Domestic casino operator Penn National Gaming, Inc. (NASDAQ: PENN) stock made a spectacular rise from pandemic lows of $3.75 in March 2020 soaring to a high of $142 a year later only to collapsed to a low of $37.76 in January 2022. The Company continues to grow its Barstool Sportsbook brand and additional physical casino locations which integrate the pandemic accommodative “3Cs” of being cashless, cardless, and contact less. Penn Gaming Studios plans to leverage the omni-channel synergy effects drive growth in its development of Barstool Blackjack and Barstool Slots. As more states legalize online sportsbooks and iGaming, Penn Gaming is prepared to launch and bolster its footprint both digitally and physically. While earnings only came in a 50% of expectations, the Company is laying the groundwork for the future. Prudent investors seeking a domestic play on casino gaming and sportsbetting can look for opportunistic pullbacks in shares of Penn Gaming.

Q4 FY 2021 Earnings Release

On Feb. 3, 2022, Penn Gaming released its fiscal year Q4 2021 earnings for the quarter ending September 2021. The Company reported a GAPP profit of $0.26 per share versus consensus analyst estimates for a profit of $0.52 per share, missing by (-$0.26) per share. Revenues grew 53.1% year-over-year (YoY) to $1.57 billion beating consensus estimates for $1.51 billion. Adjusted EBITDAR rose 31.5% YoY to $480.5 million. The Company authorized a new $750 million shares buyback program. Penn Gaming CEO Jay Snowden commented, “I am pleased to report a strong finish to another transformative year for Penn National. Our fourth quarter revenues of $1.6 billion and Adjusted EBITDAR of $480.5 million exceeded both 2020 and 2019 levels as our best-in-class operating teams continue to deliver impressive results despite the ongoing pandemic. In addition, we accomplished several strategic objectives this quarter that have laid the foundation for future growth, including the completion of our acquisition of Score Media and Gaming Inc., the continued expansion of Penn Interactive operations, the opening of our fourth casino in Pennsylvania and the roll-out of new technology at many of our casinos.”

Flat Guidance

Penn Gaming issued flat revenue guidance for full-year 2022 to come in between $6.07 billion to $6.39 billion versus $6.22 billion consensus analyst estimates. The Company expects full-year adjusted EBITAR of $1.85 billion to $1.95 billion.

CEO Comments

CEO Jay Snowden noted two new states launched sports betting, Iowa, and West Virginia. The launch of online sports betting in Louisiana brings a total of 12 states that Penn operates sports gaming in and iCasino gaming in four states. The Company expects new launches in Ohio, Ontario, and Maryland in 2022. The acquisition of the Score galvanizes Penn Gaming’s leadership in digital content, gaming, and technology in North America. The Company plans to acquire the remaining stake in Barstool Sports, Inc. in 2023. Penn Gaming opened its 44th U.S. location with a Hollywood Casino in Morgantown, Pennsylvania, marking its fourth property in that state. The latest casino incorporates cardless, cashless, and contactless ‘mywallet’ experience which exists in eight properties in Pennsylvania and Ohio. These serve as a template for future casinos moving forward. The Barstool Sportsbook saw “sizeable” growth with increased traction during football season to become one of the leading operators in the New Jersey market. Barstool social media reach exceeds 144 million, a 25% YoY increase. Barstool opened its first physical sports bar location in Chicago with additional locations expected including Philadelphia to bolster its brand and fuel its omnichannel strategy.

