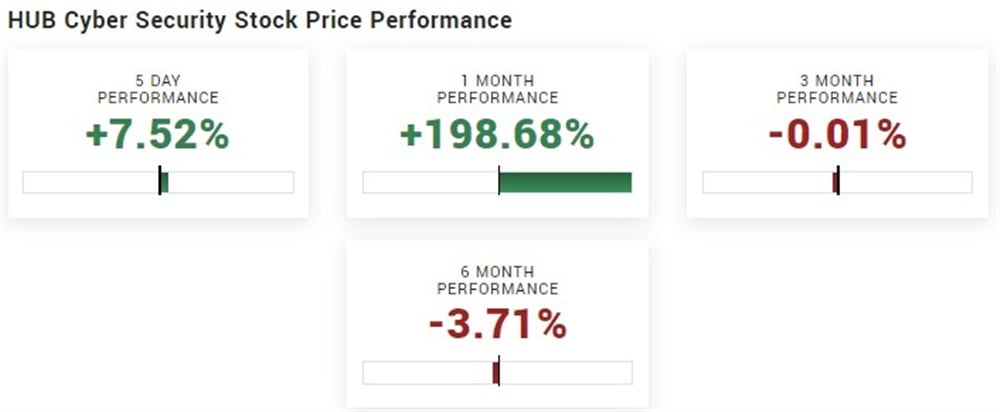

HUB Cyber Security NASDAQ: HUBC, a little-known small-cap cyber security company, has recently made headlines after its stock experienced triple-digit growth last month.

The Israeli cyber security solutions company first grabbed the headlines on October 19 after it announced that it was participating in strengthening Israel’s defenses amidst rising cyber threats.

Since that news, volume has surged in HUBC along with its share price. More recently, the company was back in the spotlight after it announced a new strategic alliance between itself and an unnamed cybersecurity company.

With the flurry of breaking news and potentially changing fundamentals, together with a developing attractive chart formation, is the seemingly little-known HUB Cyber Security a good investment? Let’s take a closer look.

What is HUB Cyber Security?

HUB Cyber Security is an Israeli company that offers a range of cybersecurity solutions, both domestically and internationally. Their services include HUB Secure File Vault, a secure file transfer system with dedicated hardware-driven security, HUB Guard for security assessment and network monitoring, D.Storm for DDoS simulation, RAM Commander for reliability analysis, and Safety Commander for integrated system safety evaluation.

They also provide advisory and professional services for cyber risk assessment, risk mitigation, incident response, and system quality and reliability. The company was founded in 2017 and is based in Tel Aviv, Israel.

HUBC has a market capitalization of $68.8 million and an average volume of 6.35 million shares. Its small market cap, light daily liquidity, and a free float of around 91 million explain its 52-week range of $0.19 to $3.10.

Recent catalysts that sent HUBC Soaring

On October 9, shares of HUBC surged on heavy trading volume due to the conflict between Israel and Hamas. Shares soared higher as there was heightened uncertainty surrounding the possibility of cyberattacks.

Then, on October 19, the company announced its participation in enhancing Israel's digital security. This move comes in response to a surge in cyberattacks targeting government entities and businesses in Israel, including an attack on the Airforce website. HUB Security will contribute its advanced cybersecurity measures, such as the Secure File Vault, to bolster the nation's digital defenses and protect critical infrastructure, emphasizing its commitment to safeguarding sensitive data and defending against cyber threats under the leadership of CEO Uzi Moskowitz.

Lastly, and most recently, on October 31, the company announced a strategic alliance with an undisclosed cybersecurity company specializing in cyber threat detection and response. The alliance includes an option for HUB to acquire all the partner's shares within the initial six months of the agreement, requiring approximately 20% of HUB's shares for the acquisition. This move holds the potential to substantially increase HUB's revenue, although the exact amount remains undisclosed. Together, the two companies will collaborate on marketing joint solutions in the European Union, Israel, and the United States.

The current setup and critical levels

Thanks to the above developments and catalysts, shares of HUBC have successfully sustained the recent rapid appreciation and are now consolidating between two critical levels.

Going forward, critical resistance stands at $0.80, and support is near $0.65. If the stock can successfully break above and hold over resistance, a move toward $1 might be possible. However, if the stock fails to do so and breaks below support and the uptrend, profit-taking, and supply might quickly overwhelm the demand, and shares could trade lower.

Therefore, investors might be best suited to practice patience while the price is being discovered and the news in the stock is being digested.

Before you consider Hub Cyber Security, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hub Cyber Security wasn't on the list.

While Hub Cyber Security currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.