Pharmaceutical

Pharmaceutical drug savings and digital healthcare platform

GoodRx NASDAQ: GDRX stock has falling to all-time lows accelerated by the

sell-off in benchmark indexes. The platform has saved consumers over $35 billion in prescription costs since inception. Over 700,000 healthcare providers have used the GoodRx platform. The Company continues to grow its network of consumers and providers. Its acquisition of flipMD will expand engagement with providers and increase and complement pharma manufacturing solutions. Despite the

Omicron impacts which dampened its Q4 2021 results, growth continues. Its Gold subscription plan has grown to over 1.6 million active members. GoodRx strives to become the largest healthcare platform in the U.S. Prudent investors seeking exposure in

digital healthcare savings can watch for opportunistic pullbacks in shares of GoodRx.

Q4 Fiscal 2021 Earnings Release

On Feb. 28, 2022, GoodRx reported its fiscal Q4 2021 earnings report for quarter ended December 2021. The Company reported an earnings-per-share (EPS) profit of $0.09 excluding non-recurring items versus consensus analyst estimates for a profit of $0.10, a (-$0.01) miss. Revenues grew 39% year-over-year (YoY) to $213.3 million, missing analyst estimates for $217.51 million. Monthly active consumers grew 14% YoY to 6.4 million. Prescriptions transactions for the quarter grew 21% YoY to $158.8 million. Subscription revenues grew 79% YoY to $17.4 million.

Downside Guidance

GoodRx lowered its fiscal Q1 2022 revenue guidance to come around $200 million, falling short of $227.44 consensus analyst estimates. Fiscal full-year 2022 revenue guidance is expected around $916 million versus $1.02 consensus analyst estimates, up 23% but still falling short of analyst expectations.

Conference Call Takeaways

GoodRx Co-CEO Dough Hirsch reviewed some of the developments for 2021 including substantial investments in the brand and acquisition of products that provide new consumer content and resources. He commented, “Our platform has grown as has our reach. We're especially excited about the delivery of our content initiatives around GoodRx Health and health care provider focused platform extensions that help providers help their patients and support our pharma manufacturer solutions offering.” The Company has helped save more than $35 billion for Americans since its inception. It saved five million users over $500 compared to pharmacy cash price. The Company raised its NPS to 90 with health care providers matching its NPS with consumers. GoodRx Co-CEO Trevor Bezdek pointed out that the effects of COVID had been underestimated in duration and impact to its business. It created a compounding effect over time due to refill frequency and the long-term nature of prescriptions. The Company has continued to grow its market share and revenues despite the headwinds. The Company launched its GoodRx for Providers product in Q4 as it plays an essential cornerstone in its goal of becoming the largest domestic provider platform. The Company has had historical adjusted EBITDA margins of 40% due to the significant cash flow generation. Bezdek expects mid-20% annual revenue growth long-term. GoodRx reached over 6.4 million monthly active users and more than 1.6 million subscription members in Q4. Omicron impacted the end of the quarter. The Company integrated with Wheel in Q4, a digital healthcare platform powering virtual primary care and behavioral health services. This enables GoodRx discounts to millions of patients of Wheel clients. More than 700,000 providers from primary care to oncology have utilized the GoodRx platform. Bezdek pointed out, “We have been introducing our new provider mode gradually to a subset of the providers who visit GoodRx and have seen strong adoption, with over 90% of providers who have been introduced opting into this new mode, which represents over 80,000 HCPs and growing. We believe this high rate of adoption without any off-platform marketing underscores its highly differentiated value from providers and points to its competitive superiority.”

