Luxury online consignment marketplace

The RealReal (NASDAQ: REAL) stock has shrugged off its Q3 2021 earnings spike as it fills the gap and heads lower into the close of 2021. The largest digital market place for used luxury apparel and collections is still showing double-digit growthy despite not being able to turn a profit. The Company suffers no supply chain disruption as the luxury resale market continues to expand globally. The RealReal should see strong

holidays sales in light of

supply chain disruptions being experienced by retailers as indicated by its CEO. The Company is a post-pandemic

ecommerce play driven by at-home consignments that “exceeded” pre-

COVID levels. Prudent investors seeking exposure in the luxury end of the retail consignment marketplace can watch for opportunistic pullbacks in shares of The RealReal.

Q3 FY 2021 Earnings Release

On Nov. 3, 2021, eBay released its fiscal third-quarter 2021 results for the quarter ending September 2021. The Company reported earnings-per-share (EPS) loss of (-$0.47) excluding non-recurring items versus consensus analyst estimates for a loss of (-$0.50), beating estimates by $0.03. Revenues rose 52.4% year-over-year (YoY) to $119 million versus $113.3 million analyst estimates. Gross merchandise value (GMV) rose 50% YoY to $368 million. Orders grew to 757,000, up 38% YoY. AOV was $486, up 9% YoY. RealReal CEO Julie Wainwright commented, “We are pleased to announce strong results for the third quarter. Our product supply has ramped nicely driven by at-home concierge appointments and our expanded retail footprint. Based on what we know today, we believe the operational and supply impacts to our business from COVID-19 are effectively behind us, and we are well-positioned for a strong holiday season. Additionally, we believe The RealReal’s unique business model is largely insulated from the supply chain shortages and certain of the inflationary impacts many retailers are experiencing. Like many retailers, we experienced certain pressures to our operations during the third quarter, namely elevated shipping costs and staffing challenges in our authentication centers. To address, we implemented multiple initiatives, including shipping diversification and last-mile optimization as well as training and development programs and a continued focus on automation. The investments we made in 2019 and 2020 to move toward expanded automation in our authentication centers have already begun to show a strong return on investment.”

Conference Call Takeaways

CEO Wainwright set the tone, “During the third quarter, our product supply ramps nicely, driven by at-home consignments that exceeded pre-COVID levels. Further, our retail stores continue to be an increasingly important and cost effective channel for securing supply. Therefore, we believe we are well positioned from a supply perspective as we enter the holiday season. Additionally, we believe The RealReal's unique business model is largely insulated from the supply chain shortages and certain inflationary impacts many businesses are currently experiencing. During the third quarter, we also managed operational pressures within the business. Like many businesses we are incurring elevated shipping costs and staffing challenges specifically in our authentication centers. To address these issues, we developed and implemented multiple initiatives including shipping diversification, and last mile optimization for the shipping cost and expanded automation and our authentication centers to address staffing shortages. She concluded, “We are confident in our ability to manage these challenges. While we are in the early innings of delivering operational expense leverage we believe the company is starting to see the benefits of previous investments. These will create significant opportunities for operating leverage as we drive toward profitability in the coming quarters. Overall, our business is continuing to experience very positive trends, and we believe these trends will continue through the end of the year and into 2022. And a final note, I'm providing forward-looking financial expectations, we intend to resume a more typical annual and quarterly guidance cadence in 2022 along with committing to a timeline to reach adjusted EBITDA profitability, expect that to begin with our next conference call.”

