Optical network and communications equipment provider

ADTRAN NASDAQ: ADTN stock has been surging along with other

networkers as the insatiable need for more broadband and connectivity accelerate from

re-opening tailwinds. The

5G rollout is a major tailwind along with multiple federal agency initiatives to build out broadband

infrastructure to serve rural communities. With the anticipation of more funding with the nearly $2 trillion Biden infrastructure bill, the tailwinds for accelerated growth is tremendous. Prudent investors seeking an affordable broadband infrastructure play can monitor shares of ADTRAN for opportunistic pullback levels to consider exposure.

Q4 Fiscal 2020 Earnings Release

On Feb. 4, 2021, ADTRAN reported its fiscal Q4 2020 results for the quarter ending December 2020. The Company reported earnings-per-share (EPS) of $0.11 versus consensus analyst estimates for $0.07, a $0.04 beat. Revenues rose 12.4% year-over-year (YoY) to $130.1 million, beating analyst estimates for $127.77 million. The Company declared a cash dividend of $0.09 per-share. ADTRAN CEO and Chairman Tom Stanton commented, “We saw substantial growth in our Tier-1 and Tier-3 service provider segments in the U.S. and a solid increase in fiber deployments in Europe. We expect that our fiber access solutions will continue to be adopted by customers around the world.”

Conference Call Takeaways

CEO Tom Stanton, set the tone, “During the quarter, we had four 10% customers, one of the highest numbers we’ve ever reported. Each of these customers percentage of total revenue was in the low-double digits, pointing to the success of our diversification efforts. Of these, there was one service provider customer and three distribution partners. These distribution partners serve hundreds of regional service providers in the U.S. market with a mix of broadband access and connected home and enterprise solutions further reinforcing our success that we are having with both customer and portfolio diversification.” The Company also added 35 new service providers in the quarter for a total of 134 for the year. The fiber access portfolio and software platforms are a compelling value proposition for customers seeking to upgrade their networks.

Broadband Growth

Growth was driven by Tier-2 U.S. regional broadband providers, accounting for 85% YoY growth and fiber access and aggregation business grew 98% YoY, with in-home services delivery platforms up 68% YoY and cloud services up 46% YoY. Europe saw strong growth as favorable funding and regulatory factors are driving the buildout of fiber access networks as evidenced by the 54% YoY growth driven by investments in 10-gig fiber access networks. To combat the extended lead times, ADTRAN has maintained elevated inventory levels resulting in increased freight costs. The Company was able to reduce non-GAAP quarterly operating expenses by 19% or $12 million through disciplined expense management. CEO Stanton concluded, “The shift to gigabit enabled fiber access networks will also drive further demand for gigabit-capable cloud-managed wireless mesh connectivity in the home or business providing material additional growth opportunities for ADTRAN as an end-to-end broadband solutions provider.”

Federal Broadband Infrastructure Buildout

ADTRAN is looking to benefit from the Federal initiatives to provide fiber to rural communities as part of the infrastructure buildout initiative. This includes the FCC’s Rural Digital Opportunity Fund (RDOF), which announced 180 winning bids in the December 2020 Phase 1 auction. The winning bidders will receive a total of $9.2 billion in funding over a 10-year period to build out broadband access to over five million homes, of which 85% will have gigabit broadband speeds. ADTRAN seeks to provide the winning bidders with its portfolio of products and services. Prudent investors can monitor for opportunistic pullback levels to consider scaling in exposure in this compelling broadband infrastructure play.

