Texas-based Class 8 electric vehicle (EV) powertrain developer

Hyliion Holdings Corp. NYSE: HYLN stock went public through reverse merger with Tortoise Acquisition Corp on Oct. 1, 2020. Shares peaked at $50 before proceeding to sell-off to a low of $15.33 before bottoming out in late December 2020. The maker of hybrid powertrains for Class 8 long haul commercial trucks utilizes various forms of

clean energy sources including electric,

hydrogenand renewable natural gas (RNG). It leaves the choice of fuel source in the hands of the operator, which can also utilize diesel and compressed natural gas (CNG). The name Hyliion is a combination of hybrid, lithium, and ion. The Company produces powertrains that can be augmented onto existing natural gas powered Class 8 long-haul trucks as well as plans for the development of its own trucks. The long haul

trucking industry is one of the ripest segments of vehicles under pressure to transition to the global decarbonization initiative. The Hyliion EV trucks are supposed to be superior to both

Tesla NASDAQ: TSLA and

Nikola NASDAQ: NKLA trucks in terms of range, payload, performance and refueling charge time. Risk-tolerant investors seeking a speculative electrification play in the trucking industry can monitor Hyliion shares for opportunistic pullback levels to scale into positions.

Hyliion Electronification Solutions

The immediate value proposition is the V1 Hybrid aftermarket solution. This is a plug-and-play electronification product that can be augmented on existing Class 7/8 trucks and tractor trailers to utilize Hyliion’s proprietary technology including battery systems, AI software, control module, data analytics, power distribution and them management. It works with existing diesel, compressed natural gas (CNS) and hydrogen fueled trucks. The end result is lower carbon emissions, improved performance, and agnostic OEM flexibility. This solution is ideal for existing trucks and fleet managers who are on the fence about committing completely to one technology. It enables an opportunity to gradually adopt to electronification. The Company has deployed these systems in fleets with over 30,000 trucks, which over two million miles driver over the road in 2020.

Data Analytics

Hyliion also plans to offer a subscription model for its software and predictive data analytics to provide preventative maintenance feedback. The Company leverages vehicle data to spot patterns and identify failures to improve truck up-time and reduce on-road failures. Hyliion powertrain systems are providing over 1GB of data per day per vehicle including vehicle data (powertrain solutions) and sensor data. Optimizes fuel economy and performance with its machine learning algorithms that improves battery usage by looking ahead, improves regenerative braking using weight estimation and extends battery life.

Hyliion Hypertruck ERX

Customer trials being in 2021 for the Hyliion Hypertruck ERX with launch partner Agility Logistics USA having pre-ordered 1,000. Agility is also an investor in Hyliion. ERX stands for electric range extender which is the powertrain system. According to the investor presentation, the Hypertruck ERX outperforms against Tesla and Nikola with a 1300 mile range compared to 500 for Tesla. The 1,300 mile range is the RNG fuel generator that recharges the battery on board which then powers the e-motor. When needed, it can be refueled in approximately 10-minutes. The payload capacity is 53,000lbs versus 43,000lbs for Tesla. Refuel/charge time is 10-minutes compared to over 30 minutes for Tesla while matching the 20 seconds for zero-to-sixty mph speed with a full load.

Asset Light Model

Most of the parts and manufacturing is outsourced through various suppliers and partners. Its lithium titanium oxide (LTO) battery cells are supplied by Toshiba. Design and engineering is outsourced through IAV Automotive Engineering and FEV. Truck modification centers are offered through Fontaine Modification and SV Lonestar Electric. E-drive components including drivetrains, excel and electrified propulsion components are supplied by Dana. The OEM assembly line installs the ERX through Freightliner, Kenworth, Volve and International & Peterbilt. The Company sells powertrains but outsources the parts and installation. This obvious a longer-term hold play, but risk-tolerant investors can use the sell-offs to scale in at opportunistic pullback levels.

