Home Depot NYSE: HD

Home Depot NYSE: HD has undoubtedly been a

pandemic winner, with shares trading well above pre-pandemic levels. Four tailwinds responsible for the home improvement retailer’s success in 2020 are:

- Bored homeowners turning into enthusiastic DIYers.

- Home equity loans becoming available at historically low-interest rates.

- More homeowners as a consequence of the work-at-home

- Stimulus checks getting applied to home improvement.

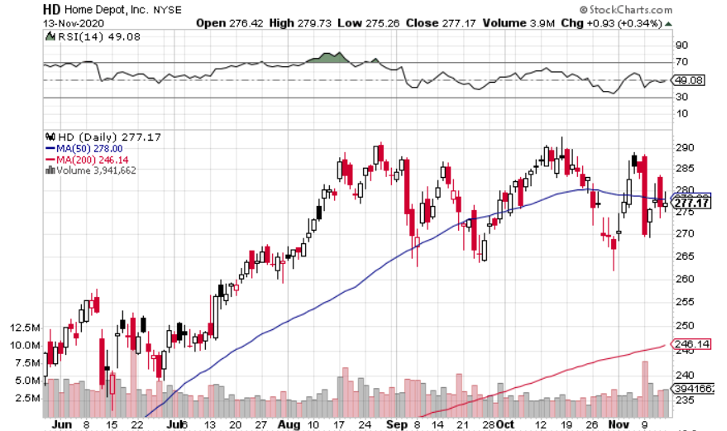

So, when the vaccine news hit the airwaves, HD shareholders weren’t too happy; shares dipped 5% last Monday – on heavy volume. Over the next four sessions, HD clawed back some of those losses, but still closed the week down 2.5%

Home Depot is set to release its Q3 earnings tomorrow. I’m expecting a strong quarter, but more importantly, I’m optimistic about the company’s post-COVID outlook.

Most of the Tailwinds Aren’t Going Away

Looking at the aforementioned tailwinds one-by-one, it’s clear that Home Depot investors shouldn’t fear a post-vaccine world:

- Bored homeowners turning into enthusiastic DIYers.

People will, post-vaccine, have a lot more ways to spend their time. No debate there. But if you’ve ever owned a home, you know that something tends to happen when you start working on it: You find other problems or areas for improvement.

Home Depot, for its part, isn’t sitting idly by. Instead, the company is investing in its digital presence, increasing the likelihood of repeat customers. On the last earnings call, VP Ted Decker said, “During the second quarter, our mobile app saw a record number of downloads, and we saw significant growth in conversion rates across all digital platforms.”

- Home equity loans becoming available at historically low-interest rates.

Historically low mortgage rates have largely been responsible for the housing boom of 2020. Less talked about, but more relevant to Home Depot, are the lower-rates on home equity loans.

The Fed is signaling that historically low-interest rates are going to exist for quite a while – perhaps 2-3 years. So, the widespread availability of a vaccine – which could come in six months or so – wouldn’t be accompanied by higher rates.

- More homeowners as a consequence of the work-at-home movement.

The shift to work-at-home has led to a mass exodus from the cities to the suburbs. Some companies are already committing to work-at-home structures well into 2021. More homeowners equal more potential customers for Home Depot.

The way I see it, most of the people that already moved to the suburbs will stay there, post-pandemic. But the rate at which people move to the suburbs will slow post-pandemic. So, I see this tailwind sticking around – but only partially.

- Stimulus checks getting applied to home improvement.

Home Depot, like a lot of retailers, benefited from the issuance of $1,200 stimulus checks earlier this year. CEO Craig Menear said, “So look, in terms of the overall benefit from stimulus, hard to quantify, but we have to believe that there's some -- when customers have more money in their pocket, there's some benefit to that.”

The good news is, there is likely another stimulus check on the way – eventually. Vaccine or no vaccine.

The bad news is that the stimulus checks aren’t going to keep coming forever. But that’s not exactly a revelation, and that reality was certainly priced into HD shares long before the vaccine news.

Attractive Valuation & Dividend

Home Depot is trading at 24.1x forward earnings, a very reasonable number considering the company’s growth prospects. In Q2, for example, revenue grew 23.4% yoy. Now, I’m not saying that 20%+ growth is going to turn into the new-normal for Home Depot. It won’t. But it won’t take much growth for Home Depot to grow past its valuation. I expect it to get there.

The dividend is solid at 2.11%, and there is reason to believe that Home Depot will raise it later this year. The dividend history shows a 5-year CAGR of over 25%, so the dividend could be much higher in a few years.

The Final Word

Home Depot was winning before the pandemic. It has won during the pandemic. And I expect it to continue winning post-pandemic.

Shares are trading at a discount at the moment, but a strong report tomorrow could change that. I’d look to get into HD ahead of that.

Before you consider Home Depot, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Home Depot wasn't on the list.

While Home Depot currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.