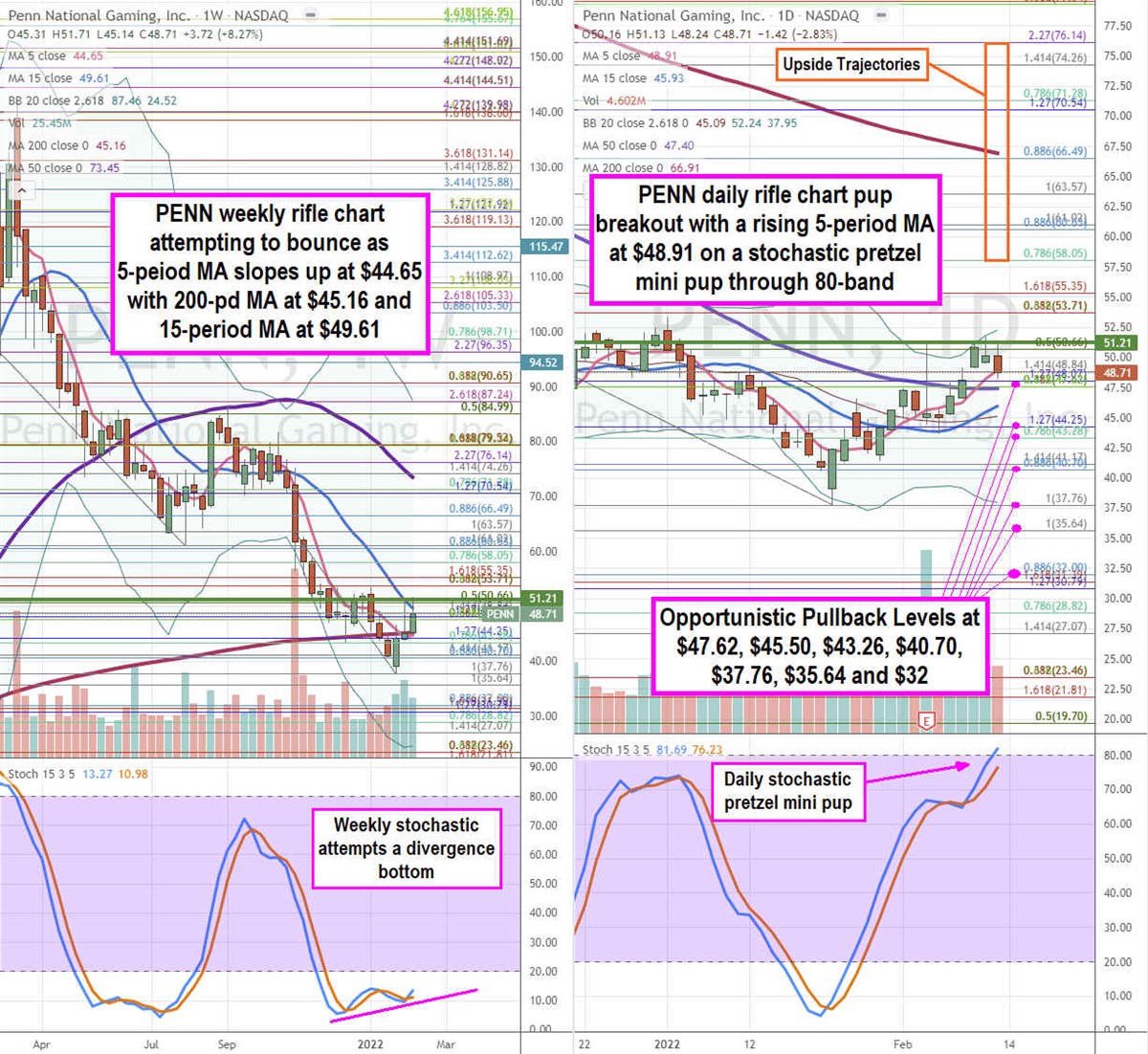

PENN Price Trajectories

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for PENN stock. The weekly rifle chart formed peaked near the $87.24 Fibonacci (fib) level before forming a weekly mini inverse pup all the way down to the 10-band bottoming out at $37.76. The weekly rifle chart downtrend is starting to wane as the weekly 5-period moving average (MA) slopes up at $44.65 with the weekly 200-period MA support at $45.16 as shares tighten to the 15-period MA at $49.61. The weekly stochastic is forming a divergence bottom as indicated by the higher band recoils as it attempts to test the 20-band. The weekly market structure low (MSL) buy triggers above the $51.21. The daily rifle chart uptrend has a rising 5-period MA at $48.91 followed by the 15-period MA at $45.93 and 50-period MA at $47.40. The daily stochastic formed a pretzel mini pup through the 80-band. The daily upper Bollinger Bands (BBs) sit at $52.24. Prudent investors can watch for opportunistic pullback levels at the $47.62 fib, $45.50, $43.36 fib, $40.70 fib, $37.76 fib, $35.64 fib, and the $32 fib level. Upside trajectories range from the $58.05 fib level up towards the $76.14 fib level.

Before you consider PENN Entertainment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PENN Entertainment wasn't on the list.

While PENN Entertainment currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.