Virtual behavioral and addiction treatment platform

Ontrak, Inc. NASDAQ: OTRK shares have been on a tear to new all-time highs. While the recovery of the benchmark

S&P 500 index NYSEARCA: SPY has been impressive, shares of ONTK have more than doubled since pre-COVID 19 levels. Formerly known as

Catasys NASDAQ: CATS , this virtual addiction treatment play was profiled when it was trading down to the $17s in March 2020 as the COVID-19 pandemic was triggering stay-in-shelter mandates worldwide. This breathed new life into remote tele-healthcare stocks like

Teladoc (NASDAQ: TDOC) and

Livongo Health NASDAQ: LVGO, who recently announced an

$18.5 billion merger. This deal further adds to the speculation that Ontrak could be an acquisition target. Investors may want to track the price trajectories for this white-hot stock to better plan potential entry and exits levels.

Q2 2020 Earnings Release

On August 5, 2020, Ontrak released its second-quarter fiscal 2020 results for the quarter ending June 2020. The Company reported a loss of (-$0.24) per share versus consensus analyst estimates of a loss of (-$0.33) per share, beating estimates by $0.07 per share. Revenues rose 124% year-over-year (YoY) to $17.2 million versus $17.1 million consensus estimates. The Company enrolled 3,389 new members for the quarter. Ontrak reaffirms 2020 revenues of “at least” $90 million, a 156% YoY revenue spike. The stock peaked near the $63.93 Fibonacci (fib) level indicating a 50% gap as a reaction to the earnings.

COVID-19 Effects on Mental Health

The effects of COVID-19 on mental health has taken a dramatic toll as the Company pointed out a crisis mental health hotline seeing an 891% spike in calls. Investors are awakening to the mental health consequences that arise from social distancing and extended periods of isolation in the backdrop of a global pandemic. Mental health issues can lead to physical maladies, which can drive healthcare costs higher. Ontrak specifically addresses these mental health issues through its network of providers on its data-driven platform to ensure a reductions in healthcare costs as the essence of its operating model.

Pandemic Driven Perfect Storm Narrative

The 50% earnings gap was driven by a perfect storm of narratives including telemedicine that accommodates the behavioral health angle especially prevalent from the effects of isolation mandates, data-driven treatment platform with sticky network effects and a tiny 17 million share float. The evidenced-based telemedicine treatment platform for behavioral and mental health thrives on cost savings and optimization. Ontrak makes money by saving money for payors including top health insurance carriers Humana (NYSE: HUM) , United Healthcare NYSE: UNH and various Blue Cross Blue Shield plans. A big win was announced on June 30, 2020, with an expansion to include Medicare Advantage members for critical behavioral healthcare in an additional 13 states. This expands total enrolled members beyond 12,000 and up 40% sequentially from Q1 2020. While numerous companies are experiencing YoY sales decline, Ontrak is reporting triple digit growth rates which underscores a perfect storm of factors that make it luminate even brighter against the dark backdrop of the universe of stocks. How do you justify a $1 billion market cap for a company looking at $90 million in full-year 2020 revenues? The current market appetite for telemedicine stocks is voracious with price-to-sales (PS) ratios ranging from 20 to 23X. Here’s a look at the trajectories for the shares both upside and downside from here.

