Consumer Staples, It’s What You Want To Own

Consumer Staples, It’s What You Want To Own

The consumer staples (XLP) stocks have been on a tear and no wonder. The global coronavirus pandemic is driving people to stay home, stock up, and social-distance, and that means big spending in the staples categories. Companies like Conagra (CAG), General Mills (GIS), the JM Smucker Company (SJM), and Kellogg (K) have all been reporting goods news. news like increased organic sales, improved profits, and positive outlook, and that has been driving their shares back to pre-virus levels and higher.

Today’s spotlight is on Kraft-Heinz (KHC). The global food-staple behemoth reported better than expected top and bottom-line results and a very favorable outlook. Where most S&P 500 companies are going to see their revenue and earnings fall sharply in Q2 Kraft sees a modest increase for both. Don’t forget, Q2 is going to be the worst-hit quarter regarding earnings for the “average company” as most major markets are in lockdown.

What The Consumers Say

When it comes to what the consumers say, following the money is always the best bet. When it comes to Kraft-Heinz, the consumers say they want what the company is selling. Revenue in the 1st quarter not only grew 3.3% from the previous year but came in above the consensus forecast. Earnings, due to a combination of pricing, volume, and mix, also grew from the previous year to beat the consensus expectation.

The average price per case sold increased by 1.6% over the last year showing the company’s ability to pass cost increases on to the consumer. Volume and mix added a total of 4.6% of growth to the results bringing organic growth to nearly 6.2% for the quarter. In the U.S., comps rose 6.4% while Internationally they rose a slightly-more robust at 6.9%.

The only bad news is that Kraft management decided to pull the full-year guidance. The silver lining is that Kraft, like so many others, is positioned to do well during the pandemic. The reason for the guidance-pull more than mitigates its existence; Kraft thinks its current guidance may be too low but is unwilling to say so. Based on the current results and what guidance they were able to provide, the analyst’s consensus is too low and in need of upward revision. As it stands now, the analysts see 2020 revenue growth as flat to slightly negative.

The Dividend, A Healthy 5%

Kraft-Heinz is not well known as a dividend-grower, far from it in fact, but that does not negate its attractiveness today. At today’s prices, Kraft is paying more than 5% with very little expectation the distribution will be cut. Along with today’s release, Kraft issued its next distribution declaration assuring the next payment safe at least.

Beyond that, Kraft is earning plenty to cover its payment despite a slightly-higher than preferred 68% payout ratio. Assuming the company can at least meet consensus over the next two years that should not become a problem. In terms of cash-flow and debt, Kraft is carrying some debt but it’s well-managed long-term debt the company has been working hard to reduce. It was just 1.5 years ago Kraft cut its dividend to $0.40 quarterly in order to accelerate the "deleveraging process to provide greater balance sheet flexibility." That process is ongoing.

The Technical Outlook: A Vee-Shape Recovery Is In Process

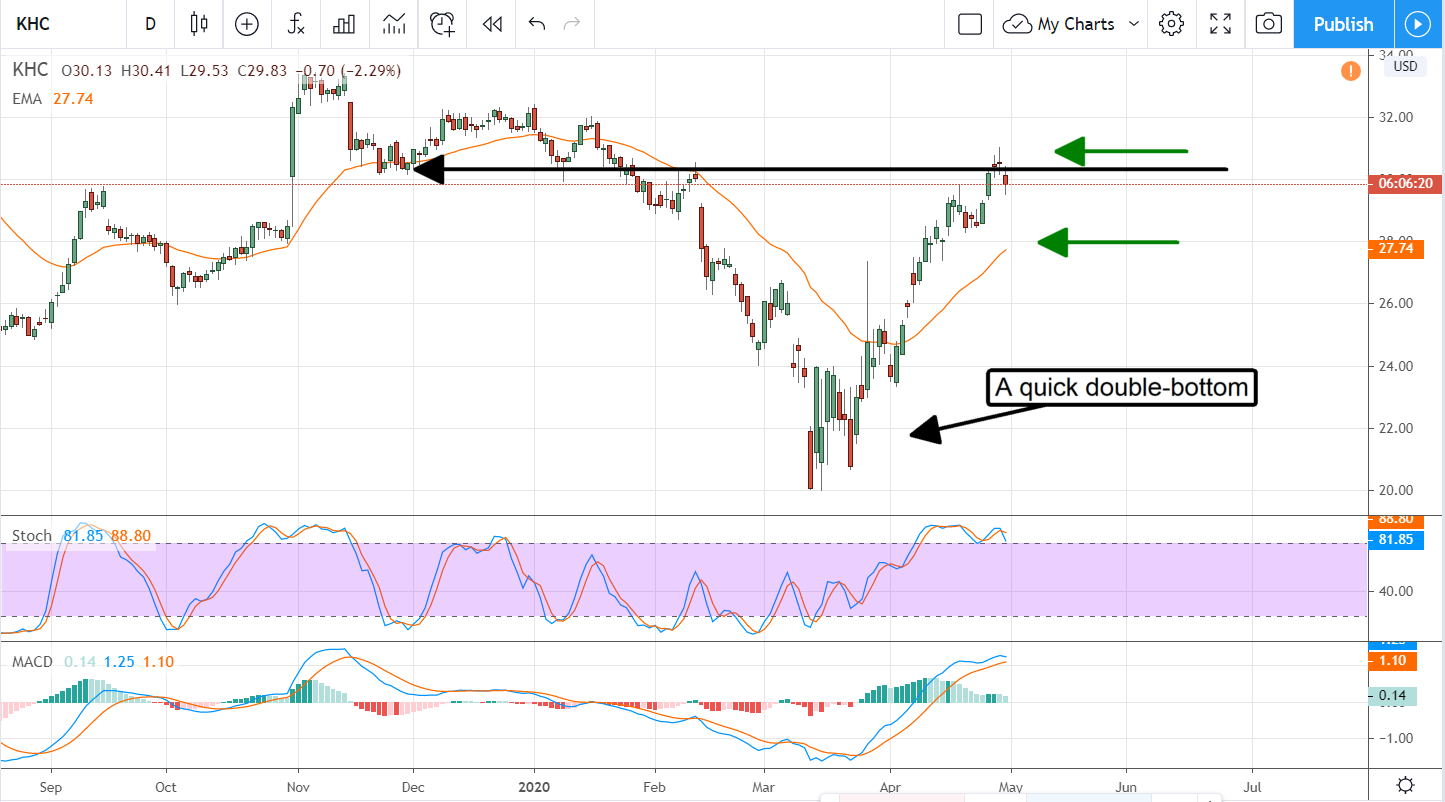

A quick look at the chart of KHC prices will show you an asset in the process of recovery. This stock saw a massive correction that shaved 37.5% off its 2020 highs and then a nice rebound. The bottom is more like a quick double-bottom than a true Vee-shaped recovery but that’s not a concern.

What is a concern is that price action appears to be flagging and the indicators are consistent with a top. This may lead the stock to correct again, possibly as low as the $28 level, despite the generally bullish outlook. If KHC falls to the EMA and confirms support I would be a buyer. Likewise, if the stock price stabilizes at today’s levels and moves above $30.25 I would also be a buyer.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for July 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.