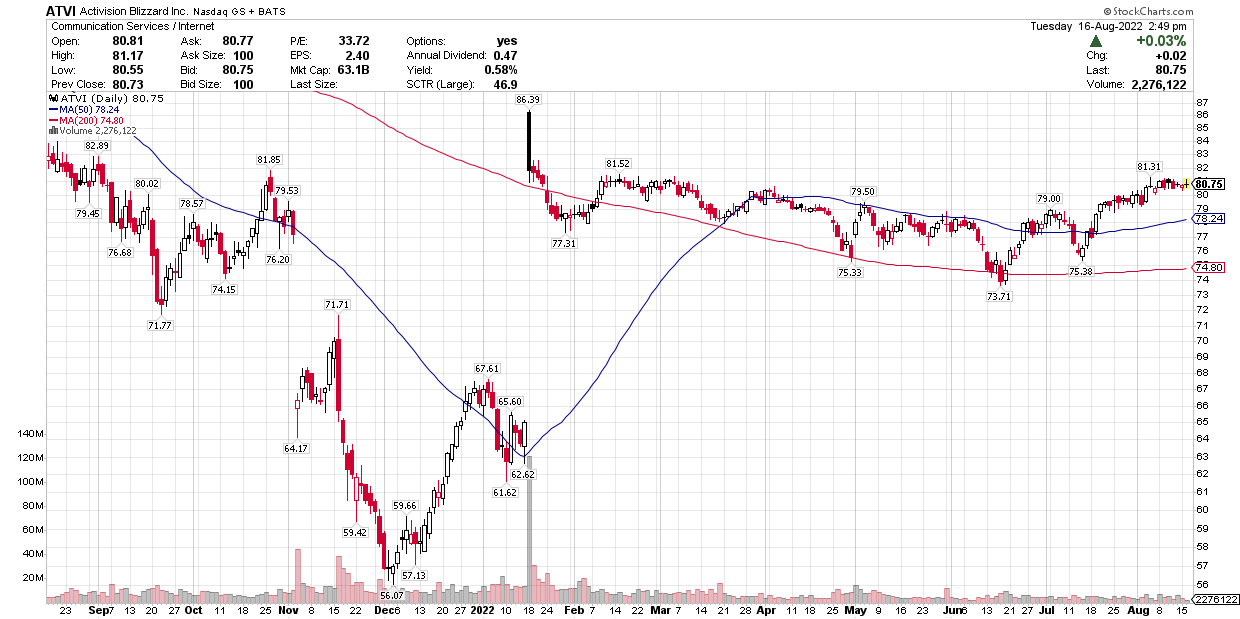

In the second half of 2018, the stock of video game giant Activision Blizzard (NASDAQ: ATVI) was flying at all-time highs up over $80 a share. Since 2012, shares had rallied over 600% and looked unstoppable. But then the rally stopped and the bubble burst.

Activision’s top competitor, Electronic Arts (NASDAQ: EA), had been sliding hard since that July and the former’s stock finally started to feel some heat coming into the late autumn. Increasingly negative press and consumer sentiment concerning the ‘loot box’ business, slowing industry-wide sales along with light guidance from management helped fuel a multi-month industry-wide correction that sent big-name shares down anywhere from 30-50% by last February. At their low point, Activision shares were trading hands for close to $40 a share.

However, they were able to steady the ship around there and consolidate for about six months. They started to move higher last August and in a rally that’s still underway, they moved above the $60 mark this month.

Promising Earnings

The company’s Q4 earnings, released after last Thursday’s session, should go a long way to helping to keep the recovery going. EPS and revenue both beat analyst expectations and even though the latter showed a year on year contraction, it was still enough to send the stock up 2% during Friday’s session to its highest level since November 2018. It looks as if management believes the darkest of the days are behind them and in a sign of growing confidence they increased the company’s dividend by almost 11%.

CEO Bobby Kotick said “our fourth-quarter results exceeded our prior outlook for both revenue and earnings per share. Our recent Call of Duty success illustrates the scale of our growth potential, as we expanded the community to more players in more countries on more platforms than ever before. With our strong content pipeline across our franchises and momentum in mobile, esports, and advertising, we look forward to continuing to delight our players, fans and stakeholders in 2020 and beyond.”

And it’s not only management who are starting to feel optimistic again. The likes of Piper Sandler, Morgan Stanley, and Stifel have all been out with fresh ratings to the upside in the past couple of weeks as weight seems to be lifted off the industry as a whole. They like the look of its upcoming game schedule and have been pleasantly surprised with the performance of the latest Modern Warfare offering.

Compared to Peers

Coming into a fresh week of trading, it will certainly be shares of Activision who start with a lighter step. Take-Two Interactive Software (NASDAQ: TTWO), best known for their Grand Theft Auto series, received a dirty downgrade on Friday as analysts were unimpressed with the ability of its upcoming titles to compensate for a bad earnings miss that morning. Shares were down over 11% by the end of the session and investors will surely be wishing they chose the Activision horse instead for 2020.

However, they’ll have had the best of it over the previous 18 months as shares of Take-Two fell the least out of the big three and rebounded the fastest. Since July 2018, Activision and EA are still both down over 20% while Take-Two are only down 11%. Going into last Friday’s session, the latter was only down about 4%.

That being said, while Take-Two rode out the volatility in style, the current momentum is with Activision and the stock looks ready and willing to continue its recovery. Shares have just filled in the gap from an ugly gap down in November 2018 and there’s little in the way of a move towards the $70-80 range. RSI is only around 60 and the MACD looks about to be on the verge of a bullish crossover so it’s all to play for.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.