Shares of PDD Holdings NASDAQ: PDD, a global, multinational commerce group formerly Pinduoduo Inc., have sharply risen over the previous six months, up over 100%.

The stock has been on an impressive run since May last year, steadily climbing higher and maintaining its uptrend. During that period, the company saw its market valuation soar to almost $200 billion, and its stock had a P/E ratio of 32.93. Despite the rapid ascent, its RSI of 61 indicates that the stock is not in overbought territory.

Moreover, from a technical analysis perspective, the stock is shaping up for a potential breakout as it consolidates in a tight range near its 52-week high.

So, for a stock that might not be as widely popular as other high-performing NASDAQ tickers, should it demand further attention given its recent run and favorable technical setup?

Well, let's take a closer look at what this company does and other important factors to consider.

What is PDD Holdings?

PDD Holdings Inc., a multinational commerce group, manages a range of businesses. One of its key platforms is Pinduoduo, an e-commerce website offering diverse products like clothing, electronics, food, furniture, and more. Another venture under its umbrella is Temu, an online marketplace. The company aims to connect businesses and individuals to the digital economy. Originally known as Pinduoduo Inc., it rebranded as PDD Holdings Inc. in February 2023.

Temu fuels growth for PDD

The company's impressive earnings and appreciation of its share price have seen it surpass Alibaba Group's NYSE: BABA market capitalization and become the most valuable Chinese e-commerce company.

Temu's parent company, PDD, outperformed expectations in its third-quarter earnings, reporting revenue higher than forecasted due to robust sales across its e-commerce platforms in China and internationally. This success was propelled by significant discounts that bolstered sales, particularly on the Chinese discount online retailer Pinduoduo and its international arm, Temu. The expansion of Temu across 48 countries, including Europe, the Middle East, South East Asia, and Australia, contributed substantially to the company's revenue growth.

Leveraging its reputation for affordable prices, Pinduoduo experienced increased demand, notably before the Singles Day shopping event in China. In the third quarter, PDD recorded revenue of 68.84 billion yuan, surpassing analysts' expectations of 54.59 billion yuan. Additionally, the company's net income attributable to ordinary shareholders rose to 15.54 billion yuan, up from 10.59 billion yuan compared to the same period the previous year.

The sentiment and analyst ratings

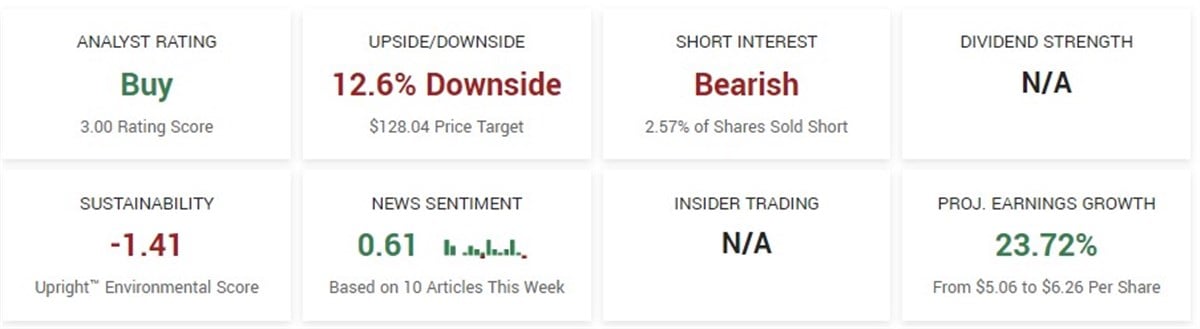

PDD is a Top-Rated stock with a Buy rating based on the ten analyst ratings. Impressively, PDD's Buy rating is above the consensus rating of Hold for retail/wholesale companies and the consensus rating of S&P 500 companies, which is also a Hold.

However, unlike the consensus price target for retail/wholesale companies and the S&P 500, which calls for an upside, PDD's price target forecasts a 12.6% downside. PDD has a high forecast of $215 and a low forecast of $95.50.

So far this year, only one analyst has taken action on the stock. On January 2, Benchmark boosted its target for PDD from $190 to $215, forecasting an upside of over 48% on the report date.

The setup in PDD

Following its steady climb last year, the discount retailer's shares have spent several weeks consolidating at its 52-week highs. Over this period, a bullish pattern has emerged, with $150 acting as the critical resistance and the breakout level. Notably, the stock has made higher lows, forming an ascending wedge on the daily chart.

Going forward, $150 becomes the all-important level, and if the stock can break above this level with authority, its uptrend and impressive ascent may continue as the stock begins a new higher leg.

Before you consider PDD, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PDD wasn't on the list.

While PDD currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.