Telehealth service

Hims & Hers Health NYSE: HIMS stock experienced the typical haircut after completing its reverse merger with a

special purpose acquisition company (SPAC) previously and symbol change. The Company started trading under the current symbol from Oaktree Acquisition Corp on Jan. 20, 2021. Shares hit a low of $13 before upgrades spiked shares as high as $25.40 before crashing down to $11.40 lows on March 5

th with a

Nasdaq sell-off. While HIMS is an NYSE stock, it is considered a

telehealth pandemic winner stock, thus got punished along with peers

LifeMD NASDAQ: LFMD and

Teladoc Health NYSE: TDOC. The acceleration of

Covid-19 vaccinations has also put a damper on this group as a return to normal assumes returning back to doctor’s offices for outpatient visits. However, the accessibility, convenience, and privacy of telehealth services may have been underestimated by the markets, notably with discrete/stigma-ridden maladies. Prudent investors who believe telehealth will be an essential part of the new normal can watch for opportunistic pullback levels to scale into a position.

Q4 FY2020 Earnings Release

On March 18, 2021, Hims & Hers released its first earnings report as a publicly listed company for its fiscal fourth-quarter 2020 results for the quarter ending December 2020. The Company reported an earnings-per-share (EPS) loss of (-$0.07) beating consensus analyst estimates for a loss of (-$0.20), a $0.13 beat. Revenues rose 67.4% year-over-year (YoY) to $41.47 million, beating analyst estimates for $37 million. Gross margins improved to 70%, up from 54% in prior year 2019. The Company noted the elevated advertising expenses in Q4 from the U.S. Presidential elections have normalized in Q1 2021 moving forward.

Raised 2021 Estimates

The Company to raised their Q1 and full-year 2021 estimates. Hims & Hers expects Q1 2021 revenues to range between $48 million to $50 million, above the $44.36 million analyst expectations. Adjusted EBITDA range is expected between (-$9.5 million) to (-$11.5 million). The Company guided 2021 full-year revenues between $195 million to $205 million compared to $183.71 million consensus analyst estimates. Full-year Adjusted EBITDA is expected between (-$35 million) to (-$45 million).

Credit Suisse Initiation

On. March 2, 2021, Citigroup upped its rating from Neutral to a BUY with a $26 price target. A week later on March 9, 2021, Credit Suisse started coverage with a Neutral rating with a $16 price target as shares closed the day at $13.58. The analyst Jailendra Singh has compelling points regarding the discrete nature of the services, “Hims & Hers opens doors for consumer who otherwise may have avoided seeking treatment, especially for stigma-ridden conditions, or prefer to keep their treatment private and confidential from their employers.” She summed it up, “As consumers have become more comfortable using telehealth, we believe HIMS is positioned to capture industry tailwinds with a leading direct-to-consumer health brand. Further, with 80% of customers being first-time buyers of services featured on the platform, HIMS establishes valuable relationships that could lead to future opportunities for organic growth.”

