With the global legal cannabis market projected to be $40 billion by 2024, cannabis has become one of the market’s hottest new sectors, mostly driven by ebullient individual investors. This month alone,

Yahoo Finance’s Cannabis Stocks index has risen 58%, fueling comparisons to the tulip bulb bubble.

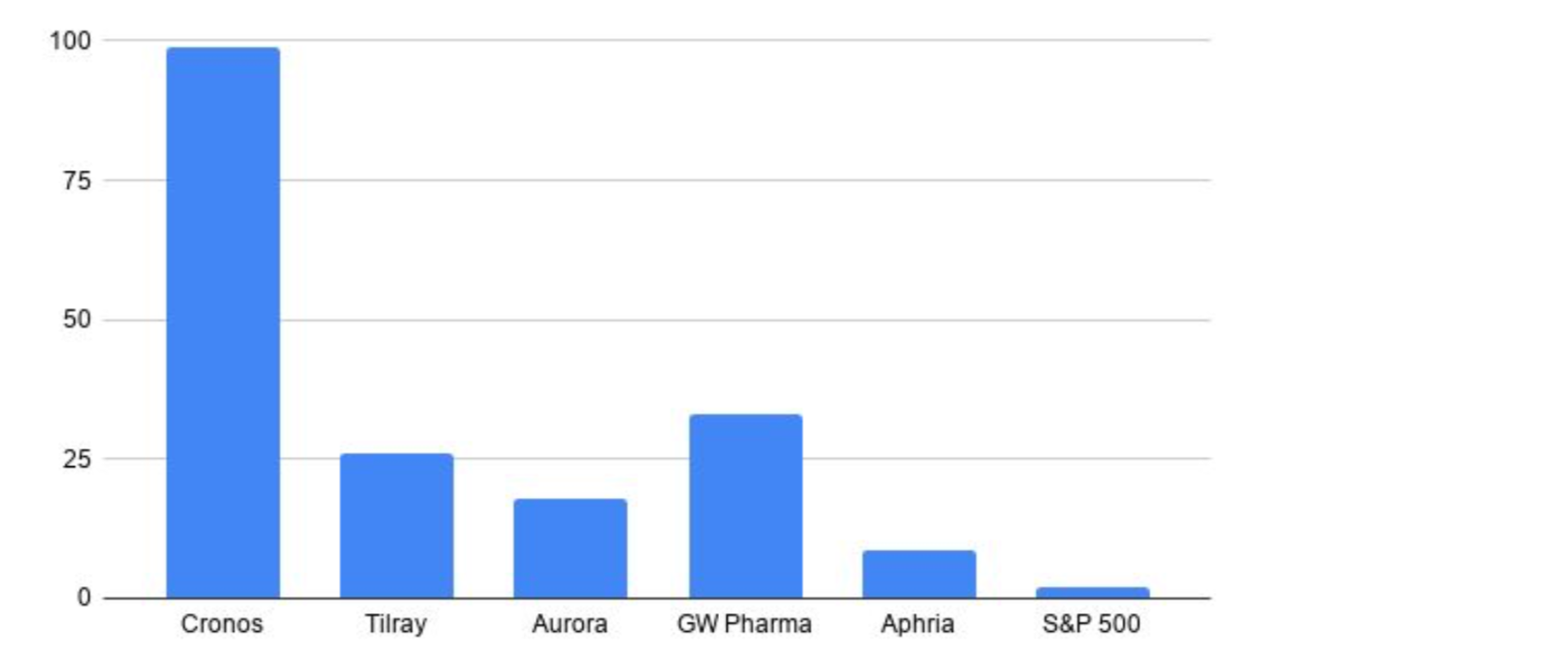

To get an idea of the valuation of cannabis stocks, let's first take a look at the market caps of companies solely focused on cannabis. That means excluding companies with some exposure, like Anheuser Busch and Altria from our analysis.

● Canopy Growth Corporation - $10.69B market cap - 36x sales

● GW Pharmaceuticals - $4.35B - 33x

● Cronos Group - $3.53B - 99x (based on trailing 6 month sales x2)

● Tilray - $2.38B - 26x

● Aphria - $1.52B

● The Green Organic Dutchman Holdings - $903MM - 123x

● Hydrogenics - $377MM - 10x

● Corbus Pharmaceuticals - $329MM - 9.7x

● CannTrust - $237MM - 5.69x

● Terra Tech - $43MM - 1.35x

● General Cannabis - $36MM - 6.9x

For the sake of simplicity, we’re going to assume that the above list encompasses the entire global cannabis industry. We’re going to ignore public companies with cannabis divisions and private cannabis companies. The above list has a total market cap of $28.2B. Assuming these companies grow at BDS Analytics’ projected cannabis market CAGR of 26.7% until 2024, we arrive at a market cap of roughly $72B--1.8x 2024’s projected global sales.

