News and Sports media company

Fox Corporation NASDAQ: FOXA stock has sold off in sympathy with the fallout in

ViacomCBS NYSE: VIAC shares. While Fox shares may have also risen in sympathy with ViacomCBS, the sell-off may have been unwarranted unless the industry is repricing itself. In addition to its brands FOX News, FOX Sports, FOX Entertainment, and FOX Television Stations, the Company also has stakes in

sportsbetting and

iGaming through its 2.5% stake in Fan Duel’s parent company

Flutter Entertainment OTCMKTS: PDYPY while building its Fox Bet free-to-play membership over 4 million players. The continued lifting of COVID-19 restrictions accelerated by the

vaccine rollout enables more live sports events to make Fox a valid

re-opening play. Shares faced tremendous

volatility when peer ViacomCBS stock collapsed in March 2021. Risk-tolerant investors seeking a long-term value play can monitor opportunistic pullback levels of ViacomCBS to consider taking exposure.

Q4 2020 Earnings Release

On Feb. 9, 2021, Fox Corporation released Q4 2020 results for the quarter ending in December 2020. The Company reported earnings per share (EPS) of $0.16 excluding non-recurring items, beating consensus analyst estimates of (-$0.04), by $0.20. Revenues grew 8.2% year-over-year (YoY) to $4.09 billion, beating analyst estimates by $100 million.

Conference Call Takeaways

Fox CEO, Lachlan Murdoch, set the tone, “The news cycle also continued to connect engaged audiences to various FOX News Media platforms: linear, digital, radio and streaming for news, analysis and opinion. In fact, the FOX News Channel finished the quarter with the highest average prime time ratings in the history of cable news.” He went on to note they expect the overall news audience will normalize but share ratings will remain dominant. FOX Sports and live events and Tubi post-election will drive growth as demonstrated by FOX clocked 170 billion minutes of live sports viewing in Q4, over 50% more than “the next competing network”. The NFC Championships had 45 million viewers. The return of live sports helped to bolster FOX Bet with nearly 3 million new players during the NFL season, “FOX Bet Super 6 now has a user base in excess of 4.3 million players and continues to be the biggest free-to-play game of its kind in the country.” The Company continues to leverage Fox Bet and Super 6 non-sports contests which include Stock Market Challenge, weekly Quiz Show and more to bolster viewer engagement. The combined viewership of all the FOX brands have resulted in 330 million average monthly users, up 30% YoY.

Tubi Platform

The Tubi streaming platform is expected to double revenues to $300 million in the current fiscal year and become a $1 billion business in the coming years. CEO Murdoch also unscored, “Tubi is an exciting growth engine for the company and a key strategic platform for not only our digital expansion, but also our broader reimagining of Fox’ broadcast model for the future… Tubi is an investment in what we internally call the broadening of broadcast, meaning the FOX Network and Tubi combining seamlessly to create a modern network-inspired business.” The addition of The Masked Singer added reach for advertisers and delivered significant view time on the platform. The advanced advertising tool helped an insurance company advertise to 100,000 more households within the same ad buy, by reducing over frequency. This resulted in multimillion-dollar ad payments to Tubi in 2021 and also a new FOX advertiser. Tubi is a magnifier of growth that enables the FOX brand to bolster the true network effect. With a modest P/E of 14.6 and a recent sell-off due to the ViacomCBS contagion, prudent investors can watch for opportunistic pullback levels on this long-term value play to gain exposure.

