Carvana NYSE: CVNA, an e-commerce platform for buying and selling used cars, is set to report its first-quarter earnings tomorrow after the bell. CVNA shares have been stuck in neutral since the turn of the calendar – rising interest rates appear to be the culprit.

In case you aren’t aware, higher interest rates hurt high-flying growth stocks disproportionately because most of their cash flows are projected to come far into the future.

But if Carvana reaches its full potential as a company, higher interest rates – assuming nothing crazy happens in the bond market – won’t be able to hold the stock back.

A look at Carvana’s recent performance gives us a sense of the company’s long-term potential. But at the same time, it shows where Carvana has some work to do.

Carvana’s Sales Exceeded Expectations in Q4, But Earnings Missed

In the fourth quarter, Carvana generated $1.83 billion in revenue, up 65% yoy and above consensus estimates of $1.6 billion. Earnings were a different story, with Carvana’s 87 cents per share loss even worse than Wall Street’s expectation for a 47 cents per share loss.

That strong revenue growth combined with an earnings-per-share loss was no anomaly. For full-year 2020, Carvana grew revenue 42% yoy to $5.59 billion, but lost $2.63 a share.

You’d love to see better earnings, but Carvana is moving in the right direction. 2020 was the seventh straight year of EBITDA margin improvement for Carvana. Management expects to extend that streak to eight years in 2020.

Carvana’s rising gross profit per unit (GPU) is largely responsible for the improving EBITDA margin. In 2020, the used car platform also increased GPU for the seventh consecutive year. And it’s not like Carvana’s GPU is inching higher; it has increased $400 or more for each of those seven years and currently stands at more than $3,000.

If Carvana hopes to continue improving its margins, it will need to buy a large percentage of its inventory direct from customers. By doing that, Carvana is able to get cars for a lower price than at auction, where the company is forced to bid against a number of interested buyers.

Top-line growth is another path to profitability, since fixed costs are spread out as more units are sold. Carvana, it turns out, is likely to experience a lot of top-line growth moving forward.

Carvana Has Potential… Serious Potential

There were 38.4 million used vehicle sales in 2020, down 6% yoy. Carvana sold 244,111 vehicles to retail buyers in 2020, up 37%. That means that Carvana handled just one out of every 157 used car transactions.

Buying a used car through a vending machine isn’t for everyone, but you can bet that millions of people are unhappy with the traditional used car buying process. Who likes getting pressured by pushy used car salesmen or spending hours scrolling through Craigslist?

Yes, there are other alternatives, but Carvana may be the most convenient. And they are all over the place. Carvana recently announced that it would offer as-soon-as-next-day touchless home delivery to Ogden, Utah residents. Ogden is becoming the 279th city to get that delivery service.It’s impossible to say just how big Carvana will get. But if the company eventually handles one out of every ten used car transactions – which seems pretty reasonable – its sales would rise more than tenfold from here.

How Should You Play Carvana?

Carvana is trading at 5.6x forward sales and the company is not expected to turn a profit in 2021. But the magnitude of Carvana’s opportunity makes shares a good long-term risk-reward.

But is now the time to get in?

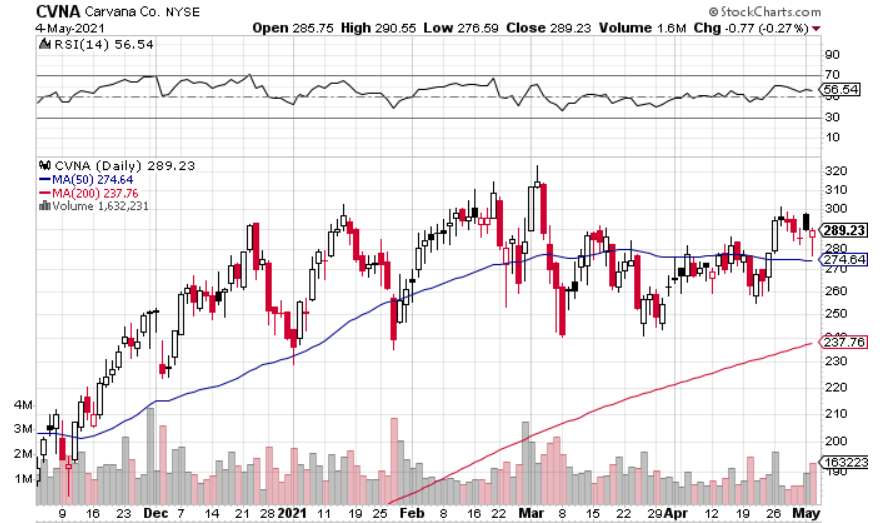

To answer that, let’s first turn our attention to the chart.

On April 26, Carvana broke above $290 a share on high volume. Over the previous six weeks, shares had been rangebound between around $240 and $290. In the six sessions since the breakout, CVNA shares have pulled back to the 50-day moving average on light volume, culminating in a reversal on high volume yesterday.

While shares still face resistance in the $310 to $320 range, Carvana looks primed for a rally towards those levels – from a purely technical standpoint. But with earnings set to be released tomorrow, it may be best to sit on the sidelines. If Carvana beats expectations, and shares eclipse the recent highs, you can consider getting in. And if that doesn’t happen, then nothing lost.

Before you consider Carvana, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carvana wasn't on the list.

While Carvana currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report