Innovation is alive and well, if you use the U.S. IPO market as your gauge.

This year is proving to be the most active since 2000 for companies going public. With about 100 new IPOs expected before year’s end, the grand total for the year could top 375.

And yes, the comparison to 2000, when the market bubble burst with a deafening bang, is something to be aware of.

However, there’s a truism with IPOs that also applies to every area of investing: Trying to predict what market conditions may be in the future is often a fool’s errand that results in a high opportunity cost.

That said, let’s take a look at how three 2021 IPOs are performing.

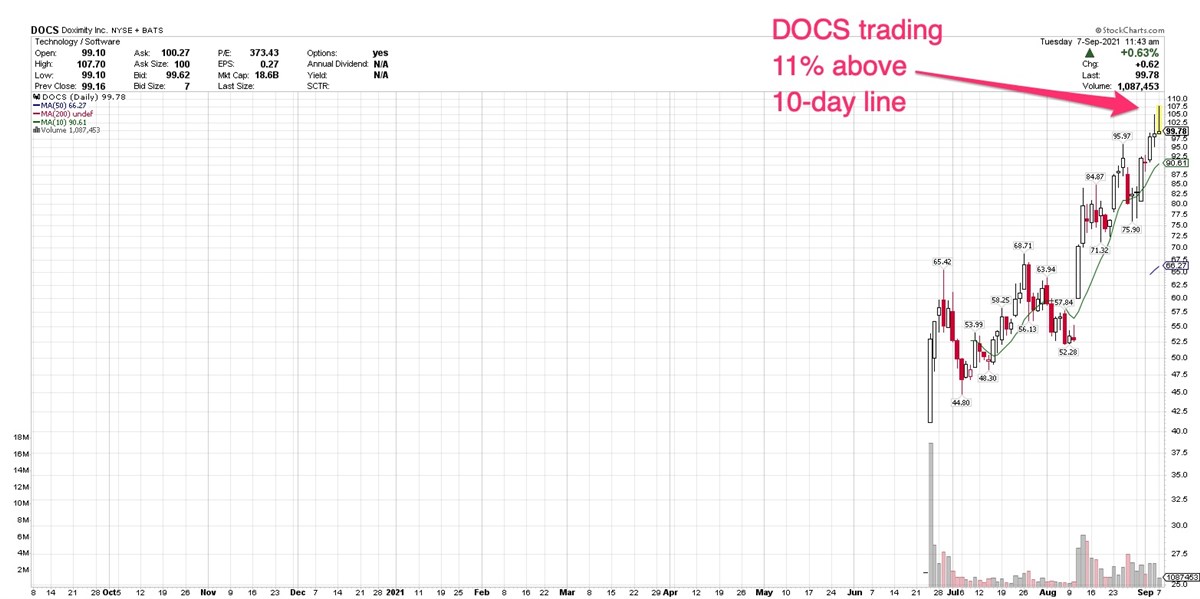

Doximity NASDAQ: DOCS offers a good example of how niching down can be a solid business strategy. The San Francisco-based company provides a cloud-based networking platform for medical professionals.

It offers members a central site for industry news, telehealth apps and tools, and ways to collaborate on cases.

The stock went public on June 24 at $26, and ended the session at $53. It rallied to a June 29 high of $65.42 before pulling back into its post-IPO base. After reporting earnings on August 11, the stock really took off.

Year-over-year earnings grew 700%, to $0.08 per share. It was the fourth quarter in a row of triple-digit profit increases. Revenue was $72.7 million, double last year’s number. Revenue growth accelerated for consecutive quarters.

Doximity is well extended from a buy point right now, with shares rallying to a new high of $107.70 Tuesday before pulling back intraday. The stock is currently trading 11% above its 10-day moving average, meaning it’s best to wait for the next pullback before attempting to buy shares.

