Shares of

Papa John's Pizza International NASDAQ: PZZA are consolidating below an all-time high and finding support near their 10-day moving average as investors add slices of the company to their portfolios.

The stock ended Monday's session at $128.66, down $0.74, or 0.57%. The trading volume was light.

The stock has climbed nearly 26% since clearing a cup-with-handle buy point of $102.49 in above-average turnover on June 9.

On August 5, the company reported better-than-expected second-quarter results. Earnings came in at $0.93 per share, up 94% from the year-earlier quarter. Revenue rose 12% to $515 million.

Earnings topped the consensus estimate of $0.69 per share.

The three-year annualized revenue growth rate is 0.56%, although growth picked up to double-digit rates in the past five quarters.

Delivery Business Grew In Pandemic

In fact, the most recent quarterly sales growth was evidence of the company's strength over the already-robust revenue from the second quarter of 2020, when lockdowns boosted delivery business.

System-wide North American same-store sales grew 5.2%, exceeding estimates.

There have been clear pandemic winners and losers, and Papa John's is in the former category. Earnings declined in 2018 and 2019, and were choppy and the first quarter of 2020.

Analysts now see the growth continuing, eyeing earnings per share of $3.12 for the full year, a gain of 123%. That's expected to rise another 12% next year, to $3.49 per share.

Papa John's stock is up 7.4% since the second-quarter report.

Year-to-date, shares advanced 52.58%. That gain is inclusive of the cup-with-handle base that began forming in February.

According to MarketBeat data, analysts' consensus rating on the stock is a "buy." Last month, eight analysts boosted their price target on Papa John's.

- In the earnings call, CEO Rob Lynch cited a couple of standout areas.

New Products Driving Sales

"The continued strength of Epic Stuffed Crust, combined with the launch of Papa John's crusted Papadias in June draw a strong customer acquisition and helped us retain many of the new customers that we acquired in 2020. Our innovation pipeline continues to be very incremental to both sales and profits," he said.

Chief financial officer Ann Gugino delivered some good news, telling analysts that the firm is raising its unit growth outlook for the year to 260 net new units, up from previous guidance for 220.

However, she repeated a refrain familiar to most investors these days: Although the company expects to increase year-over-year margins in the second half of the year, commodity and labor headwinds should moderate those improvements.

Papa John's, with a market cap of $4.7 billion, is smaller than rival Domino's NYSE: DPZ, which checks in at a $18.84 billion and is an S&P 500 component.

In its most recent quarter, Domino's grew revenue by 12%, to 1.03 billion. That's exactly the same percentage as Papa John's growth.

Domino's Also Growing Earnings

However, Domino's earnings grew at a slower rate of 4%. Nonetheless, analysts still expect full-year earnings to grow at a decent rate of 14% this year, to $13.68 per share, with an additional 15% growth next year, to $15.77 per share.

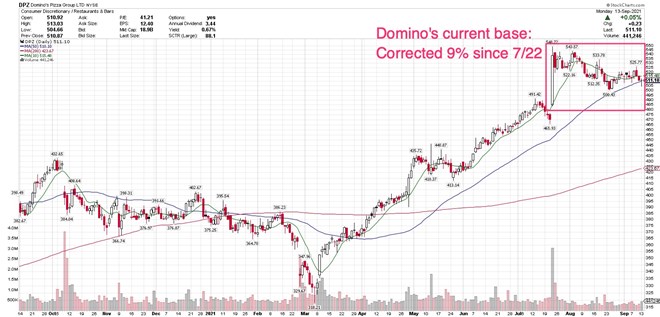

Domino's is currently consolidating below its July 22 high of $548.72, reached after the company's most recent quarterly report.

The current base has corrected 9% so far, so it can be categorized as a flat base, although its appearance on a daily chart, in particular, doesn't look so flat. A weekly chart smooths out the view.

Domino's is currently finding support just above its 50-day moving average. Shares closed Monday at $511.10, up $0.23 or 0.05%.

Year-to-date, Domino's is up 33.78%, lagging Papa John's, but ahead of the S&P 500.

- Both these pizza makers have good charts and good earnings growth, and both have very similar betas, measuring their volatility relative to the broader market. For investors looking for a potentially larger return in the coming year, the faster growth outlook for Papa John's may be an attraction, although it's important to remember that even established larger companies can surprise to the upside.

Before you consider Papa John's International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Papa John's International wasn't on the list.

While Papa John's International currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report