Hydrogen fuel cell technology provider

Plug Power (NASDAQ: PLUG) stock is getting a second wind as it rises after losing more than (-60%) from its 2021 highs of $75.49. The hydrogen fuel cell pioneer’s

energy technology is being validated through partnerships with many large companies including BAE Systems, Renault Group, Baker Hughes, SK Group and most recently Airbus. The Company is a leader in the movement for adoption of hydrogen

fuel cell mobility solutions and governments are getting on board. Plug Power is also pursuing green hydrogen as a growth driver in addition its electrolyzers making it an even more cleaner source of energy in the global

decarbonization movement. The Company expects to generate $3 billion in sales with 30% margin and 17% operating income by 2025 building a global hydrogen ecosystem as a market maker. Prudent investors seeking exposure in the

clean and renewable energy segment can watch for opportunistic pullbacks in shares of Plug Power.

Q2 2021 Earnings Release

On Aug. 5, 2021, Plug Power released its fiscal Q2 2021 results for the quarter ending in June 2021. The Company reported an earnings per share (EPS) loss of ($0.18) excluding non-recurring items, missing consensus analyst estimates for a loss of (-$0.07), by (-$0.11). Revenues grew 83.2% year-over-year (YoY) to $124.56 million beating the $111.21 million consensus analyst estimates. Plug Power CEO Andrew March commented in a letter to shareholders, "As mentioned on the Q1 earnings call, activity in the electrolyzer market has picked up significantly in terms of both volume and size of projects in the company's funnel. Growth in the electrolyzer business is estimated to be up over 400% in 2021 versus 2020 and expected to continue to grow at robust levels through 2024. As new products scale, we expect to realize significant labor and parts leverage from our reliability and resource investments. Given service platform progression, we expect break-even to slightly positive service margin run rates materializing early in 2022 and progressing towards our 2024 margin targets.”

Conference Call Takeaways

CEO Marsh set the tone, “This quarter had a mixture of successes and challenges. The successes are easy to rattle off. Revenue increased dramatically by over 75% versus the prior year, shipment of GenDrive units in new site dramatically increase versus the prior year. We closed HYVIA JV with Renault, targeting the light commercial market for vehicles in New York. This market is expected to be 500,000 vehicles in 2030, with over 30% of the market captured by the JV. We did have some challenges in the quarter associated with hydrogen costs. There are two major drivers, the cost the bending our relationship with their products. This had short-term impact on pricing and construction costs are replaced Air Products liquid tanks. This is about two-thirds of the increase in the hydrogen cost for the quarter. There also was a crisis with the availability of hydrogen due to a force majeure. Force majeure was due to a major hydrogen plant going down for two months in the Southeast. This local disruption impacted the U.S. hydrogen network. Why I think is really important? We have Plug Power made sure our customers had hydrogen throughout this event.” He concluded, “We have exciting news coming up in the coming quarters. We're increasing our gross billing guidance in 2021 to $500 million. This means we'll be increasing our gross billings by over 50% from our 2020 numbers. We will close our JV with SK this quarter as planned. We're working on the final details of the relationship both of us are really quite excited. And will also be closing our JV with Acciona in the Iberian Peninsula. We plan to build 30 tonnes of liquid hydrogen capacity with Acciona, makes it one of the largest liquid hydrogen producer in Europe. We're also targeting bookings of 250 to 500 megawatts of electrolyzers in 2021, with 250 megawatts shipping out of our new giga factory. We'll be making announcements in the second half for additional take off agreements for hydrogen plants. Finally, and this is really important. With the giga factory, we're utilizing state of the art automated equipment in our new manufacturing processes. We're playing to match our unprecedented capabilities, in sales and design of fuel cells and electrolyzers and become not only a leader in manufacturing news devices, but a global manufacturing leader. That's why we hired Dave Mindrich, who ran the Tesla giga factory in Nevada.”

