Desktop Metal Suffers From High Expectations

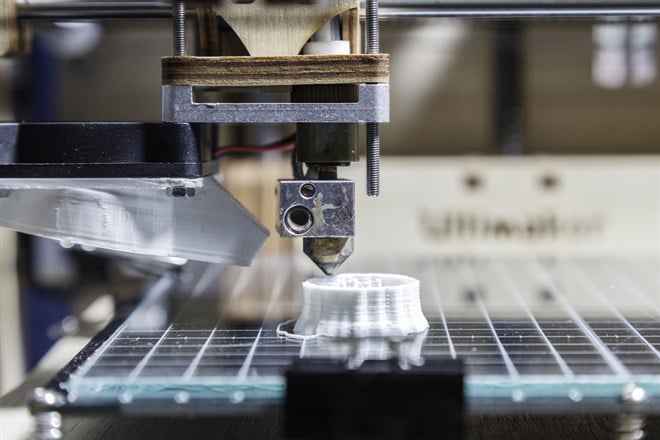

We like Desktop Metal (NYSE: DM). The company is a leader in 3D printing with a focus on what they call Manufacturing 2.0. Manufacturing 2.0’s end goal is creating end-use parts with 3D printing technology from a wide variety of materials and at a low cost. As of the end of the quarter, the company was offering 225+ 3D printing materials including wood, polymers, and applications for the dental profession. If you are looking to buy into Manufacturing 2.0 and/or the 4th Industrial Revolution we think this company is well-positioned for growth and trading at extremely attractive levels. Think about it, a machine technology that can be automated to rapidly create end-use parts as part of a larger IoT connected network? The applications are endless.

“Revenue growth accelerated as we captured strong organic momentum and inorganic opportunities,” said Ric Fulop, Founder and CEO of Desktop Metal. “Continued innovation in our core business, coupled with our inorganic strategy, strengthens our ability to grow our product portfolio, expand the high-volume applications we can offer customers, and increase our category leadership. We are well positioned to execute on our long-term growth strategy focused on Additive Manufacturing 2.0 for high-volume, end-use parts.”

Desktop Metal Has Mixed Quarter, Shares Fall

Desktop Metal actually had a very good quarter but one that came in mixed in the eyes of the analysts and market. The company produced a whopping 233% YOY growth and 35% sequential growth to top the consensus by 1400 basis points. The problem, for the market at least, is that GAAP earnings fell far short of the mark despite the earnings strength. While bad, the miss in earnings is due more to the $56 million non-cash impairment related to warrants than anything else. Other than that, GAAP losses are driven by the product line expansion, investment in growth, and acquisition of Adaptive3D all of which we view as net-positive.

The takeaway for us is that revenue is accelerating and expected to continue accelerating through the end of the fiscal year, and adjusted margins are rapidly improving. Adjusted gross profit improved by $3.3 million to $0.60 million to come in at 5.3% of sales. The rapid acquisition of new customers is helping to drive the margin improvement which should stick in the coming quarters. The company says it onboarded more new customers in Q1 2021 than in all of 2020 which we take for a very good indicator of future business. As for earrings, the company’s Q1 GAAP earnings of -$0.25 missed the consensus by $0.13 but did little to alter the company’s guidance.

Desktop Metal is expecting to see revenue come in the range of $100 million for the year which assumes robust sequential improvements over the next three quarters. The problem here is that despite the robust Q1 revenue increase and beat, the guidance is only as expected. With the Q1 results so far above the consensus, this is a bit of a letdown for the market.

The Technical Outlook: Desktop Metal Is Trying To Bottom

Price action in Desktop Metal looks like it is trying to put in a bottom. The action leading into the Q1 report looks like a Double-Bottom but resistance at the EMA is preventing the full reversal. The Q1 results are helping matters much and have price action down about 10% in early trading. If buyers don’t step in at this level we may see price action fall to $10.50 in the very near term. If that happens we would be buyers of this stock with the outlook triple-digit gains might be had over the next year or two.

Before you consider Desktop Metal, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Desktop Metal wasn't on the list.

While Desktop Metal currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Summer 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.