Spanish chicken

restaurant chain operator

El Pollo Loco NASDAQ: LOCO shares have recovered to pre-pandemic levels after collapsing to multi-year lows during the March 2020 sell-off with the benchmark

S&P 500 index NYSEARCA: SPY. The stock is up against a key resistance level heading into its Q2 2020 earnings. The Company has expanded its menu to include reformulated plant-based chicken and vegan options to ride the alternative meat trend. While the momentum is strong, risk-tolerant investors may want to consider taking a stake at opportunistic pullback price levels after the release. The recent earnings season template has been for stocks to run up into earnings and then a sell-the-news reaction despite strong numbers.

El Pollo Loco Q1 2020 Earnings Release

On April 30, 2020, El Pollo released its first-quarter fiscal 2020 results for the quarter ending March 2020. The Company reported earnings of $0.16 per share versus consensus analyst estimates of $0.10 per share, a $0.06 per share beat. Revenues came in at $105.16 million beating analyst estimates of $102.51 million, but down (-3.5%) year-over-year (YoY). The Company went into 2020 with January and February YoY comps at up 3.7% and 4.2%, respectively before the COVID-19 pandemic struck in March to drop the comps down (-1.5%) for the month. However, sales have only slipped to (-10%) of YoY sales in April, faring much better than the restaurant industry averages.

COVID-19 Adaptive Sales Channel Structure

El Pollo is well-suited for the new normal sales channel model necessary to adapt to the COVID-19 era. The Company historically generates 78% of its sales off-premise through drive-through (45%) and take-out (30%) and delivery (3%). While sales took an initial drop by (-30%) by the end of March 2020 due to isolation mandates, they have been able to recover to (-10%) by the end of April sequentially. Credit has to be given to the structural foundation of its sales distribution model.

Cumulative Effects of Digital Migration

The Company beefed up its digital platform and marketing. In April, El Pollo introduced limited-time free delivery to encourage and acclimate customers to delivery and online ordering options. Delivery sales hit record levels during this campaign. Since families are spending more time at home due to stay-at-home mandates, the Company rolled out more family meal promotions and marketing at the $20 sweet spot price point to much success. The by-product was a boost in their loyalty and rewards program engagement. The Company plans on rolling out value meals at the $5 price point with five new combo deals in September 2020. Digital migration has prompted the El Pollo to bolster marketing efforts to social and digital media which now accounts for 20% of the market budget. The Company also drew down on its $150 credit revolver to add $34.5 million cash liquidity as a measure of caution.

Restarts and Rollbacks

As isolation mandates are lifted, the Company has experienced more traffic with in-restaurant dining. While the surge of COVID-19 infections cases in hotspots including Texas, Alabama and Florida may hurt competitors, El Pollo is well suited for any potential rollbacks due to the heavy concentration on assimilating its customers to mobile ordering and off-premise sales. The pandemic phase enabled the Company to drive potentially lost in-dining sales to other channels like drive-through, take out and delivery. Same store sales have seen 3% to 5% spikes incrementally during family dinner promotion periods, which the Company can use to offset rollbacks. They have used the pandemic to accelerate their digital transformation model which will remain sticky after the pandemic. E-commerce business has tripled, and loyalty program participation reached double-digit participation levels in April. While the fundamentals continue to improve, investors should administer patience to refrain from chasing the stock.

