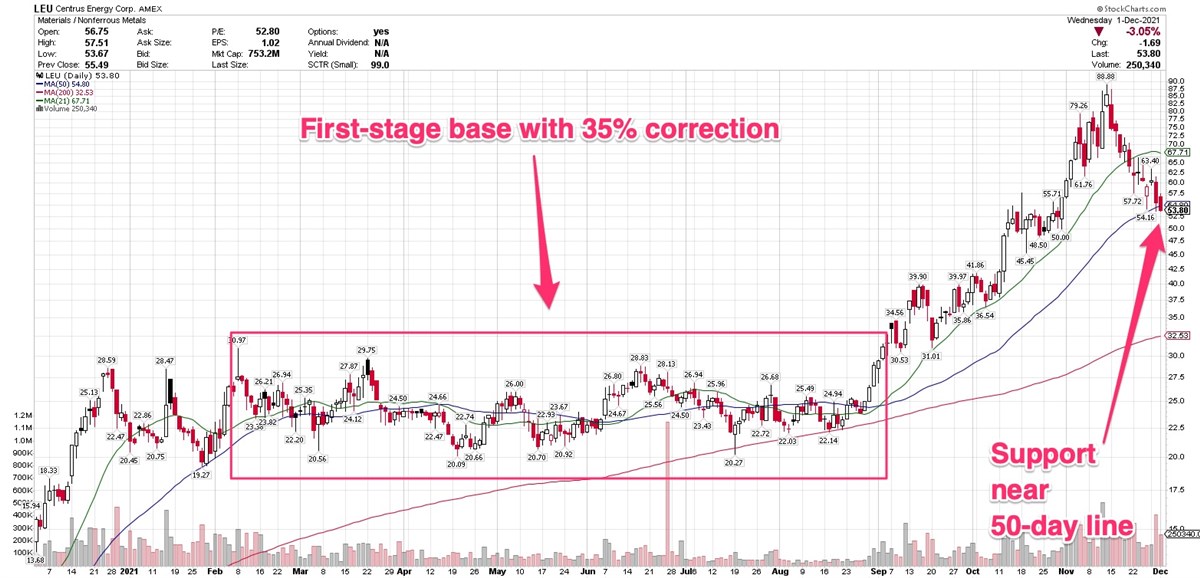

Uranium refiner Centrus Energy NYSEAMERICAN: LEU is finding support near its 50-day moving average after pulling back from a November 12 high of $88.88.

It’s gotten a boost as uranium spot prices have risen in the past seven months.

The company reported its third-quarter on November 10, earning $2.95 per share, up from a loss of $0.83 per share in the year-ago quarter. That trounced views, which called for earnings of $0.42 per share.

Revenue came in at $91.3 million, up 172%.

In addition to refining uranium, Centrus operates the first U.S.-licensed production facility for high-assay low-enriched uranium fuel (HALEU) at its enrichment facility in Piketon, Ohio.

According to a June news release, “The U.S. Department of Energy (DOE) is currently supporting a three-year, $170 million dollar cost-shared demonstration project with Centrus. The company has already built 16 advanced centrifuge machines for uranium enrichment and expects to begin HALEU production by early next year.”

Next-gen Nuclear Power

While it may not be immediately clear to the uninitiated, HALEU represents a next-generation form of nuclear power, something the Biden administration is eager to prioritize. It’s efficient and cleaner than previous nuclear fuels, giving the company a competitive advantage.

Although Centrus is a small stock, with a market capitalization of just $736.8 million, it’s been publicly traded since 1998.

The stock broke out of a second-stage base in early September, clearing a buy point above $31 in more than double normal turnover.

As is often the case with small caps, Centrus is a volatile stock, with a beta of 1.52. That means investors and traders must use extra caution, have stops in place and be ready to pull the plug if necessary.

On November 15, the day the stock skidded from its all-time high, Roth Capital analyst Joseph Reagor downgraded Centrus from buy to neutral. Shares slipped more than 12% in the session, on double average turnover.

However, Reagor also boosted his price target for Centrus to $57. Given the current support at the 50-day line, and the stock’s inherent volatility, that price target doesn’t seem difficult to reach, particularly in a time frame going out 18 months from now.

While few analysts cover the stock, those who do expect Centrus to earn $4.25 per share this year, up 646% from 2020. However, that’s expected to decline sharply next year.

"Looking forward, we are going to stay focused on pioneering the emerging market for HALEU, winning new sales, delivering strong margins, and strengthening our balance sheet," said Daniel B. Poneman, Centrus president and CEO in the earnings statement. "We are pleased with continued progress on the High-Assay, Low-Enriched Uranium demonstration program and positive momentum in our LEU segment."

Focus Heading Into 2022

While on some level that sounds like canned earnings report commentary, it does offer a strong clue as to the company’s focus heading into 2022, as well as indicating that Centrus may be putting resources into expanding the market for HALEU, rather than actively increasing the rate of profitability.

In the earnings release, the company elaborated on the business segment revenue, which clearly showed the LEU segment has the upper hand.

“Revenue from the LEU segment increased $13.3 million in the three months and $2.5 million in the nine months ended September 30, 2021, compared to the corresponding periods in 2020,” the company said.

“Revenue from uranium sales decreased $5.7 million in the three months and $10.5 million in nine months ended September 30, 2021, compared to the corresponding periods in 2020. For the nine-month period, the volume of uranium sold declined 48% and the average price increased 6%,” it added.

This stock is not currently in a buy zone, although the moving-average support is potentially a good sign, and makes this stock worth watching.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report