As the technology sector continues to drive the market's impressive surge this year, it becomes crucial to familiarize ourselves with the leading and most popular tech-focused exchange-traded funds (ETFs). Understanding their highest-weighted players and unique offerings can provide valuable insights into the sector's dynamics, given its current leadership in the market.

As tech's dominance remains evident, exploring these ETFs becomes essential for investors seeking to capitalize on the sector's potential future growth and impact on overall market performance.

You might be wondering, why should I invest in an ETF when I can just focus on an individual stock? Investing in ETFs offers instant diversification, reducing risk and providing cost-efficiency compared to single stocks. ETFs also offer liquidity and accessibility to a wide range of assets, making them suitable for seasoned and novice investors. So with that being said, let's take a closer look at three popular tech-focused ETFs.

Invesco QQQ NASDAQ: QQQ

The Invesco QQQ is a leading ETF and arguably the most popular technology-focused ETF. QQQ is an excellent choice for investors seeking diversification, exposure to Nasdaq-100 Index, and growth potential in top technology companies.

The fund offers low fees, tax advantages, and the convenience of passive investing with a diverse range of assets. QQQ has a dividend yield of 0.56% and a net expense ratio of 0.20%.

The ETF is up 44% year-to-date and has dramatically outperformed the benchmark S&P 500 by over 20%. The ETF has over 51% exposure to the technology sector, with 18.1% exposure to the semiconductors industry and 17% to the software industry. Geographically, the ETF focuses predominantly on U.S. companies, with a 99.2% exposure to the U.S.

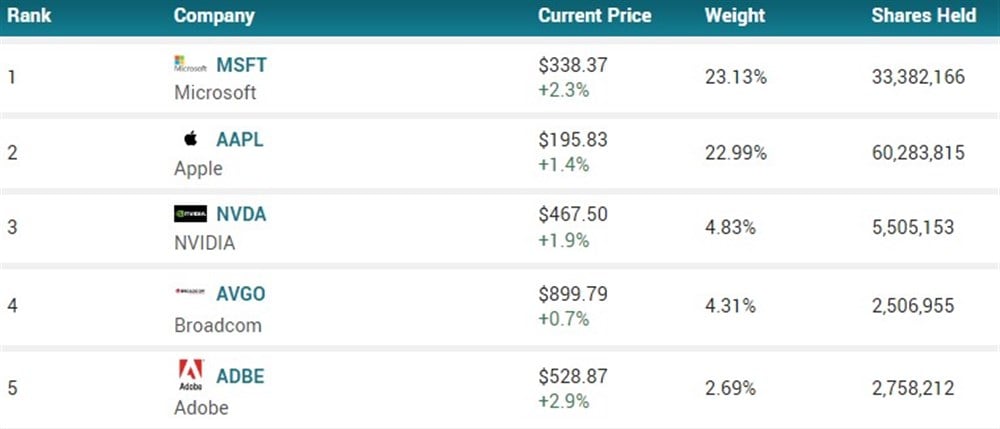

QQQ Top 5 Holdings

Technology Select Sector SPDR Fund NYSE: XLK

The XLK ETF aims to match the performance of the Technology Select Sector of the S&P 500 Index. The fund passively invests in stocks related to IT consulting, semiconductor equipment, computers, telecommunications, and wireless services.

The fund currently has $51.54 billion in assets under management, a dividend yield of 0.72%, slightly higher than the QQQs, and a net expense ratio of just 0.10%.

Like the QQQs, XLK mainly focuses on U.S. companies, with a 96.3% U.S. geographic exposure. The ETF has a 96.9% exposure to the technology sector, with 37.5% software industry exposure, 26.9% communications equipment industry exposure, and 25.3% in semiconductors industry exposure.

Year-to-date, the ETF is up 43%, and with its vast exposure to the technology sector, it's no surprise that it has vastly outperformed the S&P 500 index.

XLK Top 5 Holdings

ARK Innovation ETF NYSE: ARKK

ARKK is an actively managed ETF that seeks to provide investors with exposure to disruptive and innovative technologies that have the potential to shape the future. The ETF invests in companies across various sectors, such as healthcare, robotics, the Internet of Things (IoT), and artificial intelligence.

The fund has $9.08 billion in assets under management, a considerably higher expense ratio of 0.75%, and no dividend yield.

Unlike the XLK or QQQ, ARKK has spread its sector exposure across various industries. The ETF has a 23.9% sector exposure to technology, 19.3% to consumer discretionary, and 16.2% to health care. Its top four industry exposures are software at 12.9%, automobiles at 10.3%, IT services at 10.3%, and consumer products at 8.9%.

Year-to-date, the ETF boasts a staggering return of 58%, up almost 38% over the last three months.

ARKK Top 5 Holdings

Before you consider ARK Innovation ETF, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ARK Innovation ETF wasn't on the list.

While ARK Innovation ETF currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.