Global integrated payments platform and digital wallet

Paysafe NYSE: PSFE stock recently started trading under its new symbol on March 31, 2021. The Company is a reverse merged business combination from special purpose acquisition company (SPAC) formerly known as Foley Trasimene Acquisition Corp. II (BFT) operated by iconic investor Bill Foley. While 2020 was the year of the SPAC explosion, 2021 has been the year of the

SPAC implosion as the glut of supply and shareholder dilution triggered a migration out of these overhyped vehicles. When SPACs complete the business combination to trade under the new symbol, the underlying stocks tend to experience up to (-50%) initial sell-offs that can last from three to eight or more days. The

impending dilution from the insiders, sponsor, PIPE investors and financiers often result in deep haircuts. However, Paysafe may be one of the few that may survive and thrive as a publicly traded stock due to strong tailwinds powering growth in

digital payments and

iGaming. Risk-tolerant investors can look for opportunistic pullback levels on this newly minted stock to consider carefully scaling into a position.

What is Paysafe?

Paysafe was spawned from a series of mergers that mainly include digital wallet Skrill and Neteller payment platform, which operate in over 30 countries and 120 markets combined. It’s iGaming eCash network operates in over 50 markets and its POS ecommerce payments platform is utilized in the U.S., Canada, and Europe. Neteller was popular in the U.S. prior to the online gambling ban, but it has still flourished internationally. The reopening of iGaming accelerated by the digital sports betting movement can help reestablish the U.S. market penetration for Neteller. While digital processors like PayPal NASDAQ: PYPL and Square NYSE: SQ shun taking on the risks associated with iGaming transactions, Neteller was born out of the necessity to fill that void. Since payments have to be deposited in advance, the actual risk associated with the transaction is very small. The Company estimates iGaming in the U.S. can expand at a compound annual growth rate (CAGR) of 52% through 2025. Paysafe expects $103 billion in total 2021 transactions with 11% CAGR through 2023. iGaming is extremely lucrative as Paysafe collects heft transaction fees from users as well as collecting fees from iGaming sites willing to join its growing network. iGaming is a primary growth driver especially with the continued state-by-state acceptance trend making its way around the country.

Founder Shares Lockup

According to the FORM 10-K filed Feb. 25, 2021, the Sponsors acquired 34.5 million Founder Shares for $25,000 on July 15, 2020. The Sponsor has agreed not to sell, transfer, or assign any Founder Share until the earlier to occur including either a one-year lockup period upon the completion of the Business Combination (March 30, 2021) or if shares hit $12 or more for 20 trading days within any 30-day trading period starting 150-days after the Business Combination completion. Basically, there’s a five to six-month lock-up period for Founder shares provided shares stay at or above $12 per share, which may act as a floor further out.

Cryptocurrency Expansion

On March 25, 2021, Paysafe announced a partnership with cryptocurrency exchange platform Coinbase for U.S. customers. The Paysafe Skrill digital wallet expands its U.S. offerings to 37 states enabling cryptocurrency trading and transactions through a white label solution powered by Coinbase. Skrill also announced the rollout of the Skrill VISA Prepaid card in 2021. This continues to enhance its penetration into the underbanked demographic that is often overlooked by banks and major payment platforms.