Valuations

The median price-to-sales ratio of the above list of companies is 18x, this is compared to the S&P 500’s modest 2.18x P/S ratio. It’s clear that massive growth is already priced into these stocks given their multiples.

Even though Cronos looks the most expensive on a P/S basis, it’s also the only profitable publicly traded cannabis-only firm on Yahoo Finance’s watchlist, which is worth noting.

Given BDS Analytics projected 26% CAGR for the industry, the question is: which of these firms will significantly outpace that?

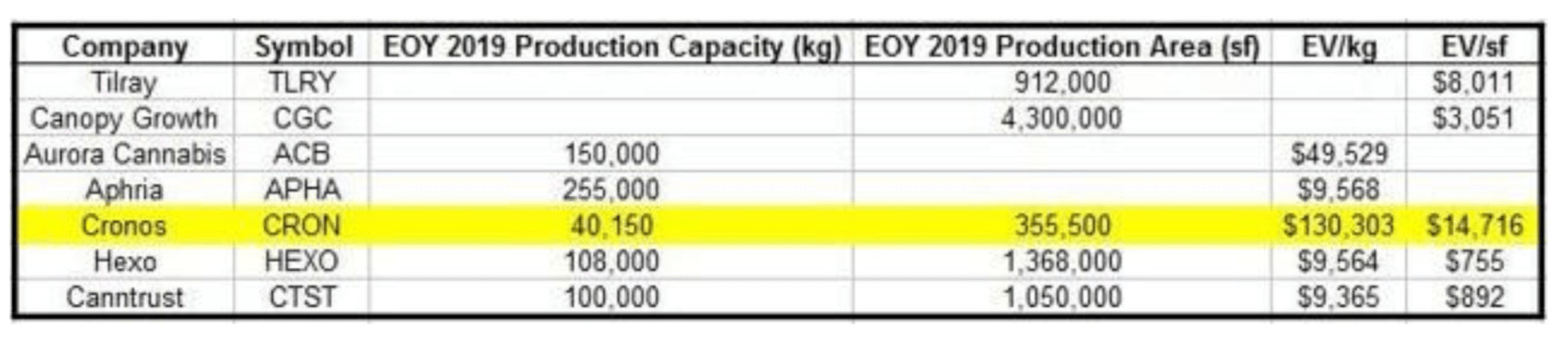

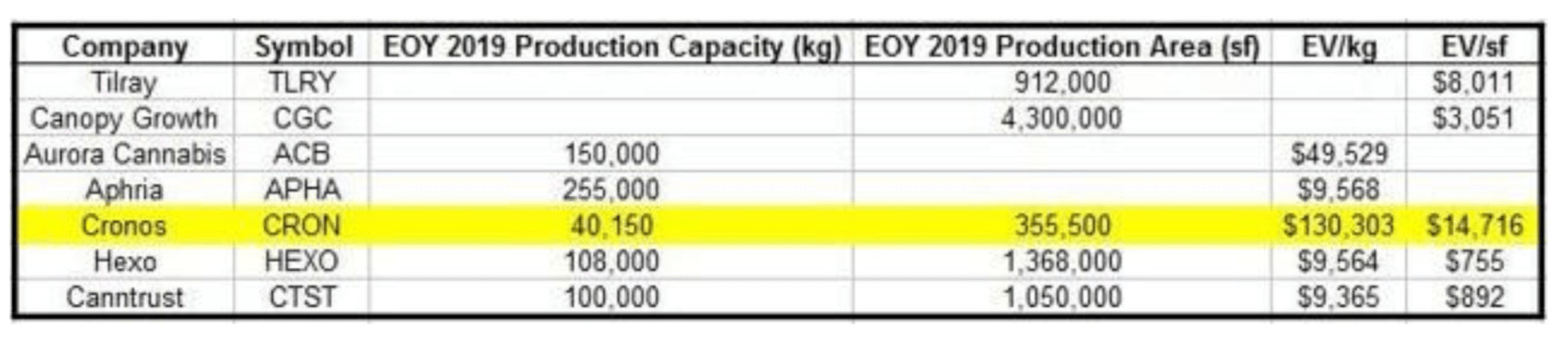

Amit Ghate put together an analysis of the larger public cannabis companies in relation to their production capacity as a function of their enterprise value. This is where it gets interesting, as Cronos, who is trading at 26x trailing earnings, is being valued at $130K per kilogram of cannabis they produce, which can be seen in the chart below, courtesy of Ghate.

Commoditization

Commoditization

For the most part, cannabis is a commodity. While enthusiasts discriminate between different types of marijuana, as legalization spreads throughout the west, differentiation reduces.

Companies applying a wholesale business model are likely to suffer the most. As the addressable market expands, larger competitors will enter the space and drive margins down. While companies like Canopy have the first-movers advantage, tobacco companies like Altria have the capital to buy a wholesale operation.

You can see the effects of Canopy’s pivot to a wholesale-based model in the chart below, seeing a sharp decline in their average sales price per gram of cannabis.

