There’s A Lot Of Good News Out There

There’s A Lot Of Good News Out There

The stock market is often an irrational beast and never more so, seemingly than when it is discounting a future event. Take, for instance, the recent correction. The correction was sharp and swift, not because the economy was in decline but because of an expectation that it would.

What made the correction so wild, what took the market down to its deepest low in over a decade, was the unknown. We didn’t know how bad the pandemic would impact economic activity so the market prepared for the worst.

Now, the market is rising and seemingly, again, for no reason. Earnings are in the dumper, the outlook for S&P (SPY) EPS growth this year is the worst on record, and the outlook is incredibly uncertain. Despite those facts, there are glimmers of hope that point not only to an economic rebound but to a new all-time high for the S&P 500.

#1) Economic Reopening - The Rebound Has Begun

Regardless of your opinion of the economic reopening, it is happening and it means a couple of things for the stock market. First and foremost, it means that businesses will be able to begin generating some cash flow and produce, hopefully, some profit. If nothing else, businesses can at least offset the costs of shut-downs in preparation for a fuller reopening later in the year. Retailers like Kohls (KSS) have about 50% of their stores open and are expecting close to 100% reopening by mid-year/early 3rd quarter. At the same time, reopening means people are going back to work. Not everyone will go, some folks I hear make more on unemployment than working, and some are still leery of the virus, but enough will to impact the data in terms of employment and consumer health.

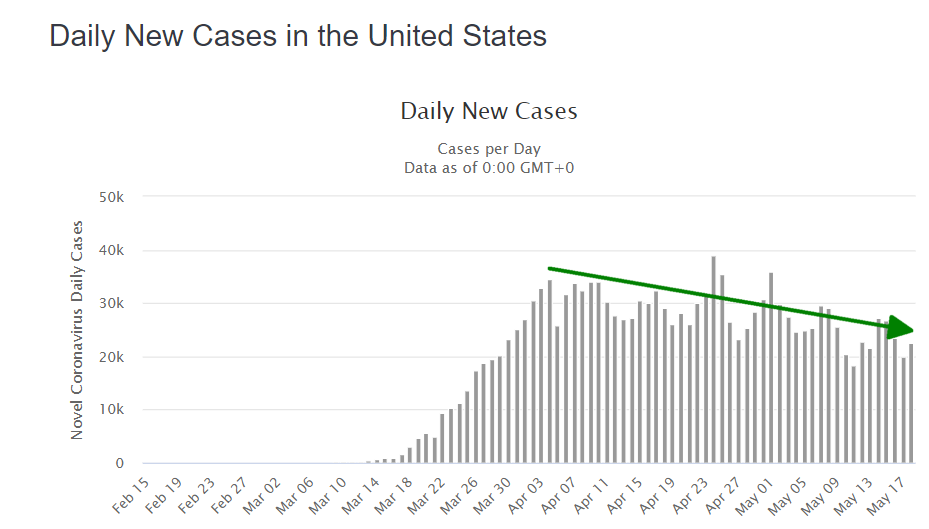

#2) COVID-19 Is On The Ropes

Not to paint too optimistic a picture on things but it looks like we are on the downslope of this pandemic in a couple of ways. First, at least in the U.S., the number of new daily cases continues to trend lower suggesting our containment/curve-flattening efforts are working. That could change but until the data shows it that’s where we are. Second, there are a number of positive developments in the search for treatments and cures that are lifting spirits. The reopening is one thing but if we can lick the issue and send it packing the economy will be back to game-on-Donkey-Kong.

- Moderna (MRNA)- Moderna is perhaps the leader in the search for a vaccine. The company reported favorable Phase 1 results proving the drug’s potential. Not only is the treatment tolerable by humans, but the test subjects also showed increasingly positive effects in tandem with higher doses.

- Sorrento Therapeutics (SRNE)- Sorrento announced the isolation of an antibody that can 100% inhibit the activity and replication of COVID-19. While not a preventative, and yet to be approved or even confirmed by peer review, the discovery could lead to a full economic recovery well ahead of the 18 to 24 months predicted by most economists and health officials.

#3) The Earnings Outlook - It’s Pretty Bullish

The earnings outlook for 2020 is toast, I’ve already said that, but the market is already looking beyond the present toward the future. Not only is the outlook for this year beginning to brighten, but the outlook for next year is outright fantastic. Every single S&P 500 sector will see at least a 5% expansion in EPS next year with many looking at vastly greater improvement. Sectors like the Consumer Discretionary, Materials, and Industrials are going to see their earnings and revenue grow more than 40% and reclaim virtually all the missed income from 2020. And the outlook continues to improve.

#4) The Bonus Reason - The Technical Outlook Is Bullish

The reopening, the drugs, and the outlook are lifting the market’s spirits and you can see that in the charts. The S&P 500, since bouncing off of a strong secular-grade support zone, has been rebounding in-line with the secular trend and set up to move higher.

Most recently, the index retested support at the short-term moving average where support confirmed, the index bounced, and a post-correction high was set. The new high is supported by the indicators, both stochastic and MACD, which are showing bullish crossovers that are, again, in-line with the prevailing secular trend.

The near-term outlook is bullish but the next target for resistance is close at hand. The index may find strong resistance in the range of 3,000 to 3,125 but, once that is cleared, the path to retesting the all-time high is clear.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.