PSFE Opportunistic Pullback Levels

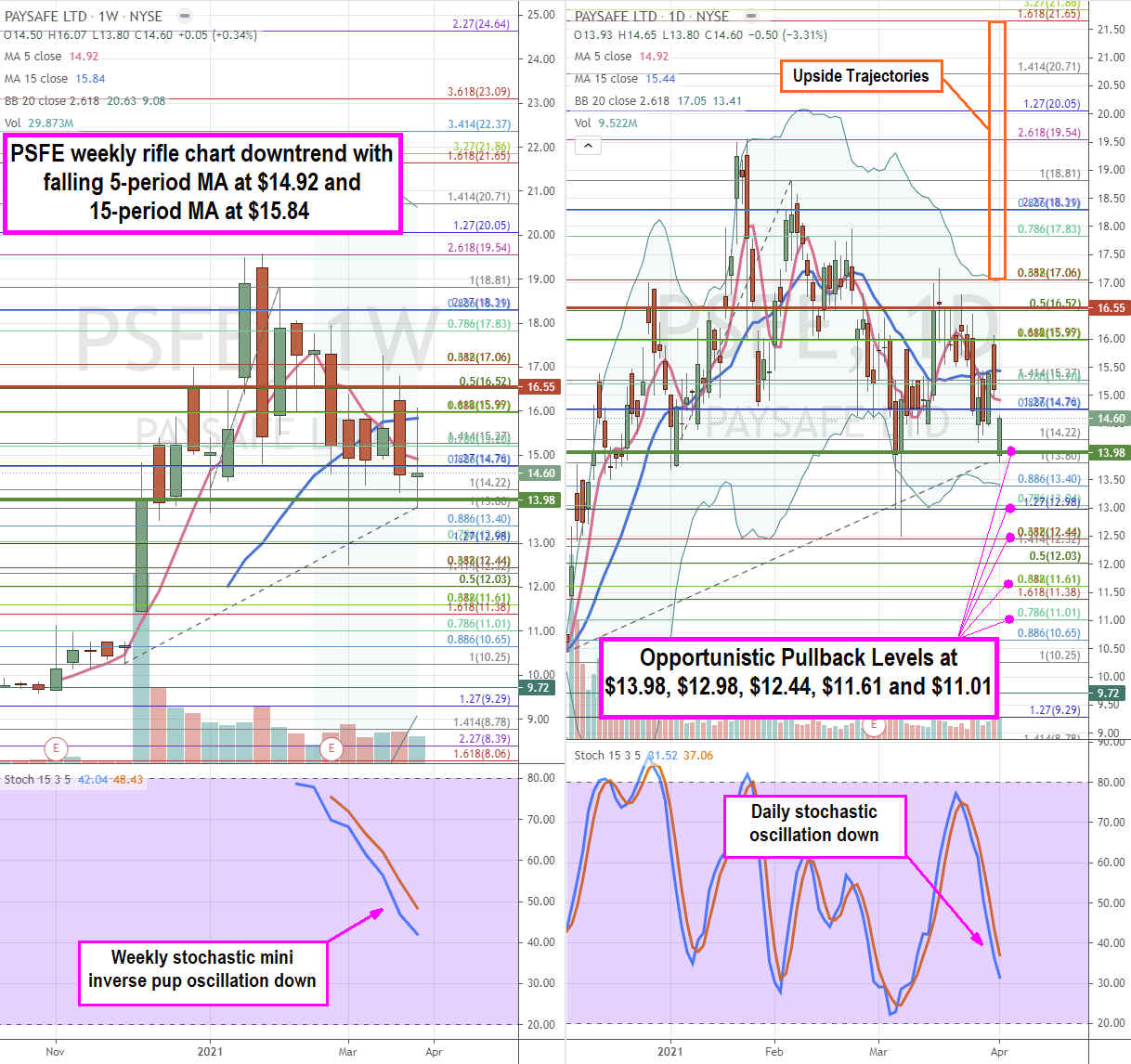

We use the rifle charts on the weekly and daily time frames to provide a short-term perspective for PSFE shares. The weekly rifle chart peaked at $19.54 Fibonacci (fib) level. The weekly downtrend has a falling 5-period moving average (MA) at $14.92 with a stalling 15-period MA at $15.84. The weekly stochastic has been in a mini inverse pup falling towards the 40 band with lower Bollinger Bands (BBs) at $9.08. The daily rifle chart has broken down with a falling 5-period MA at $14.92 and flat 15-period MA at $15.44 with lower BBs at the $13.40 fib. The daily market structure low (MSL) triggers above $13.98 versus the daily market structure high (MSH) trigger below $16.55. Risk-tolerant investors can look for opportunistic pullback levels at the $13.98 MSL trigger, $12.98 fib, $12.44 fib, $11.61 fib, and the $11.01 fib. Potential upside trajectories range from the $17.05 fib to the $21.65 fib. It’s worth watching PYPL and SQ price action as strong moves with the major digital payment platforms may finds it was to PSFE shares.

Before you consider Paysafe, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Paysafe wasn't on the list.

While Paysafe currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.