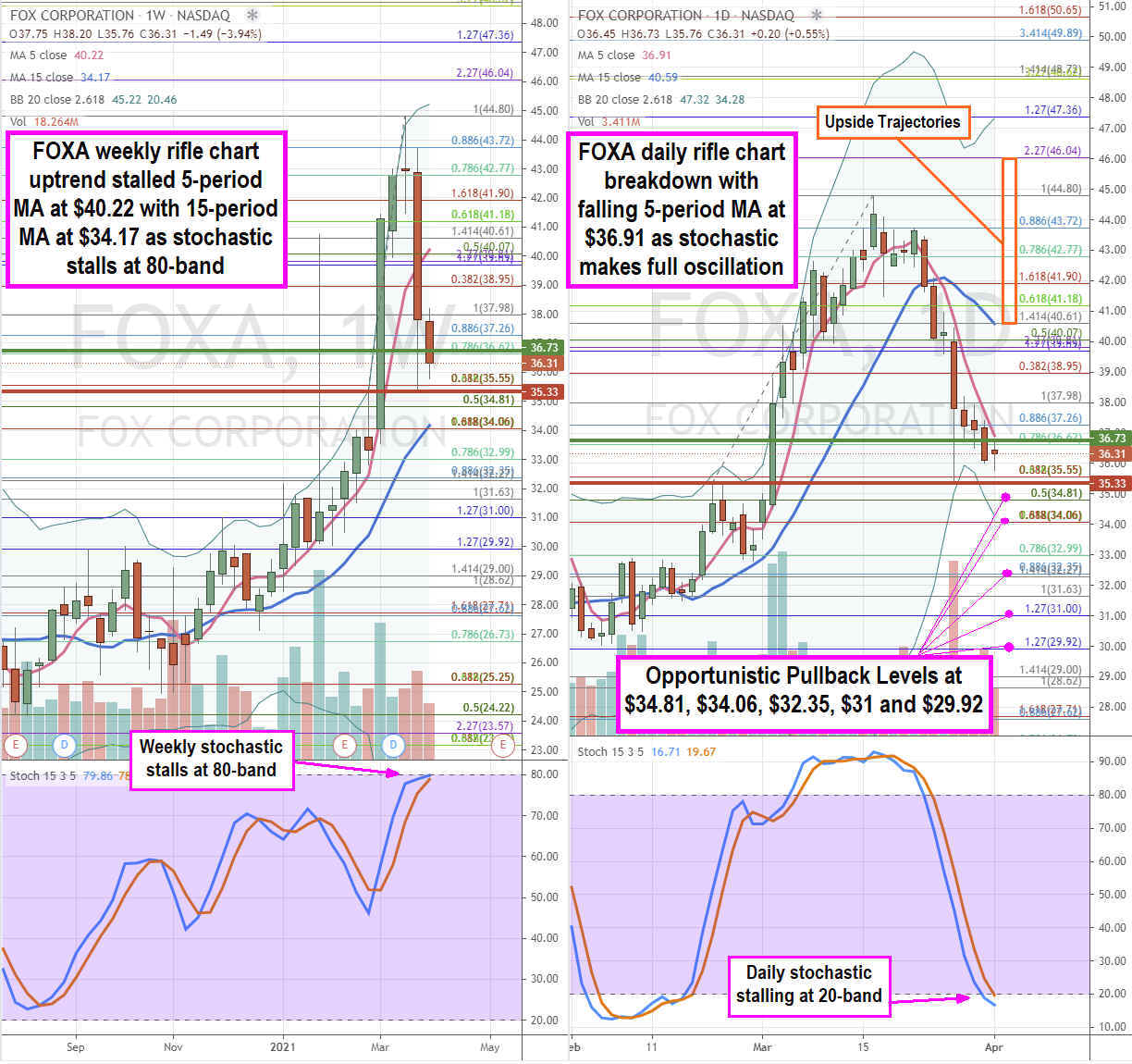

FOXA Opportunistic Pullback Levels

Using the rifle charts on weekly and daily time frames provides a near-term view of the landscape for FOXA stock. The weekly rifle chart uptrend peaked at the $44.80 Fibonacci (fib) level. The weekly 5-period moving average (MA) stalled at $40.22 with a rising 15-period MA at the $34.06 fib. The weekly stochastic stalled at the 80-band as shares collapsed in sympathy with fallout in media stocks triggered by the VIAC implosion. The daily market structure low (MSL) triggers above $36.73, while a weekly market structure high (MSH) sell triggers below $35.33. The daily rifle chart is in a downtrend with 5-period MA at $36.91 with lower Bollinger Bands (BBs) at $34.28. The daily stochastic made a full oscillation down through the 20-band. Risk-tolerant investors can monitor opportunistic pullback levels at the $34.81 fib, $34.06 fib, $32.35 fib, $31 fib, and the $29.92 fib. Upside trajectories range from the $40.61 fib upwards to the $46.04 fib level.

Before you consider FOX, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FOX wasn't on the list.

While FOX currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Summer 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.