HIMS Opportunistic Pullback Levels

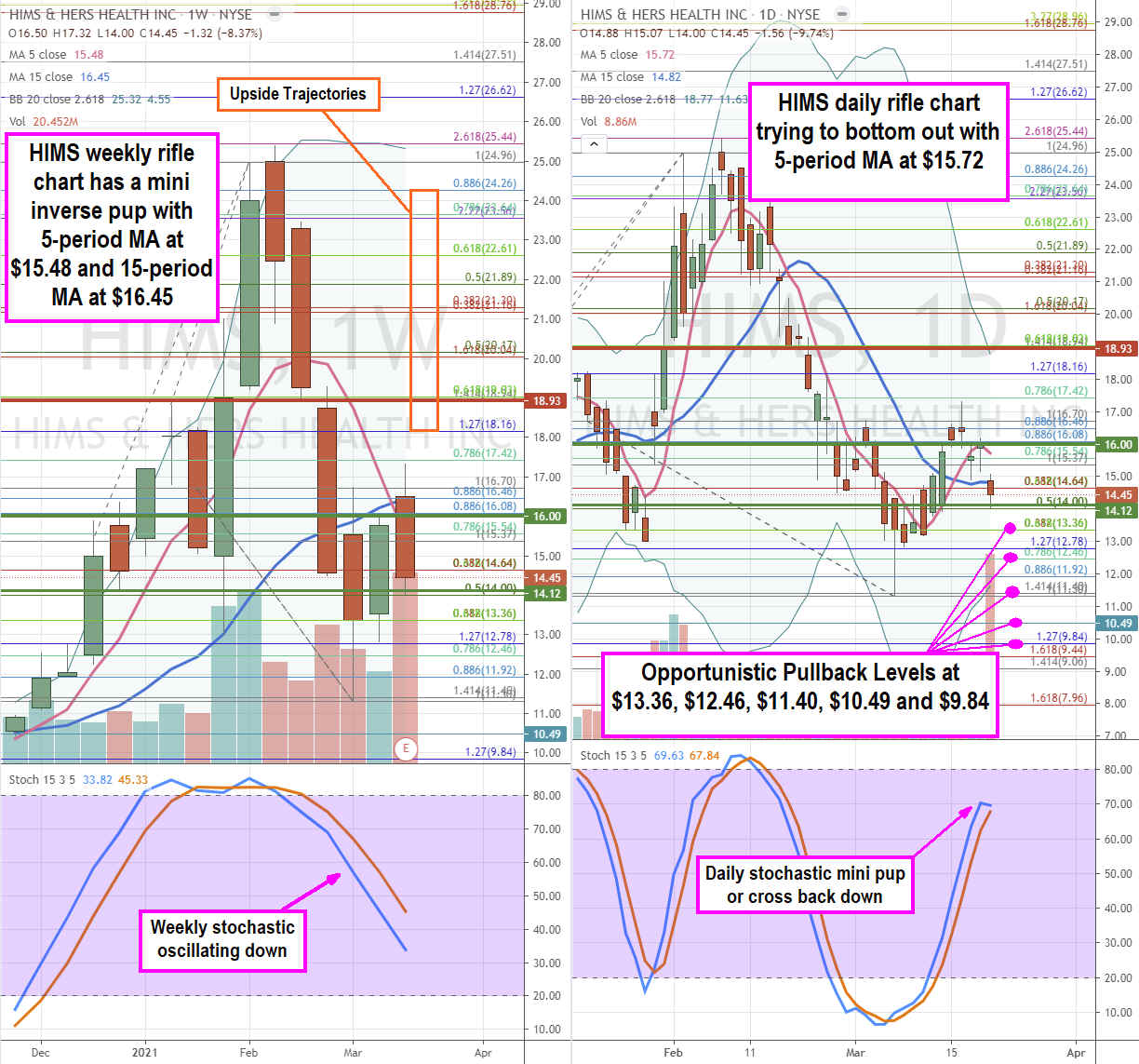

Using the rifle charts on the weekly and daily time frames provides a near-term view of the landscape for HIMS stock. The weekly rifle chart peaked out at the 2.618 Fibonacci (fib) level at $25.44 on Feb. 8, 2021. Shares proceeded to sell-off as the weekly stochastic crossed down through the 80-band for a full oscillation move towards the 20-band. The weekly 5-period moving average resistance (MA) is falling at $15.48 and the 15-period MA is at $16.45. Shares bottomed out at the $11.40 fib on March 5th formed a daily market structure low (MSL) buy trigger above $14.12 and a weekly MSL trigger above $16. The weekly market structure high (MSH) sell triggered under $18.93, which becomes a very formidable resistance on bounces. The daily rifle chart reversed into an uptrend powered by the bullish stochastic mini pup grind through the 20-band as it peaked and stalled at the 70-band. The initial pop peaked at $17.12 as shares gapped down on the earnings reaction stalling out the daily 5-period MA. Shares were able to hold the $14.12 daily MSL trigger but await the direction of the daily stochastic which can either form a bullish mini pup on a bounce through the 5-period MA and weekly MSL trigger above $16 or a cross down that would reawaken the weekly mini inverse pup. Prudent investors can monitor for opportunistic pullback levels at the $13.36 fib, $12.46 fib, $11.40 fib, $10.49 fib, and the $9.84 fib. Keep an eye on peer telemedicine stocks LFMD and TDOC as they move together. Upside trajectories range from the $18.16 fib up towards the $24.26 fib with potential to the $28.26 fib.

Before you consider Hims & Hers Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hims & Hers Health wasn't on the list.

While Hims & Hers Health currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.