Whirlpool NYSE: WHR

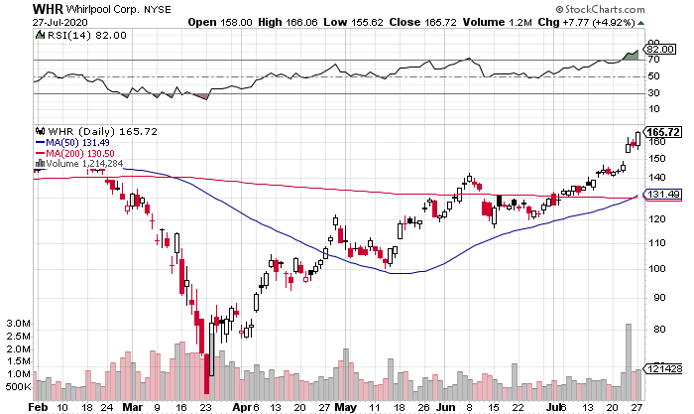

Whirlpool NYSE: WHR shares broke out to 52-week highs on Thursday after reporting better-than-expected Q2 earnings and full-year guidance. After closing down slightly on Friday, shares tacked on further gains in Monday’s session, surging nearly $8 to over $165 a share.

At first glance, Whirlpool’s Q2 numbers look bad. Its net sales of $4 billion were down 22% yoy. Its EPS (on a GAAP basis) came out to $0.55, down 47% yoy. But these numbers both beat expectations. The market had priced in an extremely poor year for Whirlpool. Now that Whirlpool, a leader in the home appliance industry, sees brighter days ahead, shares have responded positively.

Taking A Look Under the Hood

North America performed well, relatively speaking, with sales down 12.5% yoy. The stimulus checks were deemed responsible for much of the outperformance, as many customers seemingly used the checks to buy home appliances. But Whirlpool struggled in Asia (sales down 37% yoy) and Latin America (down 51% yoy). Those two regions accounted for around 25% of Whirlpool’s sales last year, but that number is tracking at just 17% this year due to the huge decline relative to North America.

Whirlpool saw its order pipeline increase in late Q2 moving into early Q3, giving it confidence for the remainder of the year. The company now anticipates 2020 sales to decline 7-12%, a sizeable improvement over previous expectations of a 10-15% decline.

In its Q2 earnings call, management said that margins have held up better during the current crisis compared to the 2008 crisis. In 2008, EBIT margins dropped to around 3.5% and bottomed out at around negative 1%. But in Q2, the quarter that should turn out to be the worst of the pandemic-related crisis, Whirlpool recorded ongoing EBIT margins of over 5%.

Whirlpool is implementing $500 million in cost savings to help weather the storm. During the earnings call, CEO Marc Robert Blitzer gave some color on that move:

“We are very confident on our $500 million total cost takeout for 2020. And as we said in the prepared remarks, $500 million or more of which $150 million is roughly raw material. I wouldn't call that structural. And of the remaining $350 million, there is about $100 million, which are non-structural like furloughs or travel expense reduction, whereas $250 million structural actions, which we largely implemented in the second quarter, that's what the 80% refers to, which of course, will have an impact – had some impact already in Q2, but the large impact is in the second half.”

Whirlpool is expecting positive cash flow going forward, but even if business takes an unexpected turn for the worse, its current $2.5 billion cash position and $2.5 billion available in remaining committed credit facilities give it ample liquidity in the event of an unexpected slowdown.

Valuation

Whirlpool is trading at around 13x projected 2020 earnings and 10.5x projected 2021 earnings. While long-term earnings and revenue growth has pretty much been flat, the P/E ratio is appealing even if the company doesn’t grow much, if it all, going forward. It’s even more attractive considering many of the alternatives in a frothy market.

The company has temporarily suspended its share repurchases. However, its dividend of a little over 3% remains in effect, a solid yield in this market.

Where Can You Get In?

Whirlpool had a very deep V-shaped move, particularly for a home appliance company. From early-February to mid-March, shares lost roughly 60% of their value, bottoming out at $63.26 a share. As stated earlier, shares are now around $165, nearly tripling in a little over four months.

Shares are quite extended now, as evidenced by an RSI that is well into overbought territory.

Ideally, you would see a tight consolidation over a period of two or three weeks, culminating in a high-volume breakout.

Alternatively, you could bite the bullet and get in now; shares are an excellent value at current levels. It’s easier to buy a stock with an extended chart if the value is clear vs. buying a high-flying tech stock with huge revenue growth but low (or no) earnings.

The 50-day moving average just crossed over the 200-day moving average, which is a bullish sign. But both moving averages are around 20% below WHR’s current share price. If you want to limit your downside, you’d have to pick a somewhat arbitrary number 5-10% below your purchase price.

The Final Word

Whirlpool shares show clear value, but the chart doesn’t offer a clear entry point. You can either get in now or take a wait-and-see approach. Either way, keep an eye on Whirlpool; shares have an excellent risk/reward profile at current levels.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report