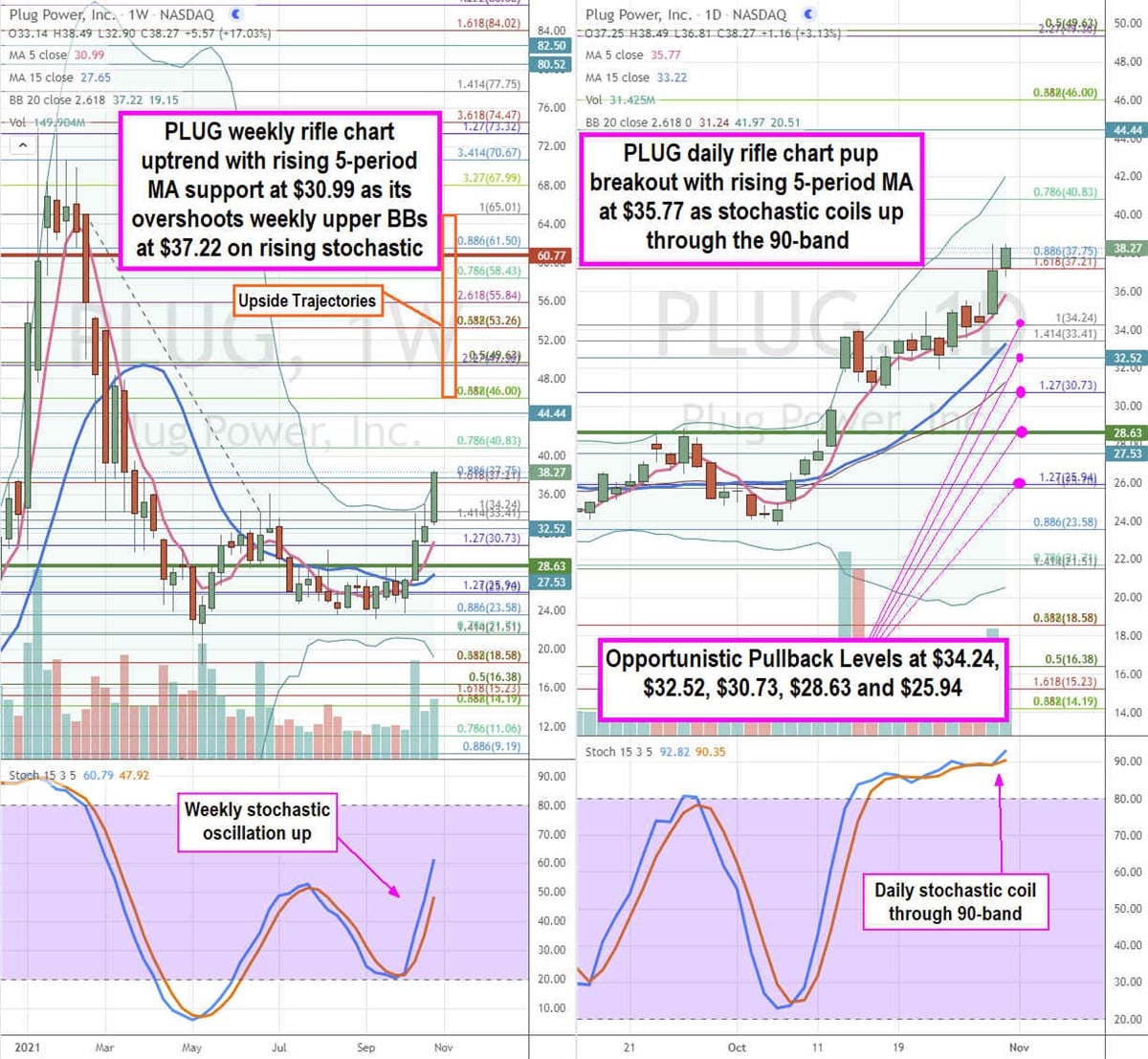

PLUG Opportunistic Pullback Levels

Using the rifle charts on weekly and daily time frames provides a precision view of the landscape for PLUG stock. The weekly rifle chart exploded through the $37.75 Fibonacci (fib) level. The weekly rifle chart formed a breakout with rising 5-period moving average (MA) at $30.99 that exceeded its upper weekly Bollinger Band (BBs) at $37.22. The weekly stochastic is rising up through the 60-band. The weekly market structure low (MSL) buy triggered above the $28.63 level. The daily rifle chart formed a pup breakout with a rising 5-period MA at $35.77 and upper daily BBs at $41.97 as the stochastic coils again higher through the 90-band. Shares have been in a short squeeze so its best to wait for some reversion. Risk-tolerant investors can watch for opportunistic pullback levels at the $34.24 fib, $32.52, $30.73 fib, $28.63 weekly MSL trigger, and $25.94 fib. Upside trajectories range from the $46.00 fib up towards the $65.01 fib level.

Before you consider Plug Power, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Plug Power wasn't on the list.

While Plug Power currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.