Johnson & Johnson Today

JNJ

Johnson & Johnson

$176.48 -0.92 (-0.52%) As of 03:59 PM Eastern

- 52-Week Range

- $140.68

▼

$181.16 - Dividend Yield

- 2.95%

- P/E Ratio

- 18.87

- Price Target

- $176.29

After years of post-COVID-19 normalization and the impact of its Kenvue spinoff, Johnson & Johnson’s NYSE: JNJ stock price is back in rally mode. It is still early in the game, but the Q2 results affirm that growth is back, acceleration is happening and is expected to continue in the back half of the year.

Acceleration may be stronger than forecasted due to expected approvals and pipeline progress that promise to sustain this company’s growth over the long term. The critical takeaway is that this Dividend King’s capital return is as safe as ever and will continue to grow for the foreseeable future.

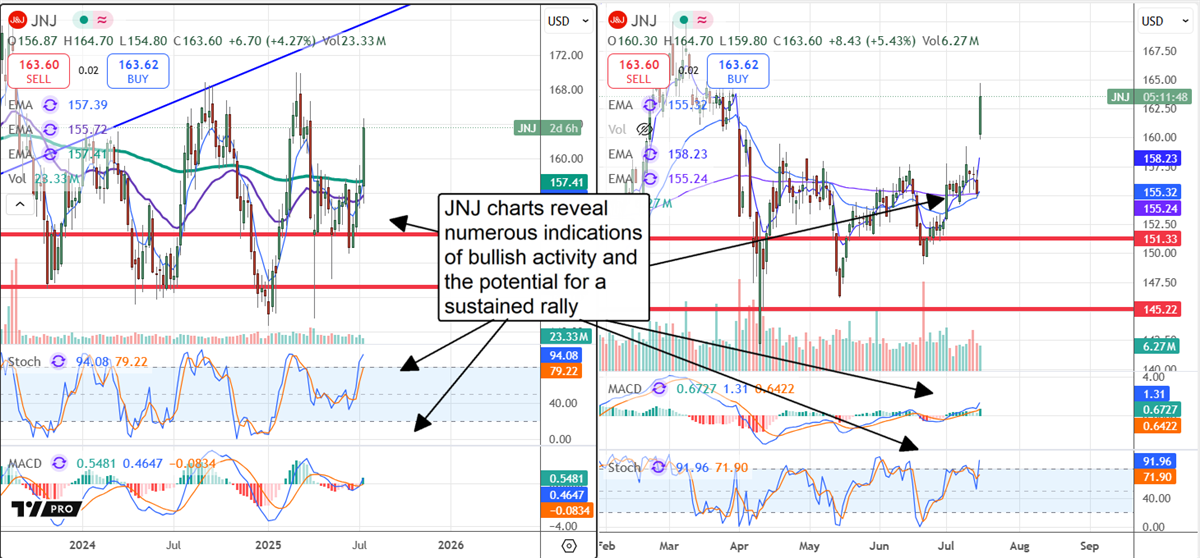

Elements aligning with the outlook for stock price rally include the price action in 2025, the stochastic and MACD indicators, and the cluster of moving averages, which shows solid support as of mid-July.

The price action is central to the rally thesis. It showed solid support at the $145 level in 2023, 2024, and again in 2025, followed by a higher level at $150 later in the year. The move to a higher support level indicates bullish sentiment advancing, which was confirmed by the price surge following the release.

The market rose above the cluster of moving averages, representing broad market support, and triggered buying signals in the indicators.

Both stochastic and MACD have swung into converging bullish entry signals on the weekly and daily charts, creating a strong buy signal with a convergence of convergences. This indicates that a high percentage of market participants are behind the move.

The cluster of moving averages, visible on the chart of weekly prices, comprises the short-term 30-day moving average for traders and speculators, as well as the longer-term 150-day and 150-week EMAs for buy-and-hold investors. This cluster serves as the launchpad for a longer-term, sustained rally driven by results.

Johnson & Johnson Produced Value-Building Results in Q2 2025

Johnson & Johnson Stock Forecast Today

12-Month Stock Price Forecast:$176.29-0.15% DownsideModerate BuyBased on 20 Analyst Ratings | Current Price | $176.55 |

|---|

| High Forecast | $215.00 |

|---|

| Average Forecast | $176.29 |

|---|

| Low Forecast | $152.00 |

|---|

Johnson & Johnson Stock Forecast DetailsJohnson & Johnson had a solid Q2 with strength in both operating segments, revealing strength in the broader pharmaceutical and medtech industries. The company produced $23.7 billion in reported earnings, up 5.8% compared to last year and 370 basis points better than expected.

Favorable FX tailwinds impacted the top and bottom line, but are not the only reasons for strength. Operational performance, new products, and demand also contributed to a 7.8% increase in the U.S. business and growth abroad.

Segmentally, MedTech was strongest, with a 7.3% increase and 6.1% adjusted growth, while Innovative Medicine grew by 4.9% reported and 3.8% adjusted.

Margin news is also favorable to the rally. The company improved its gross and operating margin due to quality and FX tailwinds, leaving the net at $5.54 billion or up 18% compared to last year. The bottom line of $2.77 in adjusted earnings is also better than MarketBeat’s reported consensus, outperforming the estimate by 330 basis points, and the margin is expected to remain solid through year’s end.

JNJ Guidance Is a Catalyst for Higher Share Prices

Johnson & Johnson’s guidance is a catalyst for higher share prices. It includes increased expectations for revenue and earnings that exceeded the consensus estimates at the mid-point, and may be cautious. The critical takeaway is that the outlook aligns with the outlook for increasing capital return, which is robust. JNJ’s incremental share repurchases provide modest leverage for investors, as they reap a 3.35% annualized yield.

Analysts' trends align with JNJ's budding stock market rally. They include increased numbers of current reports, those less than 12 months old, a firm Moderate Buy rating, and price targets ranging around the $170 level.

The $170 level aligns with the top of JNJ’s two-year trading range and is this market's critical resistance and trigger point.

Before you consider Johnson & Johnson, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Johnson & Johnson wasn't on the list.

While Johnson & Johnson currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.