Packaged food and beverage maker Campbell soup stock is one of the rare stocks that remains green for the year, up 6.5% versus the

SPDR S&P 500 ETF NYSEARCA: SPY, which is down -24% in 2022.

The

Campbell Soup Company NYSE: CPB has expanded its products beyond soup, enabling it to appeal to consumers with more than just "cozy" food. Its diversified portfolio ranges from meals and beverages that include Swanson frozen meals, Pace, V8, Prego sauces and SpaghettiOs. Its snack brands include Cape Cod, Goldfish, Kettle Brand, Pepperidge Farms and Snyder’s of Hanover pretzel snacks. The original Campbell’s Soup Company brand has expanded to include variations like Slow Kettle, Homestyle, Well Yes! and Healthy Request.

The Campbell Soup Company often competes in different food aisles with health-conscious brands like Healthy Choice and gluten-free Udi’s, owned by

Conagra Foods NYSE: CAG. The company has also expanded to produce Slow Cooker and Skillet Sauces to help consumers make complete meals beyond soup. Its Pacific Brands line includes new organic canned and ready-to-serve meals and plant-based chilis. The snacks segment has grown to 46% of total sales. The

pandemic was a boon for business as consumers stockpiled its products during lockdowns.

Inflationary pressures have taken their toll on earnings as EBIT fell (-4%) to $1.3 billion despite a 1% net revenue increase.

"M'm M'm Good" Earnings

On September 1, the Campbell Soup Company released its fiscal fourth-quarter 2022 results for the quarter ending September 2022. The company reported an earnings per share (EPS) profit of $0.56, excluding non-recurring items that match consensus analyst estimates. Revenues climbed 6.1% year-over-year (YoY) to $1.99 billion, beating consensus analyst estimates for $1.98 billion for the quarter. EBIT fell to $170 million versus $411 million a year ago. Adjust EBIT rose 5% YoY due to higher adjusted gross margin, partially offset by higher adjusted administrative expenses and lower adjusted other income.

Fiscal 2023 Guidance

Campbell Soup issued fiscal full-year 2023 guidance for EPS of $2.85 to $2.95 versus $2.92 consensus analyst estimates. Revenues are expected to rise 4% to 6%, or $8.88 billion to $9.05 billion versus $8.78 billion analyst estimates. Campbell Soup CEO Mark Clouse commented, “During fiscal 2022, we demonstrated a significant step up in execution across the company with improved supply chain performance and effective revenue management to counter inflation. Our solid foundation and momentum will serve us well in fiscal 2023 as we continue to make progress on unlocking Campbell's full growth potential.”

Hunkering Down in Recessions

During recessions and depressions, consumers tend to hunker down with shelf-stable and nonperishable foods. Campbell products fit the bill with its packaged brands with very long shelf lives. Soups and snacks were staples during the pandemic and are a good cover during economic uncertainty. In this sense, Campbell makes sense as a recession hedge stock as people look for an inflation reprieve to cut down on food expenses.

Flat Guidance

Campbell reaffirmed fiscal full-year 2022 EPS of $2.75 to $2.85 versus $2.78 consensus analyst estimates. The company expects revenues to come in between $8.31 billion to $8.47 billion versus $8.42 billion consensus analyst estimates.