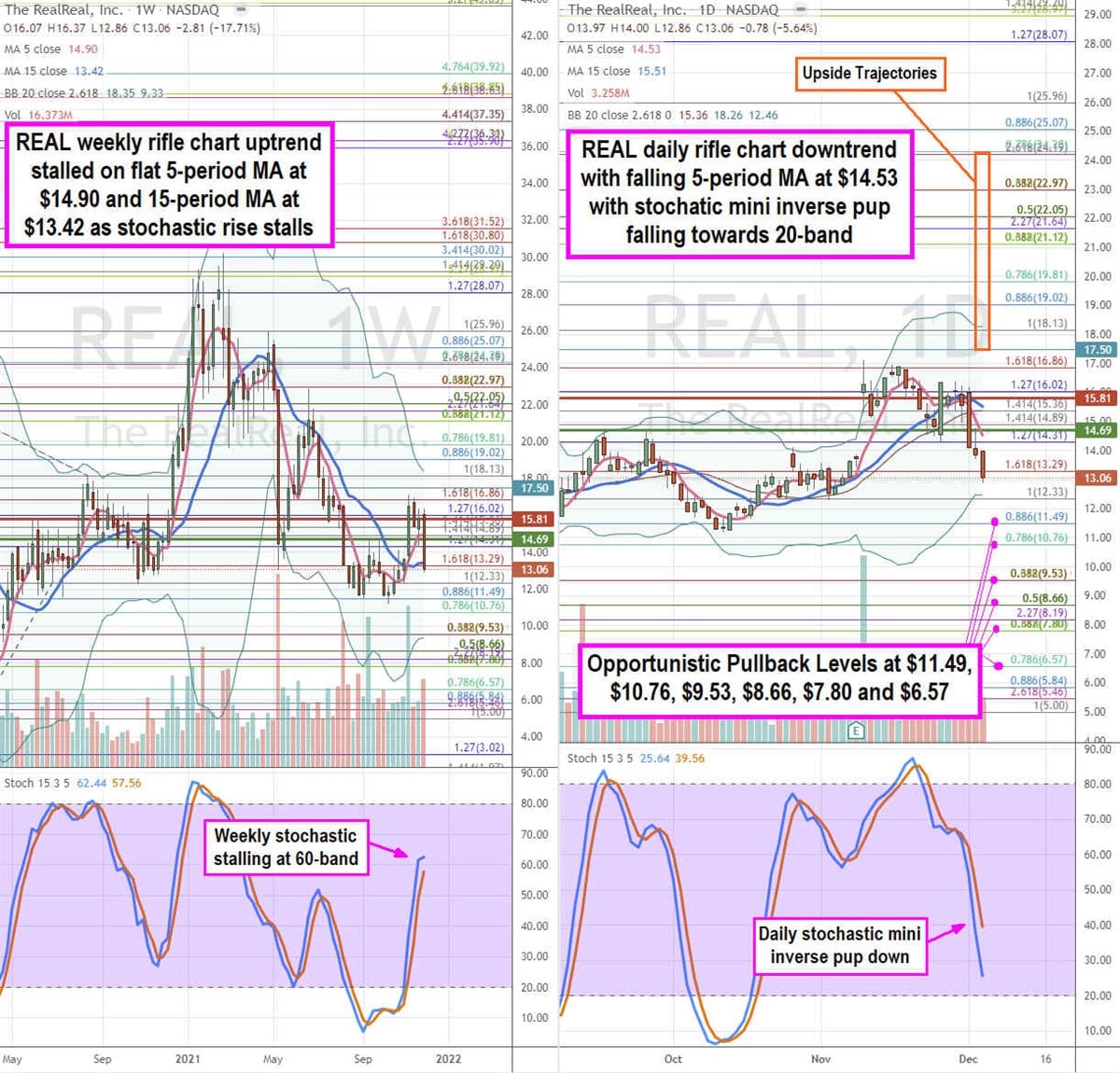

REAL Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames provides a precision near-term view of the price action landscape for REAL stock. The weekly rifle chart spiked on earnings to peak near the $16.86 Fibonacci (fib) level. Shares have since reversed sharply as the weekly uptrend stalled with a flat 5-period moving average (MA) at $14.90 and 15-period MA at $13.42. The weekly stochastic stalled just above the 80-band. The daily rifle chart triggered a market structure high (MSH) sell signal on the $15.81 breakdown. The daily 5-period MA is falling at $14.53 followed by the daily 15-period MA at $15.51. The daily lower Bollinger Bands sit at $12.46. Bulls will need to breakout REAL through $14.69 to trigger the daily market structure low (MSL) buy signal. Prudent investors can watch for opportunistic pullback levels at the $11.49 fib, $10.76 fib, $9.53 fib, $8.66 fib, $7.80 fib, and the $6.57 fib level. Upside trajectories range from the $17.50 level up towards the $24.29 fib level.

Before you consider RealReal, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and RealReal wasn't on the list.

While RealReal currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.