This trend of margin compression is likely to continue across the industry. There will always be room for branding and luxury products to differentiate, but when it comes to wholesale cannabis, the outlook seems bleak as it’s essentially an indoor farming business.

Price Discovery

Institutions are generally more informed and careful than the average individual market participant. Stocks with a lot of institutional ownership are usually priced fairly, relative to the rest of the market’s valuations.

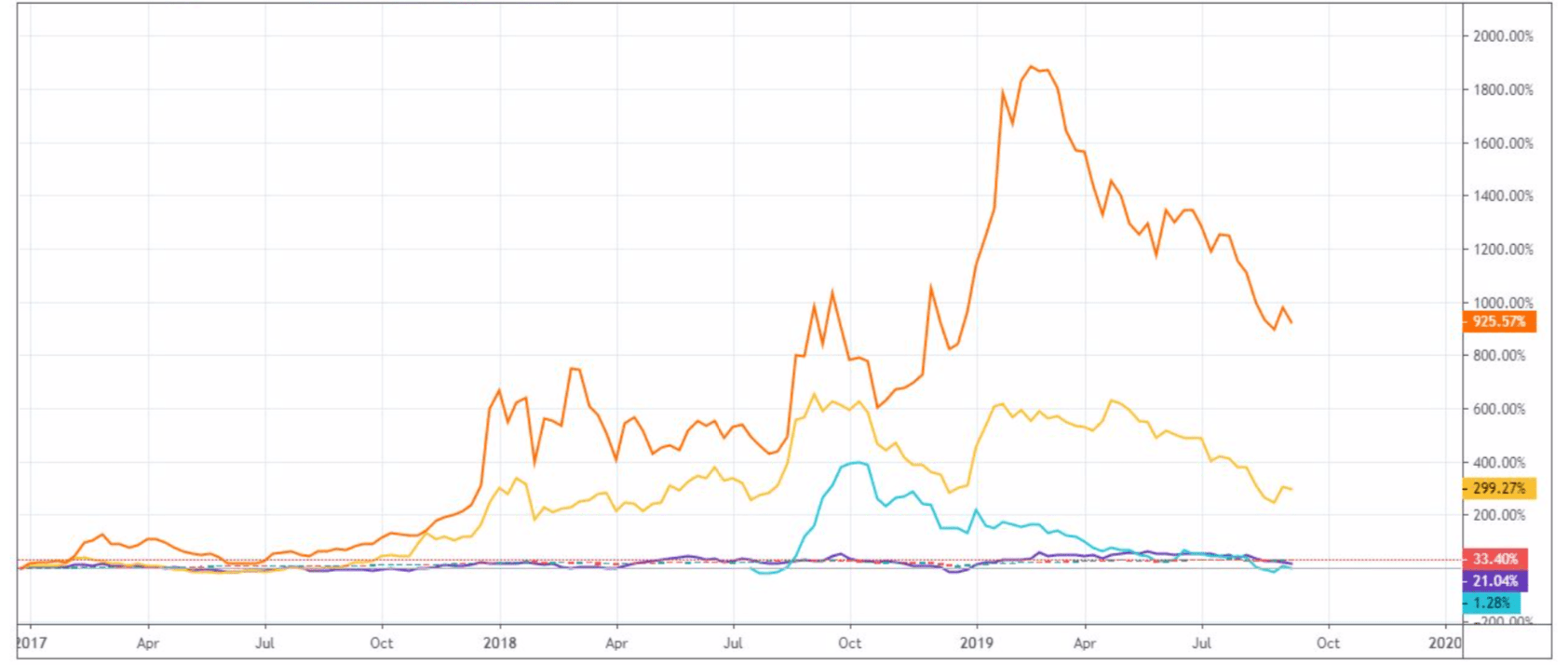

Smaller and more volatile stocks, like most cannabis stocks, can be given ridiculous valuations due to their low institutional ownership. There are no big players to step in when the price gets too low and “back up the truck,” and conversely, nobody to sell masses of shares when the price gets ahead of itself.

This seems to be on display when looking at cannabis stocks like Cronos Group, who are being valued at $130K of enterprise value for every kilogram of cannabis they produce.

Below is a chart of the S&P 500 compared to some of the larger cannabis stocks. When retail investors have control over price discovery, the below chart happens.

Technical Analysis

I created an equally weighted index of the largest publicly traded cannabis stocks (market caps over $1B).

The index is in a sustained downtrend, making a series of lower highs and lower lows and trading well below the key 50 and 200 day moving averages.

Final Thoughts

While the cannabis industry has barely started its growth, investors may have been too quick to strike. Markets are very effective at discounting the future, meaning much of this future growth is already priced into the stocks with their hefty premiums.

Investors who bought into

cannabis stocks early were rewarded handsomely, and that may happen again if weed stocks come back into favor. However, prudent investing, whether it is based on growth or value, involves buying things you can put an intrinsic value on with a reasonably assured margin of error. Betting on further multiple expansion would be speculation.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report