GameStop NYSE: GME CEO Ryan Cohen attempted to bring clarity to the market in a televised interview. He says the company isn’t trying to be a Bitcoin repository and isn’t following in the steps of Strategy NASDAQ: MSTR, which is good news. However, what he didn’t do was provide an update on a coherent plan for the business, which is slowly consuming itself.

GameStop Today

$23.32 -0.75 (-3.11%) As of 10/10/2025 03:59 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $20.35

▼

$35.81 - P/E Ratio

- 31.95

- Price Target

- $13.50

The only thing holding it afloat is its cash balance, which has so far been used solely to purchase Bitcoin.

There is an opportunity in the trading cards market, but the question is whether GameStop can capture it. The forecasts vary but agree that trading cards and card trading are becoming increasingly popular, with a 2025 market value in the low billions.

The industry is expected to grow at a solid single-digit pace through the middle of the next decade, potentially topping the $50 billion mark. GameStop’s collectible business is improving, but it is insufficient to provide a robust or positive outlook for the retail business.

GameStop’s collectibles business grew robustly in FQ1 but remains a small portion at only $211.5 million. The bad news is that the approximately $75 million business increase is offset by weaker hardware and software sales and a $254 million inventory reduction, which suggests that clearance is the driver, rather than any kind of pickup in the trading card business.

Short-Sellers Sell Into the Bitcoin Hype

Regardless of Bitcoin’s value as a cryptocurrency, its value to GameStop and investors is dubious and that quality is reflected in the short-selling data. While down from the peaks set in 2020 and 2021, GameStop's short interest has risen since April and reached multi-year highs in June. The activity is a key factor in the stock price action and critical to the movement in June and July.

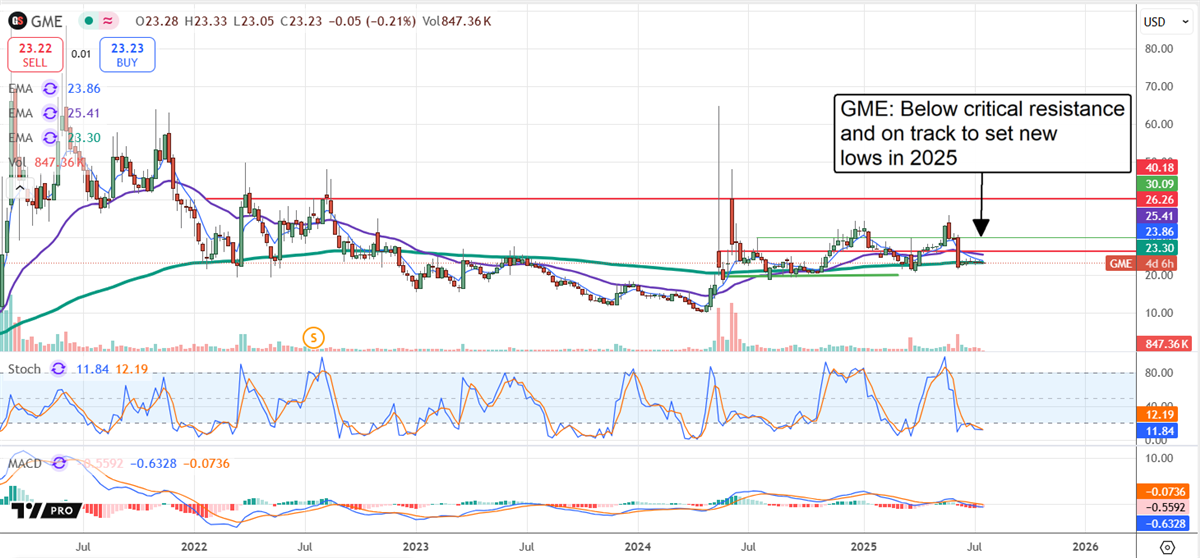

GameStop’s price is near long-term lows and the bottom of a trading range, with July's action suggesting a lower low is forthcoming.

The trigger for lower lows may already be in motion. The company announced plans for a debt offering (no coincidence to Strategy’s strategy here) and since upsized it due to demand. The critical takeaway is that this once debt-free company now has more than $2 billion, and potentially more than $2.5 billion, in senior convertible debt on its balance sheet, with no clear strategy for utilizing it in the best interest of its shareholders.

Meanwhile, the single analyst to cover the stock reiterated a bearish rating. Michael Pachter of Wedbush questions why investors would buy GameStop for exposure to Bitcoin when they can buy Bitcoin, a Bitcoin ETF, or other, more direct investments.

He rates the stock as a Strong Sell and forecasts a decline to $13.50, representing a 40% drop from the critical support target.

Institutional Support Is Shaky for GameStop

GameStop Stock Forecast Today

12-Month Stock Price Forecast:$13.50-42.11% DownsideReduceBased on 2 Analyst Ratings | Current Price | $23.32 |

|---|

| High Forecast | $13.50 |

|---|

| Average Forecast | $13.50 |

|---|

| Low Forecast | $13.50 |

|---|

GameStop Stock Forecast DetailsInstitutions are buying GameStop on balance in 2025, but their support is shaky. The activity was centered in the early part of the year but has since slacked off to nearly nothing in early Q3, and they own less than 30% of the total.

With the total share count up more than 60% year over year in Q1 and additional dilution a possibility, the group is unlikely to provide significant support without a catalyst to drive it.

The catalyst could arrive with the Q2 earnings report, but investors should not invest too much in this possibility.

Two analysts tracked by MarketBeat forecast the company will return to growth despite divestitures and negative trends in 2024 and early 2025.

Before you consider GameStop, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GameStop wasn't on the list.

While GameStop currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.