Home Depot NYSE: HD is moving higher on the combined forces of outperformance and an expectation for tailwinds to develop in 2025. Better-than-expected consumer trends, acquisitions, and the pro-business drive outperformance in 2024, leading the company to improve guidance against a backdrop of negative sentiment. Tailwinds will form in 2025 as policy headwinds ease and Trump’s business and consumer-friendly policies spur activity, specifically in the housing market.

Home Depot Today

HD

Home Depot

$359.32 +0.28 (+0.08%) As of 03:59 PM Eastern

- 52-Week Range

- $326.31

▼

$439.37 - Dividend Yield

- 2.56%

- P/E Ratio

- 24.38

- Price Target

- $426.77

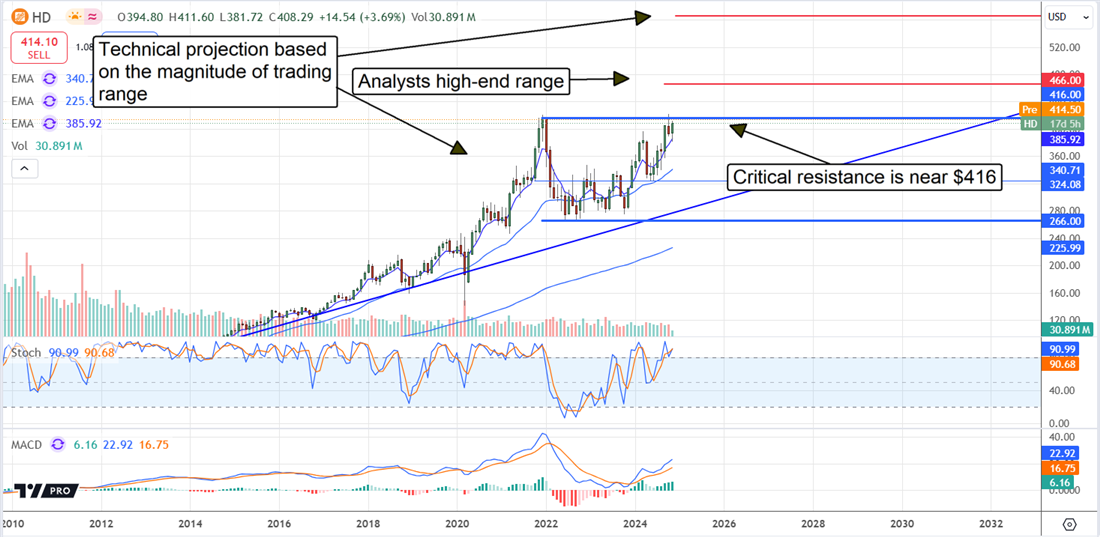

The forecast for interest rate cuts has eased from its peaks set a few months ago but remains favorable, with the base rate expected to fall another 50 basis points or more by the end of the year. The takeaway for investors is that Home Depot outperforms and builds leverage through acquisitions ahead of an expected shift in economic fundamentals. It raised guidance for 2024, and the forecasts for 2025 are likely cautious because of tailwinds expected to develop. That means the stock is positioned for the analysts' upgrade cycle to continue, and with the stock already near record highs, a new high is likely. The technical indications suggest an additional 12% advance once the critical resistance is broken, and a larger 35% gain is possible over the next four quarters.

Home Depot Grows With Acquisition of SRS

Home Depot struggled in Q3, with comp sales declining, but the weakness was far less than anticipated. All the analysts tracked by MarketBeat had lowered their estimates during the quarter, setting the bar very low. The company’s $40.2 billion net revenue is up 6.6% primarily because of the acquisition of SRS, which is expected to add about $10 billion in annualized revenue, worth about 6% of the 2025 consensus estimate. Comps are down 1.3% across the network and 1.2% in the core U.S. market.

Home Depot MarketRank™ Stock Analysis

- Overall MarketRank™

- 97th Percentile

- Analyst Rating

- Moderate Buy

- Upside/Downside

- 18.8% Upside

- Short Interest Level

- Healthy

- Dividend Strength

- Strong

- Environmental Score

- -1.92

- News Sentiment

- 1.54

- Insider Trading

- Selling Shares

- Proj. Earnings Growth

- 3.11%

See Full AnalysisMargin news is also favorable, with margin contraction being less than expected. Acquisition and growth-related impairments impacted the company’s cash flow and margin, but the 70 basis point decline allowed for leveraged performance on the bottom line. The company’s $3.78 in adjusted EPS fell $0.07 compared to last year or 180 basis points, outpacing the consensus by 350 bps and the top-line strength by 100. The salient point is that an adjusted operating margin of 13.8% allowed for income growth despite the contraction, helping to sustain the company’s robust financial outlook.

Guidance was raised, helping to lift market sentiment. The company raised its full-year revenue guidance to up 4%, including the addition of SRS and the extra 53rd week, nearly 100 basis points above the consensus estimate. Earnings guidance is also favorable, with operating margin expected to hold steady sequentially and adjusted earnings expected to fall only 1% for the year.

Home Depot Builds Value With SRS Acquisition

The worst that can be said about the SRS acquisition is that it increased the company’s debt and leverage, but the impact will be short-lived. The company is a solid cash-flow producing machine and can tackle the debt, running at 10X equity in late 2024. The offsetting factor is the positive impacts of the acquisition on the balance sheet, which include increased current and total assets, with total assets up nearly 28% and lagged by a 23% increase in liability.

Shareholder equity is up 300% and will likely grow as debt is reduced. Regardless, the cash flow outlook and balance sheet are sufficient to sustain the capital return program, including the dividends and buybacks. The dividend is worth $9.00 and yields more than 2.10%, with shares near record highs and the distribution is expected to grow in 2025. Buybacks reduced the share count by 0.5% at the end of the quarter and are also expected to continue in 2025.

Home Depot Tracking for New Highs

The trend in analysts' sentiment ahead of the release is unlikely to end now that guidance for Q4 is in. The trend includes improving sentiment and price expectations with fresh coverage entering the picture, sentiment firming, and the price target increasing. The consensus target is near $466 and is up 25% over the last year, 500 basis points in the month leading into the release. The consensus implies fair value near the all-time high, but the revision trends suggest a move to the high-end range near $466 is likely. A move to $466 could happen quickly once the all-time high is surpassed.

Before you consider Home Depot, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Home Depot wasn't on the list.

While Home Depot currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.