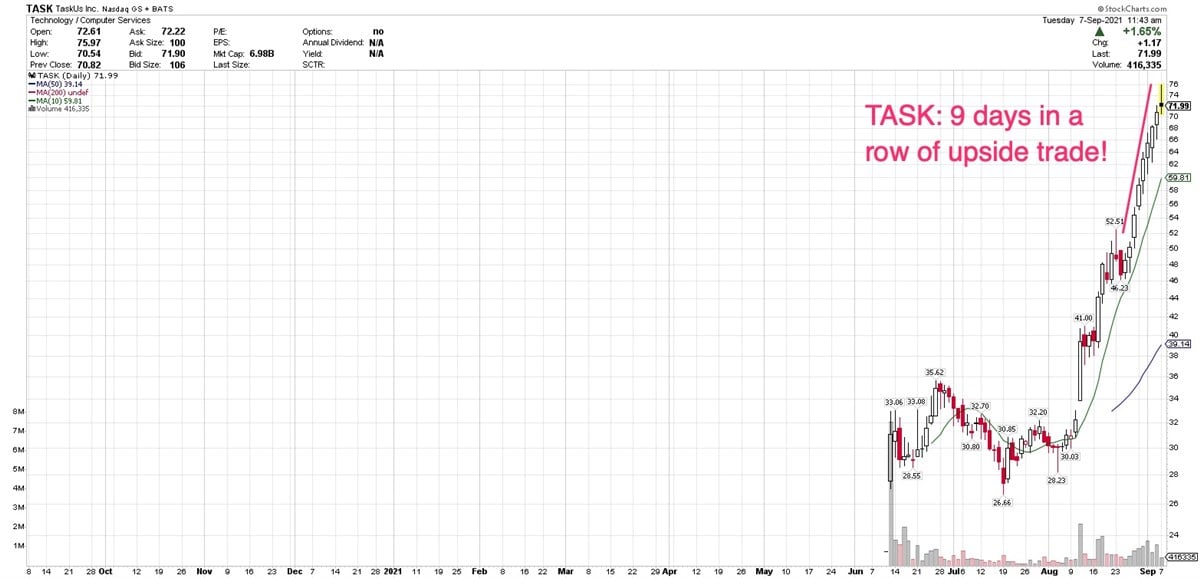

If you think Doximity is a fast riser, check out Taskus’ NASDAQ: TASK chart. The stock went public on June 11 at 23, and has risen 213% in its short life as a public company.

Taskus provides digital outsourcing for tech companies.

The stock is up 135.52% in the past month. Tuesday marked the ninth session in a row with upside trade, although as the broader market declined early in the session, Taskus and other stocks gave up some early gains.

The company’s revenue growth certainly supports the level of optimism. Sales grew at double-digit rates in the past eight quarters, with year-over-year increases ranging from 26% to 58%.

The company has been profitable since 2016, although there have been quarters where earnings growth declined. However, particularly with a newer company, it’s understandable that earnings may fluctuate as the company puts resources into fast growth.

With the stock trading 19% above its 10-day average, and 83% above its 50-day, it’s clearly not a great time to hop onto the momentum train. As always, I’d advise waiting for either a new base or a pullback to a key moving average before making an investment.

Finally, SEMrush NYSE: SEMR, which went public on March 25, is up 45.72% in the past month. The company helps business customers drive traffic and improve their online presence through content distribution via social media and Web sites. It also helps its customers measure their marketing campaign effectiveness.

The stock has formed two bases since going public at $14. It cleared its most recent cup-shaped base on August 27, when it passed a June 24 high of $26.31 in slightly below-average volume. In the next session, turnover increased to 26% above average as the stock added to its gains.

Like Taskus and Doximity, SEMrush is trading too far above key moving averages to be a “buy” contender at this time. However, that can change quickly, and this company’s fundamentals make it watchlist-worthy.

SEMrush is rapidly growing revenue, with double-digit increases in the past six quarters, and revenue growth acceleration in the past four. It’s yet to notch a profit, but often, newer fast-moving techs with strong revenue growth are good candidates for buying.

Before you consider SEMrush, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SEMrush wasn't on the list.

While SEMrush currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report