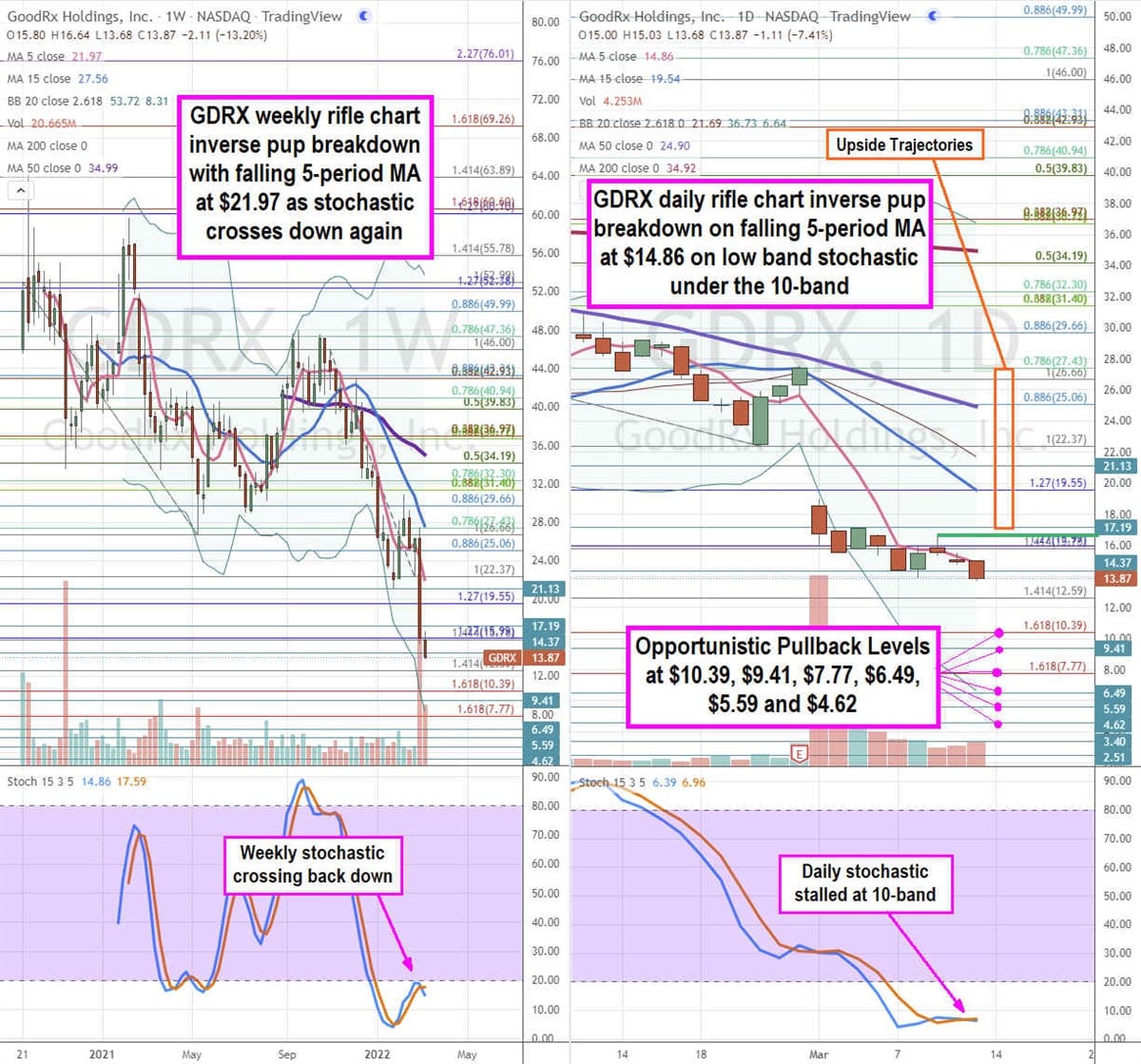

GDRX Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames enables a precision view of the price playing field for GDRX. The weekly rifle chart peaked near the $27.43 Fibonacci (fib) level before plunging on earnings results. The weekly rifle chart formed an inverse pup breakdown with a falling 5-period moving average (MA) at $21.97 followed by the 15-period MA at $27.56 with lower weekly Bollinger Bands at $8.31. The weekly stochastic rejected off the 20-band bounce attempt and has turned back down again. The daily rifle chart downtrend continues with a falling 5-period MA at $14.86 and 15-period MA at $19.54 with lower BBs at $6.64. The daily stochastic is stalled under the 10-band. The daily market structure low (MSL) triggers on a breakout through $16.64. Prudent investors can watch for opportunistic pullback levels at the $10.39 fib, $9.41, $7.77 fib, $6.49, $5.59, $4.62, $3.40, and $2.51. Upside trajectories range from the $17.19 level up towards the $27.43 fib level.

Before you consider GoodRx, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GoodRx wasn't on the list.

While GoodRx currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.