So far this quarter, and this may surprise you, Palantir Technologies NYSE: PLTR has been one of the top-performing technology stocks, specifically in its industry of software infrastructure. Shares of PLTR are so far up almost 19% on the quarter, significantly outperforming most of its peers in the industry.

After trading near the low end of its six-month range, the stock gapped into the high end, near resistance, thanks to third-quarter results that topped estimates. However, the stock has since traded into a critical area of resistance and is among the Lowest-Rated Stocks.

Will the earnings gap in PLTR hold and possibly have continued momentum higher? Or is the stock heading back to the low end of the range? Let’s take a closer look.

Recent earnings beat estimates

Palantir's recent financial report for the third quarter brought positive news and resulted in the stock surging almost 20% and breaking its short-term downtrend.

The company exceeded expectations with earnings per share at 7 cents, surpassing the anticipated 6 cents. Additionally, its revenue reached $558 million, slightly above the expected $556.1 million. Compared to the previous year, Palantir's third-quarter revenue saw a notable 17% increase from $478 million to $558 million.

The company reported a net income of $72 million, or 3 cents per share, substantially improving from the $123.9 million net loss in the same quarter last year. Impressively, this marks Palantir's fourth consecutive profitable quarter, making it eligible for inclusion in the S&P 500.

Palantir anticipates reporting between $599 million and $603 million in revenue for the fourth quarter and has raised its full-year revenue guidance to a range of $2.216 billion to $2.22 billion.

Despite topping estimates, analysts refuse to budge

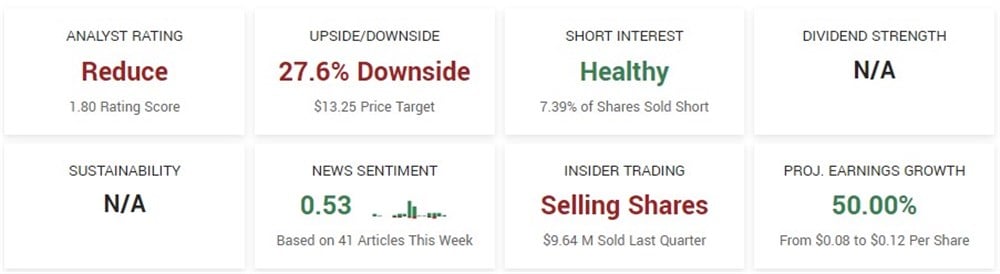

Although the stock surprised many with its latest report and showed confidence by raising its full-year revenue guidance, analysts have maintained their bearish stance. In fact, PLTR finds itself on the Lowest-Rated Stocks list, a list of the one hundred companies that have received the average rating among analysts in the last twelve months.

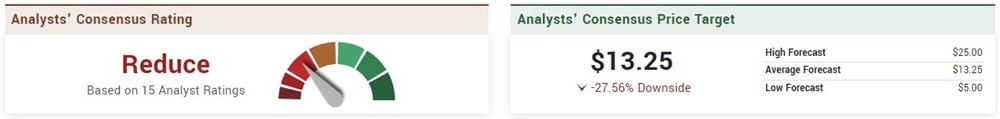

Based on fifteen analyst ratings, the consensus rating on PLTR is Reduce. Out of the fifteen ratings, six are Sell, six are Hold, and just three are Buy. Notably, the analysts’ consensus price target, $13.25, predicts over 27% downside for the stock.

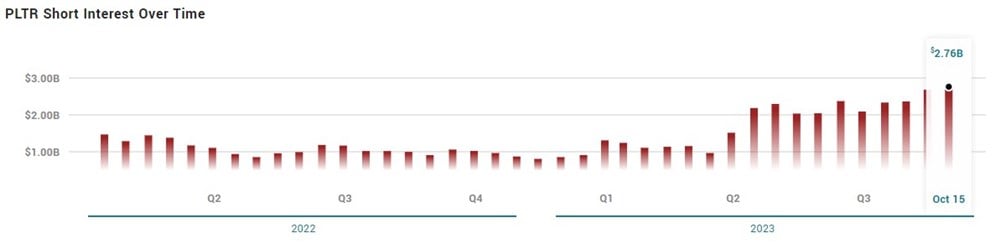

This cautious, bearish outlook spills over into the short interest in PLTR, with 7.39% of the float sold short as of October 15.

Is it the right time to invest?

With the stock trading fresh off a large earnings gap, a P/E ratio over 300, and the RSI steadily creeping closer to oversold territory, it might be wise to employ patience and discipline instead of chasing the stock at current levels.

There is no denying that the company’s most recent results will provide confidence to long-term investors and holders of the stock. However, for those yet to get involved, chasing the stock up almost 20% from recent levels, in the high-end of a six-month range, and extended from the 200-day Simple Moving Average (SMA) does not seem like the best idea.

Instead, if you want to get involved, perhaps waiting for a pullback and higher low near the rising 50-day SMA, between $16 and $17, might make more sense and provide better risk: reward.

Before you consider Palantir Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Palantir Technologies wasn't on the list.

While Palantir Technologies currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.