HYLN Opportunistic Pullback Levels

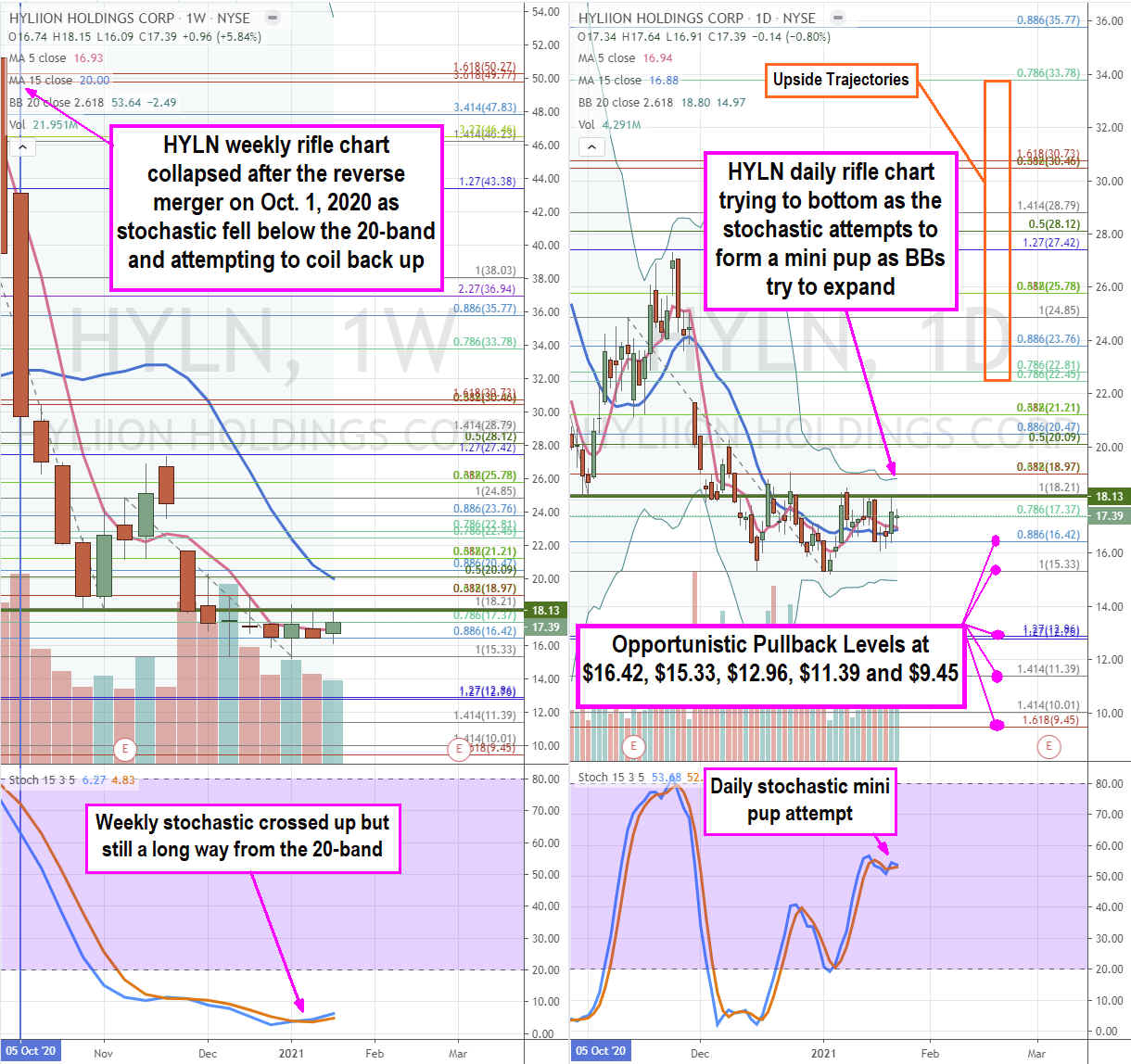

Using the rifle charts on the weekly and daily time frames provides a precision near-term view of the landscape for HYLN stock. The weekly rifle chart has been collapsing in a downtrend since the reverse merger business combination started trading under the symbol HYLN on Oct. 1, 2020. The weekly market structure low (MSL)triggered above the $23.76 Fibonacci (fib) level. However, that coil peaked at the $27.42 fib before falling again on the weekly mini inverse pup under the 20-band as it fell to new lows at $15.33. The weekly MSL formed another trigger above $18.13. The daily rifle chart has been trying to bounce with a stochastic mini pup to trigger the weekly MSL but has so far failed four previous attempts. The pullback have become shallower as the weekly stochastic is trying to cross up through the 20-band. Risk-tolerant investors can look for opportunistic pullback levels at the $16.42 fib, $15.33 fib, $12.96 fib, $11.39 fib, and the $9.45 fib. The upside trajectories range from the $22.45 fib up to the $33.78 fib.

Before you consider Hyliion, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hyliion wasn't on the list.

While Hyliion currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.