LOCO Price Trajectories

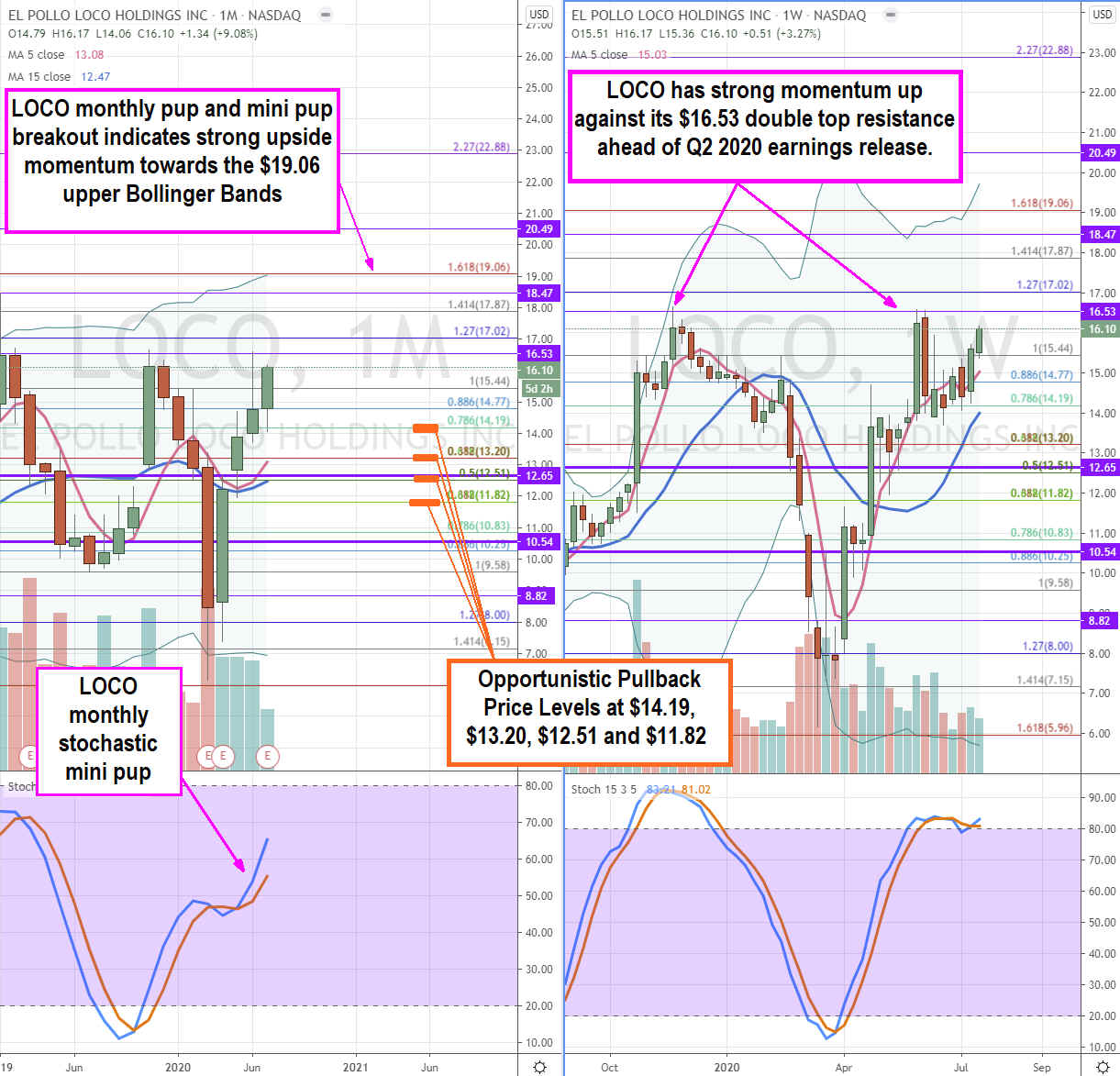

Using the rifle charts on the monthly and weekly time frames provides a broader view of the landscape for LOCO stock. The weekly rifle chart formed a market structure low (MSL) buy above $12.65 and the weekly MSL trigger formed above $10.54. The monthly rifle chart has a powerful double-barrel pup formation composed of a pup breakout and stochastic mini pup which targets the monthly upper Bollinger Bands (BBs) at the $19.06 Fibonacci (fib) leveltarget. The weekly also has a daily pup breakout attempt as it nears that double-top area at $16.53. Clearly the momentum is strong on this one, but investors should be aware of a sell-the-news reaction upon earnings release. Rather than chasing shares higher, it would be more prudent to wait for opportunistic pullback entry levels at the $14.19 fib, $13.20 monthly 5-period MA/fib, $12.51 sticky 2.50s zone/fib, and $11.82 overlapping fib. The bar has been set high heading into the July 30, 2020, earnings release. Any warnings or shortfalls from the April 2020 levels of 90% YoY sales recovery could trigger profit takers, therefore, pay attention to the pullback levels for better entries.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.