Here’s What the Charts Say

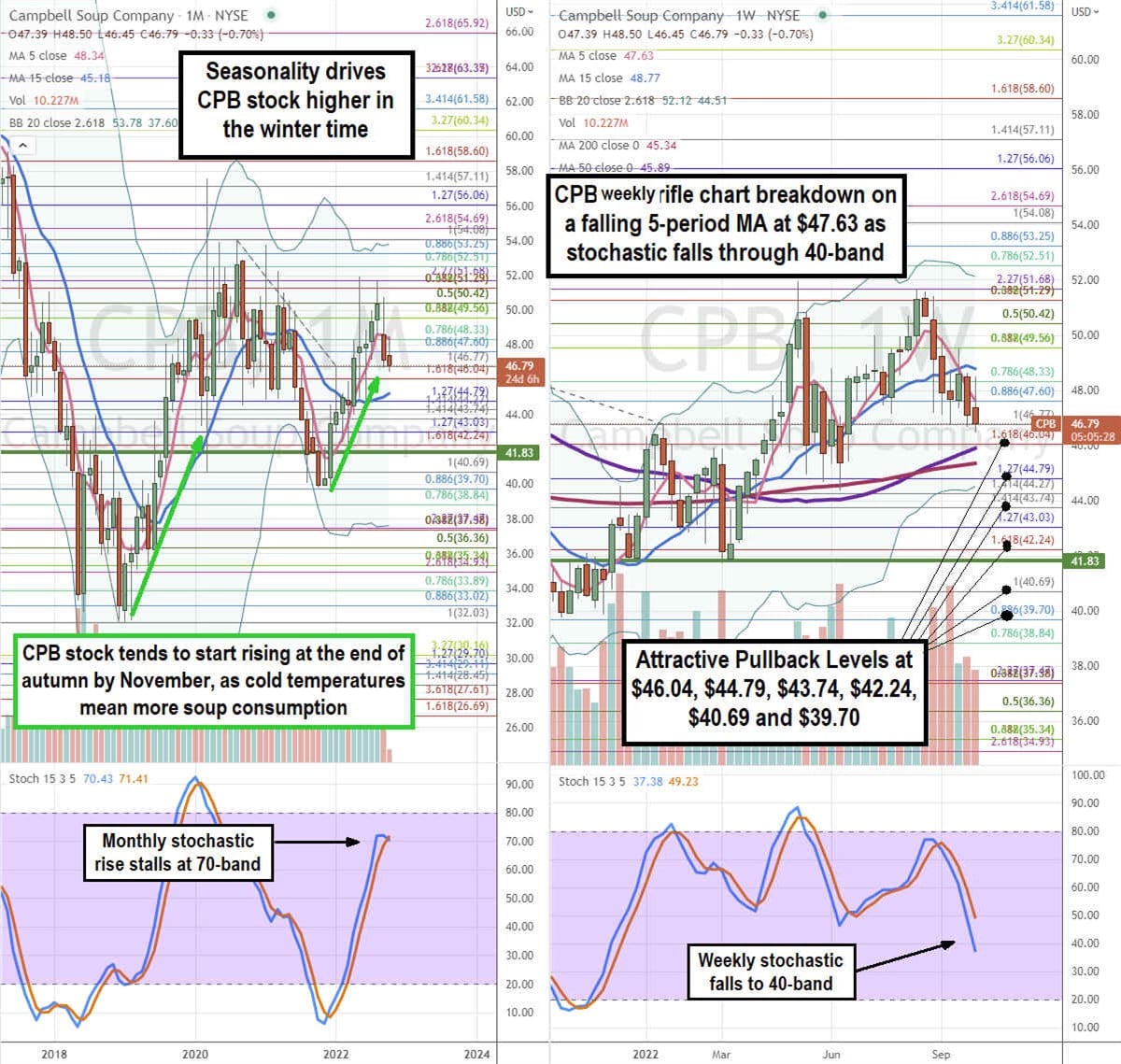

The rifle charts on the monthly and weekly timeframes provide a bird’s-eye view of the landscape for CPB stock. The monthly rifle chart uptrend stalls after peaking off the $54.08 Fibonacci (fib) level. The monthly five-period moving average (MA) flattens at $48.34 and 15-period MA slopes up at $45.18. The monthly stochastic rise stalls at the 70-band, possibly setting up a crossover down. The monthly lower Bollinger Bands (BBs) sit at $37.60. The weekly rifle chart breakdown has a falling five-period MA resistance at $47.63, followed by the 15-period MA at $48.77. The weekly market structure low (MSL) buy triggered on the $41.83 breakout. The weekly 50-period MA support sits at $45.89 and the 200-period MA support sits at $45.34. The weekly lower BBs sit at $44.51. Attractive pullback levels sit at the $46.04 fib, $44.78 fib, $43.74 fib, $42.24 fib, $40.69 fib and the $39.70 fib level.

Good Food and Good Value

The iconic brand coined the popular slogan “soup is good food,” making Campbell Soup Company synonymous with soup since its launch in 1869. It’s a global brand but hasn’t been struggled against the strong U.S. dollar as it collects over 93% of its total revenues from the U.S. It’s one of the cheapest packaged food brands compared to its competitors in terms of price/earnings (PE) and enterprise value to EBITDA (EV/EBITDA). Campbell stock trades at 16x forward earnings and 10.3 EV/EBITDA compared to The Hershey Company NYSE: HSY at 27x forward earnings, 20.3 EV/EBITDA and Lamb Weston Holdings Inc. NYSE: LW at 28x forward earnings and 22 EV/EBITDA. Value investors will also appreciate its 3.16% annual dividend yield.

Before you consider Campbell's, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Campbell's wasn't on the list.

While Campbell's currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.