ADTN Opportunistic Pullback Levels

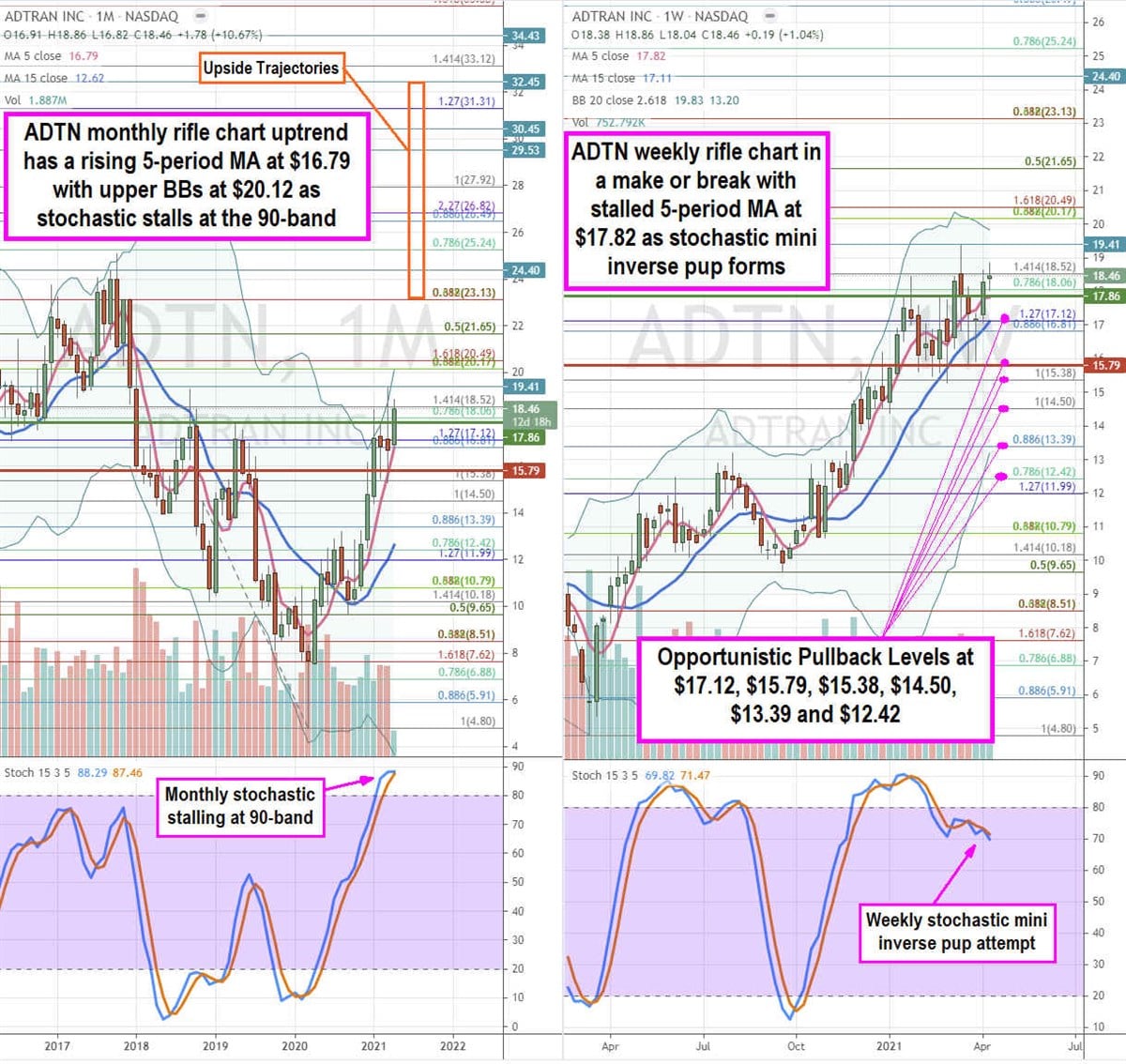

Using the rifle charts on the monthly and weekly time frames provides a precision view of the landscape for ADTN stock. The monthly rifle chart has an active uptrend with a rising 5-period moving average (MA) support at $16.79 with monthly upper Bollinger Bands (BBs) near the $20.14 Fibonacci (fib) level. The monthly stochastic is stalling near the 90-band setting up a climactic mini pup or a crossover down. The weekly market structure low (MSL) buy triggered on the breakout above $17.86, while a weekly market structure high (MSH) triggers below $15.79. The weekly rifle chart has been choppy as shares have breached both the flat 5-period MA at $17.82 and the rising 15-period MA at $17.11 for the past month. The weekly stochastic is starting to form a mini inverse pup but won’t trigger until the weekly MSH triggers. This make or break will take some time to resolve. Prudent investors can monitor for opportunistic pullback levels at the $17.12 fib, $15.79 weekly MSH trigger, $15.38 fib, $14.50 fib, $13.39 fib, and the $12.42 fib. Upside trajectories range from the $23.13 fib up to the $32.45 level. Keep an eye on CSCO and JNPR as a networker peer tend to move together as a group.

Before you consider ADTRAN, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ADTRAN wasn't on the list.

While ADTRAN currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for July 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.