. First, the oil needs to be discovered.

Once discovered, the oil needs to be drilled and extracted, which the oil drillers do. Once the oil comes from the ground or sea, it has to be transported by shipping and logistics companies, trucks, tankers and pipelines to be refined. Refineries process crude oil into usable forms like gasoline and diesel fuel. The usable fuels then go to gasoline stations, airports, and other distribution platforms to end users like commuters and passengers. Each piece of this sequence involves many companies, and investors can look for oil investments.

How to Buy Oil Stocks

Once you decide to take the plunge, learning to invest in oil pays. Here are the steps to take when you're ready to buy oil stocks.

Step 1: Research the oil and gas industry.

Familiarize yourself with the industry by keeping abreast of news, reading research reports and learning more about the oil processing sequence. Consider concentrating your investments on specific parts of the industry. Some oil companies partake in more pieces than others. These vertically integrated oil stocks tend to be more expensive than companies focusing on just a portion of the industry, but you are getting more stability for the price. In your research, you can find some of the best oil stocks on MarketBeat as a starting point.

Step 2: Select some candidates that meet your investment criteria.

As you do your research, you should run across some stocks in the oil industry. It helps to compile a list of criteria that you are looking for. It can be a combination of profitability, growing revenues, stable dividends, blue chip large capitalization or riskier small market cap and price range. You can start your search for potential investment candidates with MarketBeat's oil and energy stocks list. The goal is to start with many and narrow down to one or two oil stocks that fit your risk profile and investment goals. As you narrow down the candidates, it's time to do the legwork and research the companies.

With your list of candidates, it pays to have a reliable research plan. Fundamental analysis pertains to researching the company and the business operations. Look at its most recent earnings report to gauge if revenues and profits are growing, flat, or falling. Read the latest press releases and analyst recommendations. Look at financial ratios like price to earnings (P/E ratio), price to sales, price to cash flow, price to book ratio and quick ratio to see how the stock trades compared to the industry and your other candidates. Having multiple candidates helps when comparing and contrasting financial ratios. Look at insider trading to see if insiders are buying or selling shares. Take a look at the news articles.

Watch the short interest, especially if it's high, which is 20% or higher, which could indicate a sign of trouble or offer the potential for a short squeeze. You can find all this information on MarketBeat by typing in the symbol. A quick look at the MarketBeat MarketRank Forecast™ provides a snapshot of the company.

The next part of your research is technical analysis. This is the study of the stock's price action using charts. Remember that a company's fundamentals can be strong, but the stock may be weak, and vice versa. Stock prices can be influenced by factors affecting the overall stock market, the industry, and its peers. News about the company itself may not be the only thing affecting its price.

Technical analysis focuses solely on price movement, not the reason behind the price move. Reading the charts helps to identify the price trend, which is the direction of the stock (up, down, or sideways). It can help identify support levels and prices with a concentration of buyers buying the pullbacks. It can help identify resistance levels which are price levels with a concentration of sellers selling into rising prices.

Candlestick charts help provide a roadmap for the stock since they record historical price action to gauge the potential future price action. You will find that stocks tend to move as a group with their peers. Similar stocks tend to behave similarly. You will notice this phenomenon called correlation. When stocks move in the same direction, it's a positive correlation. When they move in opposite directions, it's called a negative correlation. It is prudent to note each candidate's correlation with their peers and the stock market.

Technical analysis aims to determine where the stock has been (history) to understand where the stock can go moving forward. Based on these numbers, you can decide at which prices you can buy the stock.

Step 5: Execute your trade and manage your investment.

After determining your entry price, stop-loss, and target price, it's time to execute the trade with your broker. Try to avoid chasing the stock at the highs of the day. It helps to be patient and wait for the stock to come down to the price levels you are comfortable buying.

Once you are in a position, checking it periodically for news is prudent. Placing trade alert alarms at specific prices can help you manage your trades when you can't be present to watch the action. Remember to take profits at target price levels and take stop-losses if those price levels hit.

As the stock moves, these levels may change depending on the trend. It's a good idea to adjust targets and stops periodically. If you're profitable, it's prudent to have trailing profit stops. You sell some stock at these price levels to protect the gains.

Ethical Issues of Investing in Oil

Oil has been controversial, from the methods used to drill the oil to the environmental pollution caused by the end user. It's also a hot topic when it comes to geopolitical events. Wars have been fought because of oil. There's much history that can have ethical consequences. Separating personal feelings and opinions from objective stock analysis and research is essential. Ethical issues can stir up emotions. If they are too much, then consider investing in other industries. Stock market investing is best done without emotional influence to remain objective and disciplined to react if fundamentals or technicals change.

Pros and Cons of Investing in Oil

Here are some pros and cons to consider when investing in oil stocks.

Pros

The upside of an investment in oil stocks includes:

- Potential for gains: The potential for outsized gains is a significant reason for buying oil stocks. When oil stocks rise, they can continue to trend for an extended period. This can work both ways, trending higher or trending lower.

- Stable income potential: Dividends from blue chip oil stocks can provide a stable income. They have stood the test of time through boom and bust markets and strong and weak economies.

- Diversification opportunities: Diversification helps to hedge your portfolio. Oil stocks, including rising interest rates, can outperform the market during macroeconomic uncertainty. This was evidenced by their strong performance in 2022 as the U.S. Federal Reserve raised interest rates aggressively.

Cons

The downsides of investing in oil stocks can come from many different angles:

- Volatility: Volatility can be high with oil stocks. With so many outside influences, including OPEC and geopolitical tensions, oil stocks can react first and follow through afterward.

- Geopolitical risk: Geopolitical risk can impact oil stocks up and down. News of oil-producing nations and the threat of impacting the global oil supply can cause rapid and substantial reactions.

- Prices tied to crude oil: Oil stocks are tied to the price of oil. Since oil is a commodity, oil futures are the first instrument to move. Whatever affects the price of crude oil will likely pull oil stocks with it.

Future of Oil Stocks

With the global decarbonization movement, the world and automotive industry is migrating to electric vehicles. This may impact the use of oil in the future, but it may also help offset the shrinking oil supply. The risk of civilization moving away from using oil has been overblown. There's also the impact of regulatory changes, as the government may add more restrictions To reduce greenhouse gases. As long as you manage your stock investments by staying abreast of the news and executing profit and loss stops, you shouldn't be surprised if oil usage falls.

OPEC's Influence on Oil Stocks

Often referred to as the oil cartel, the Organization of the Petroleum Exporting Countries (OPEC) comprises 13 countries. These countries meet twice yearly to set oil production quotas among the member nations. Their decisions impact the global supply of oil, which can move prices.

FAQs

Here are some of the common frequently asked questions.

Is investing in oil stocks a good idea?

Yes, it can be a good idea, depending on your time frame and investing goals. It's never a good idea to impulsively jump into oil stocks without thorough research and a game plan. It's also prudent to seek advice from an investment professional.

How can I invest in oil with little money?

For small accounts, you can start by investing in oil exchange-traded funds (ETFs) to get a diversified range of stocks in the oil industry. You can also invest in fractional shares if your broker offers that option. Lastly, consider taking options trades to benefit from upside potential, but the downside risk is much higher, with the potential to lose all of your investment.

How to invest in oil and gas companies?

You must have a brokerage account to invest in oil and gas companies. Many zero-commission brokers with mobile apps can onboard new accounts within minutes. Once you open and fund your brokerage account, you can participate in the research and advance toward investing in the oil and gas industry.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

They believe these five stocks are the five best companies for investors to buy now...