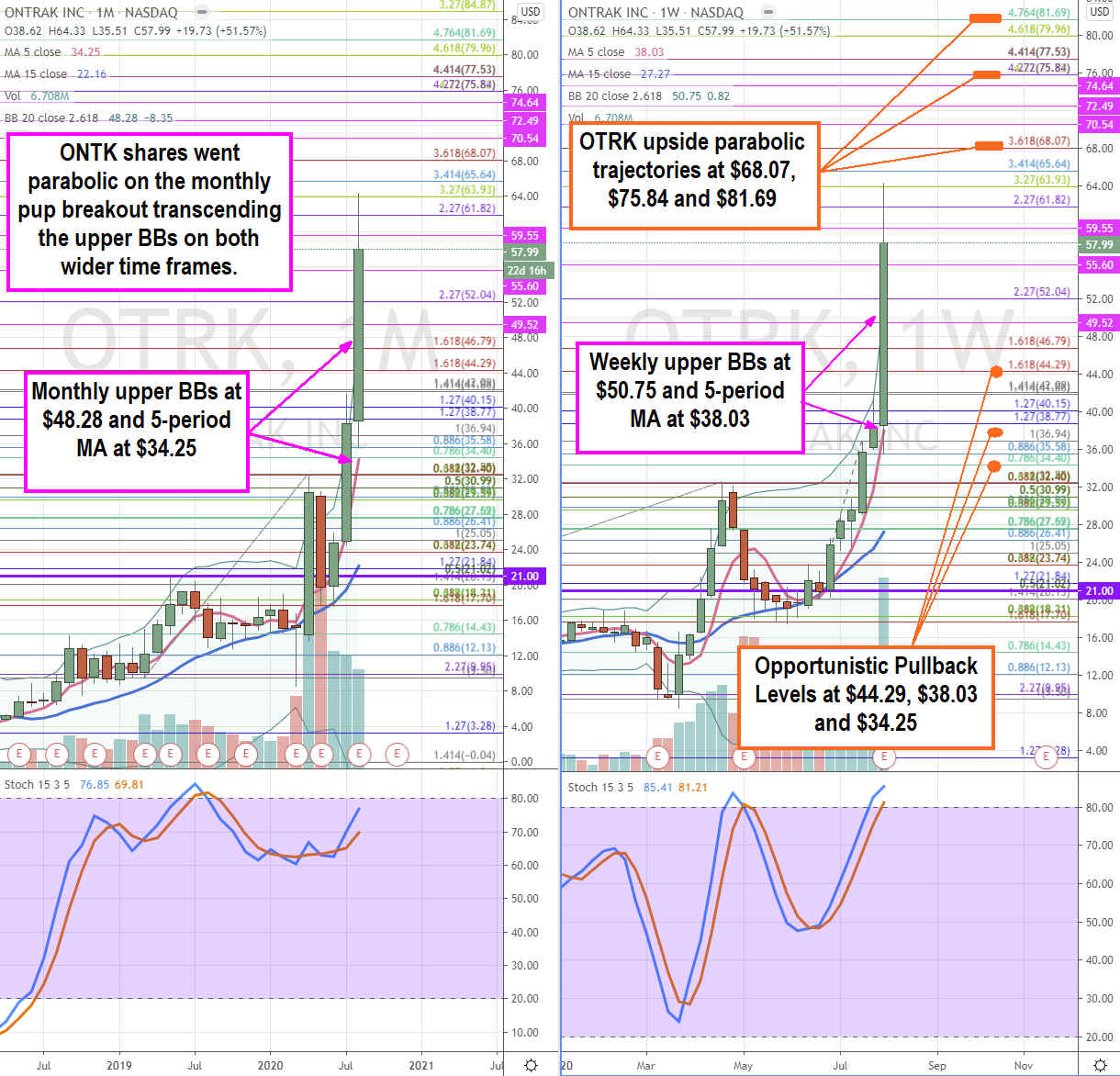

OTRK Price Trajectories

Using the rifle charts on the monthly and weekly time frames provides a broader view of the landscape for OTRK stock. The monthly rifle chart formed a bullish pup breakout with a stochastic rising towards the 80-band. The pup breakout went parabolic blasting through the monthly upper Bollinger Bands (BBs) at $48.28 and The 5-period moving average (MA) is at the $34.40 fib. The weekly rifle chart triggered a market structure low (MSL) buy trigger above $21.00. The weekly pup and stochastic mini pup squeezed through the 90-band surpassing the $50.75 upper BBs with 5-period MA at $38.03. OTRK shares are driven by the perfect confluence of factors triggered by the pandemic and currently trading around P/S of 23X. The super thin 17 million share float can keep share elevated for extended periods of time which should propel prices towards upside trajectories at $68.07 fib, $75.84 fib and $81.69 fib. In the absence of gravity (above the upper BBs), inertia takes over.

In parabolic situations, the upper BBs are key bumpers that bulls must protect. If shares fall under the upper BBs at $50.75 and $48.28, then prices can quickly fall as gravity kicks in back to the 5-period MAs at $38.03 (weekly) and $34.25 (monthly). Potential opportunistic pullback levels are at the $44.29 fib, $38.03 weekly 5-period MA and $34.25 monthly 5-period MA. This is a thinly traded stock that gets thinner as price appreciates. Only nimble traders and active investors should even consider playing. It pays to monitor TDOC price action as a lead indicator.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.