Entegris NASDAQ: ENTG

Entegris NASDAQ: ENTG is an example of a company that provides products or services to another industry and can benefit from the latter’s growth. For example, copper producer

Freeport McMoRan NYSE: FCX sells to electric vehicle producers, which can boost its fortunes.

Entegris develops, manufactures, and markets micro-contamination control products, specialty chemicals, and advanced materials handling solutions for the semiconductor industry, as well as others. It serves a global customer base.

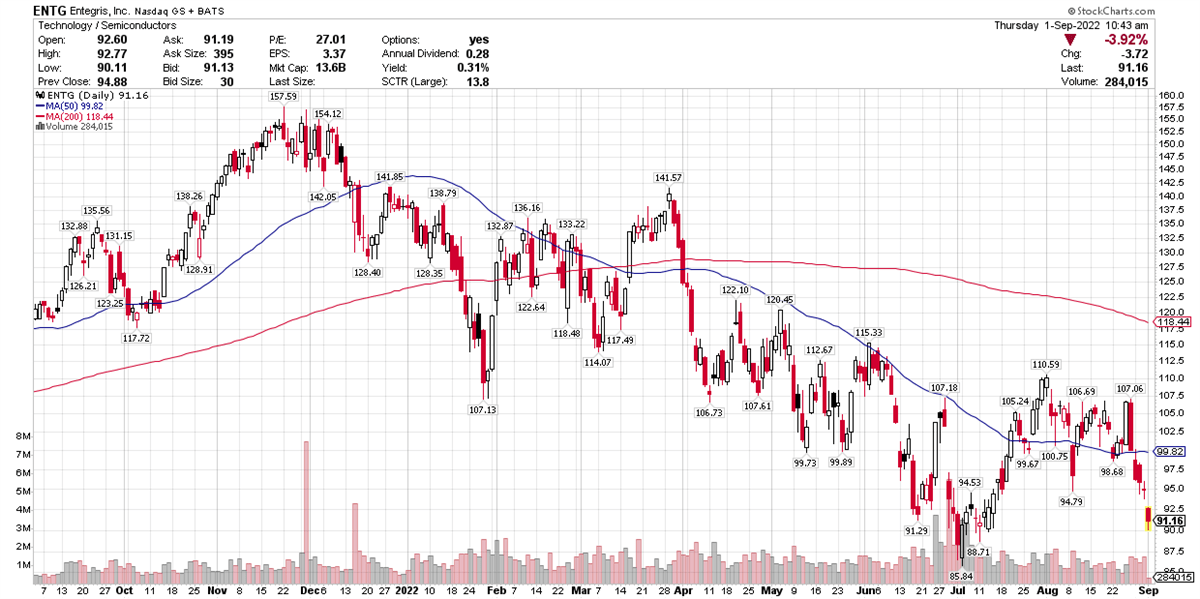

Like so many other companies, it’s been in a correction since late last year. Shares are down 30.61% so far this year, and there haven’t been many shorter-term gains to make investors happy.

So what’s to like about this stock?

Analysts’ consensus rating is a “moderate buy,” as you can see on MarketBeat’s analyst ratings page. The price target is $146.10, a 53.98% upside.

Driving that optimism is a history of double-digit earnings and revenue growth over the past eight quarters. Trailing 12-month revenue is $2.56 billion, reflecting growth in the past two years. Wall Street expects earnings per share of $4.24 this year, which would be an increase of 23%. Next year, that’s seen growing by another 14%, to $4.85 per share.

Of course, anything having to do with semiconductors is known to be cyclical, so those estimates can change. But for the moment, the fundamentals look promising.

The company reported second-quarter results on August 2. Among the highlights:

- Sales grew 21% from the year-ago quarter to $692.5 million, topping consensus estimates, as you can see using MarketBeat’s earnings data for the stock.

- The adjusted gross margin contracted 160 basis points to 44.8%, and the adjusted operating margin was essentially flat, at 26.4%. This is not the kind of news that makes big investors happy.

- Earnings of $1.00 per share missed analysts’ consensus estimate of $1.05 a share. Again, not something investors like seeing.

- Entegris generated $110.9 million in operating cash flow and held $2.7 billion in cash and equivalents.

In a statement accompanying the earnings release, CEO Bertrand Loy said: "Sales growth and operational execution were once again very strong in the second quarter ... Non-GAAP EPS was slightly below our expectations in the second quarter, primarily due to a significant decline in a few major currencies versus the U.S. dollar."

The company guided toward sales between $1 billion and $1.04 billion in the current quarter, higher than the consensus estimate of $811.2 million.

Entegris shares skidded 3.79% the week of the report, and dropped 13.67% in August.

Fizzling Along With The Market

As a whole, semiconductor equipment makers have been losing ground in tandem with the broader market, an attempted rally fizzling in mid-August.

The stronger dollar has affected other stocks in this industry besides Entegris. For example, the largest semiconductor equipment maker, by market cap, is Netherlands-based ASML Holding NASDAQ: ASML.

That stock declined 14.71% in August. It initially advanced after its most recent earnings report, on July 20, but topped out as the broader market stumbled.

However, analysts identify specific problems facing the company. On August 29, Morningstar’s Abhinav Davuluri wrote, “Based on recent strengthening of the U.S. dollar relative to the euro (with both currencies effectively at parity), we are lowering our USD-denominated fair value estimate for wide-moat ASML to $696 per share from $761 per share.”

Davuluri added that he was maintaining the Euro-denominated fair-value estimate of EUR 696 per share.

Analysts have a “moderate buy” rating on the stock, according to MarketBeat data. The consensus price target is $777.43, a potential upside of 62.80%.

Seasoned investors are aware that semiconductor manufacturing and related services tend to go through boom or bust cycles. However, like most industries, there’s an element of following the broader market that tends to affect performance. Even if these stocks show promise for the future (and we all know the need for semiconductors isn’t going away in our lifetimes), it’s often a good idea to wait for a stock to gain some upside momentum, rather than trying to catch the proverbial falling knife.

Before you consider Entegris, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Entegris wasn't on the list.

While Entegris currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.