Visual social media platform Pinterest NYSE: PINS stock is widely believed to be just a pandemic benefactor that will recede as the acceleration of COVID vaccinations drives the return to normal and re-opening theme. However, that would be underestimating both the stickiness of the platform and the benefits from the re-opening theme as advertisers flock to the brand safe platform for consumer dollars. The Company describes itself as a visual discovery engine for people to find inspiration for their lives with recommendations that accommodate personal tastes and interests. Shares sold off during the March Nasdaq correction. This can present opportunistic pullback levels for prudent investors seeking a social media play with re-opening tailwinds and not mired in controversy like the larger social media platforms being targeted by Congress.

Q4 FY 2020 Earnings Release

On Feb. 4, 2021, Pinterest released its fiscal fourth-quarter 2020 results for the quarter ending December 2020. The Company reported an adjusted earnings-per-share (EPS) profit of $0.43 excluding non-recurring items versus consensus analyst estimates for a profit of $0.32, beating estimates by $0.11. Revenues surged by 76% year-over-year (YOY) to $706 million beating analyst estimates for $647.03 million. Global monthly active users (MAUs) rose 37% YoY in Q4 to 459 million. For the full-year 2020, Pinterest added a total of $100 million global MAUs. The average revenue per user (ARPU) rose 29% YoY to $1.57. Pinterest expanded its sales team in Western Europe to help grow international business grew 145% YoY and now represent 17% of total revenue. Pinterest raised its Q1 2021 forecast for revenue growth in the low 70% range YoY. This is higher than the consensus analyst estimates that call for 59% YoY revenue growth or $432 million.

Conference Call Takeaways

Pinterest CEO, Ben Silberman, set the tone, “People need a place to dream and be optimistic, away from politics and bad news. They need a space to focus on themselves based on what they want to do, not what other people will like. And businesses want to reach people early in the planning process before they decide what to buy for their lives.” The Company introduced Story Pinners feature in the quarter that enables creators to share multipage content about enriching their own personal lives. He mentioned a Pinner, Dennis Dixon, receiving 10 million views to share his workout routines and ordinary day-to-day things. The Company seeks to incorporate more shopping tools utilizing augmented reality (AR) to enhance user experience, like a shadow try-on feature users can use. The niche is the positive environment of the platform which is further accentuated by the headline making controversy with peer social media platforms that have triggered the wrath of Congress. CEO Silberman stressed the progress the Company has made on the shopping front, “We made progress on the shopping front. We made it easy to switch directly into shop mode from the search query. So, we introduced new features from merchants, all of which led to a 6X increase in shopping advertisers on Pinterest in Q4.” The Company plans to expand monetization in Latin America in 1H 2021.

Drama-Free Inspiration Driven Visual Social Media

The appeal of Pinterest is the lack of controversy, which serves both the users and most importantly advertisers and businesses. The platform has a brand positive appeal driven by inspiration and monetarized through non-intrusive, frictionless, and suggestive recommendations. This is a relief to consumers who are fed up with creepy Google NASDAQ: GOOGL ads that pop up with products for items you may have used the search engine for earlier. This may seem like a non-tangible asset, but it definitely produces tangible results as other social media platforms face political, ethical, moral, and commercial scrutiny.

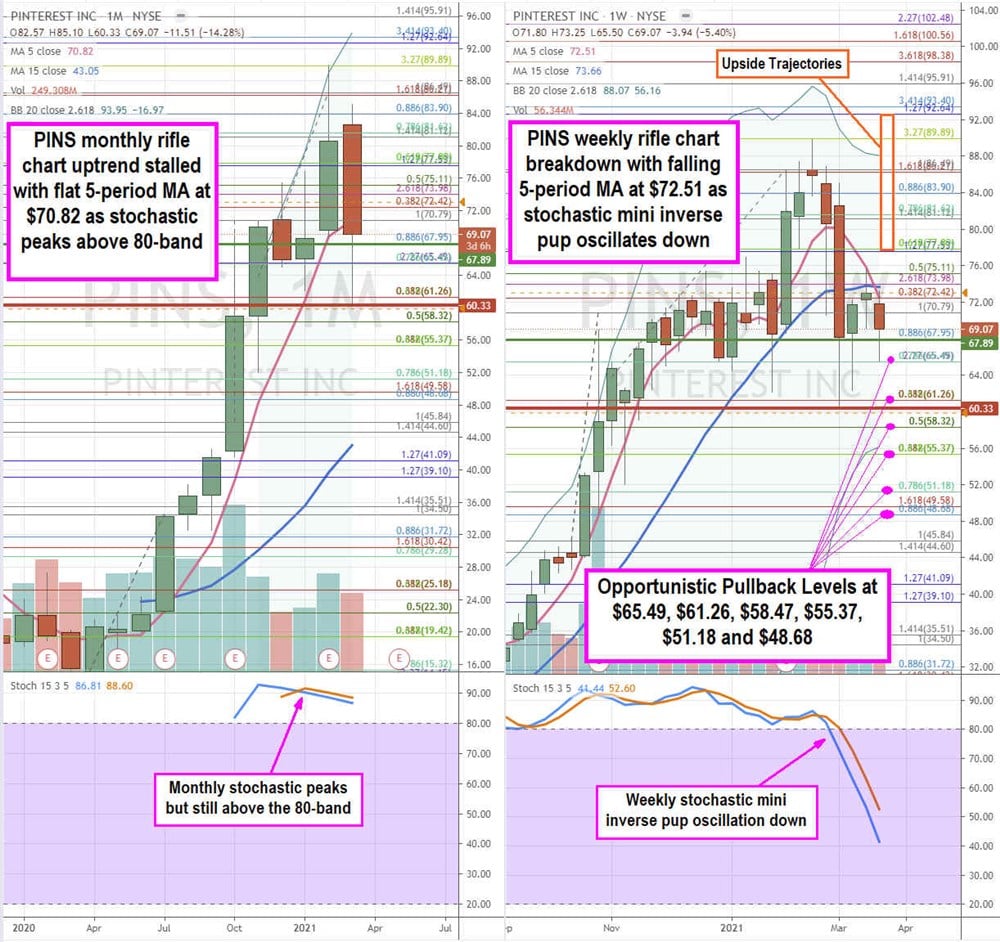

PINS Opportunistic Pullback Levels

Using the rifle charts on the monthly and weekly time frames provides a bird’s eye view of the price action landscape for PINS stock. The monthly rifle chart uptrend peaked sharply at the $89.89 Fibonacci (fib) level. Shares quickly collapsed to $60.33 before coiling back below the monthly 5-period moving average (MA) at $70.82. The monthly stochastic peaked and crossed down but still remains above the critical 80-band overbought line in the sand. The weekly rifle chart is breaking down as the 5-period MA at $72.51 crossed down through the 15-period MA at $73.66. While the daily market structure low (MSL) triggered above $67.89, the monthly market structure low (MSH) sell triggers on a break below the $60.33. The weekly rifle chart has a bearish stochastic mini inverse pup that may cause shares to fall to the weekly lower Bollinger Bands (BBs) at $56.16. Prudent investors can watch for opportunistic pullback levels at the $65.49 fib, $61.26 fib, $58.47 fib, $55.37 fib, $51.18 fib, and the $48.68 fib. Keep an eye on social media stock peers SNAP, TWTR, and FB as they tend to move together as a group. Upside trajectories range from the $77.53 fib up towards the $92.64 fib level.

Before you consider Pinterest, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pinterest wasn't on the list.

While Pinterest currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.