I Can’t Say I Didn’t See That One Coming

Goldman Sachs (GS) shocked the market this morning when lead-analyst David Kostin downgraded 2020 EPS growth to zero. I say shocked because the market was already spooked. The spreading coronavirus threatens to shut down the global economy in a way the trade war never could. Supply chains around the world are in danger of disruption if not break-down and that will surely have an impact on revenue and earnings.

“Our reduced profit forecasts reflect the severe decline in Chinese economic activity in 1Q, lower end-demand for US exporters, disruption to the supply chain for many US firms, a slowdown in US economic activity, and elevated business uncertainty … A more severe pandemic could lead to a more prolonged disruption and a US recession” In this case, S&P 500 earnings could fall by double-digits in 2020.

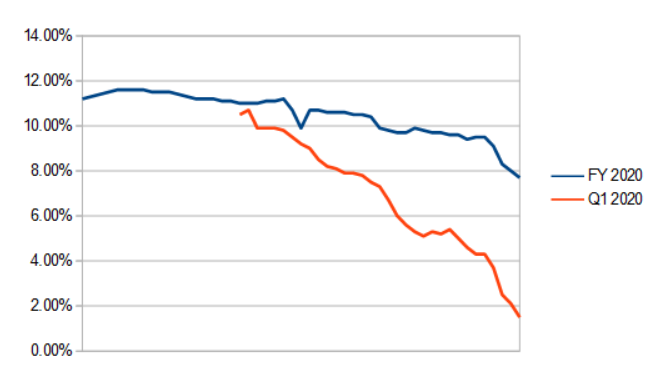

What surprises me is how long it took the market to understand this reality. I’ve been warning about an earnings-induced correction for over a year. That’s because the outlook for S&P 500 (SPY) EPS growth in 2020 was already in decline, way back then. At the current pace of decline, not counting the viral-impact, the 2020 consensus was on track to reach zero well before the end of the year. Add in the impact of the virus and EPS could very well turn negative for the year and soon.

The Warnings Signs, They Were There

Apple (AAPL) was the first real warning. When Apple warned the virus would impact its revenue by 6% or more the market should have taken this to heart. Apple is the world’s largest manufacturer of consumer technology and more than just a bellwether. Apple’s results will impact an entire industry and are representative of a much larger issue within the market. Company’s with exposure to China are going to fell the pain and not just those doing business in China.

Apple was not the first to warn about the impact of the virus and it surely won’t be the last. So far, a little more than 40% of S&P 500 businesses have issued some form of warning although most have failed to quantify the impact. Today’s news also includes a warning from tech-giant Microsoft (MSFT), another bellwether of the global economy, about the viral impact to its revenue.

Microsoft says it will not be able to meet its Q3 guidance for the More Personal Computing segment of the business. The company had been expecting revenue in a range of $10.75 to $11.15 billion allowing for the impact of the virus based on conditions at the time. Since then, Microsoft says the supply chain is not coming on-line as quickly as anticipated.

From the MSFT press release …

“Although we see strong Windows demand in line with our expectations, the supply chain is returning to normal operations at a slower pace than anticipated at the time of our Q2 earnings call. As a result, for the third quarter of the fiscal year 2020, we do not expect to meet our More Personal Computing segment guidance as Windows OEM and Surface are more negatively impacted than previously anticipated. “

The Outlook Is Dimming

What the Goldman note doesn’t talk about is the possibility(likelihood) that calendar Q1 EPS growth will be negative. The consensus target for Q1 2020 is already a low 1.7% and falling sharply. At this pace, the consensus will surely fall below 0.0% before the start of the next reporting cycle. The consensus for the full year is still hovering around 7% but I expect to see that falling as soon as this week.

The upshot is that not all S&P 500 companies face the same risk. The trade war highlighted this fact well. S&P 500 companies with more than 50% exposure to China saw their EPS decline double digits in 2019 while those without posted modest increases. This fact isn’t a guarantee U.S.-centric business won’t be impacted by the virus but it does offer an element of safety until the threat passes … or gains a foothold here in the U.S.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.