Experience management system provider Qualtrics International NYSE: XM stock has bounced after bottoming at the $21.72 level. The Company was spun-off from SAP NYSE: SAP several years ago and is coming into its own. While it is yet to turn profitable, it has provided forecast to reach breakeven in fiscal 2022. Revenues are still rising double digits despite the recent earnings miss. Qualtrics is a leader in experience management systems (EMS) for both customer and employee management. Employee experience is a major factor in workforce and talent attracting and retention in this tight labor market amidst the “Great Resignation” era. The Company has a 10-year head start in the EMS segment which is continuing to become as significant as CRM management. Prudent investors seeking exposure in a leader in the EMS segment can watch for opportunistic pullbacks in shares of Qualtrics.

Q4 Fiscal 2021 Earnings Release

On Jan. 26, 2022, Qualtrics released its fiscal fourth-quarter 2022 results for the quarter ending December 2021. The Company reported a non-GAAP earnings-per-share (EPS) loss of (-$0.07) excluding non-recurring items versus consensus analyst estimates for a loss of (-$0.02), a (-$0.05) miss. Revenues grew 48% year-over-year (YoY) to $316.04 million beating analyst estimates for $297.65 million. Full year subscription revenues grew 51% YoY to $870.7 million. Total remaining performance obligations rose 51% YoY. Qualtrics CEO Zig Serafin commented, "Q4 was an outstanding quarter, capping off a record year of growth for Qualtrics. Not only did we cross the $1 billion revenue milestone, but we’re accelerating past it, as experience management becomes even more critical to business success.”

Guidance

Qualtrics issued its guidance for fiscal Q1 2022 with EPS between (-$0.02) to $0.00 versus (-$0.01) consensus analyst estimates on revenues between $324 million to $326 million versus $314.69 million. Qualtrics issued its fiscal full-year 2022 guidance with EPS between (-$0.02) to $0.00 versus (-$0.01) consensus analyst estimates on revenues between $1.402 billion to $1.406 billion versus $1.36 billion.

Conference Call Takeaways

CEO Serafin provided more quarterly details as subscriptions rose 61% YoY which lead them to raise fiscal full-year 2022 revenue guidance. He expounded on the growing significance of experience management (EM) as it comes just as “critical” as customer relation management (CRM) and human resource management (HRM) systems. It’s easier now to lose customers and employees from mismanagement of experiences. The Company has had a 10-year lead in the EM industry resulting in a 128% net retention rate in its latest quarter. The acquisition of Clarabridge is synergistic and supportive, “Clarabridge adds a critical new layer to our platform that helps organizations discover everything that their customers and employees are saying wherever they're saying, it including in social media, e-mail, support calls, chats and product reviews. Our customers are designing products services and experiences that their customers want next by acting on customer feedback from anywhere. And they're designing new ways of working by listening to their employees.” CEO Serafin outlined how its has helped organizations like Southwest Airlines NYSE: LUV to bolster its hiring and onboarding using its Candidate Experience solution. He also detailed how the Company helped Comcast to help build a culture of feedback for its workforce as well as better understanding their advertisers and publishers. The Company ended the quarter with 143 million dollar customers as part of the 3,000 new customers in full-year 2021. On the key benefits of its acquisition, “Clarabridge is one of the most advanced intent emotion and sentiment understanding systems and is now uniquely part of our platform. And as part of this, Clarabridge is creating opportunities for us to expand rapidly into digital, voice and social media analytics.”

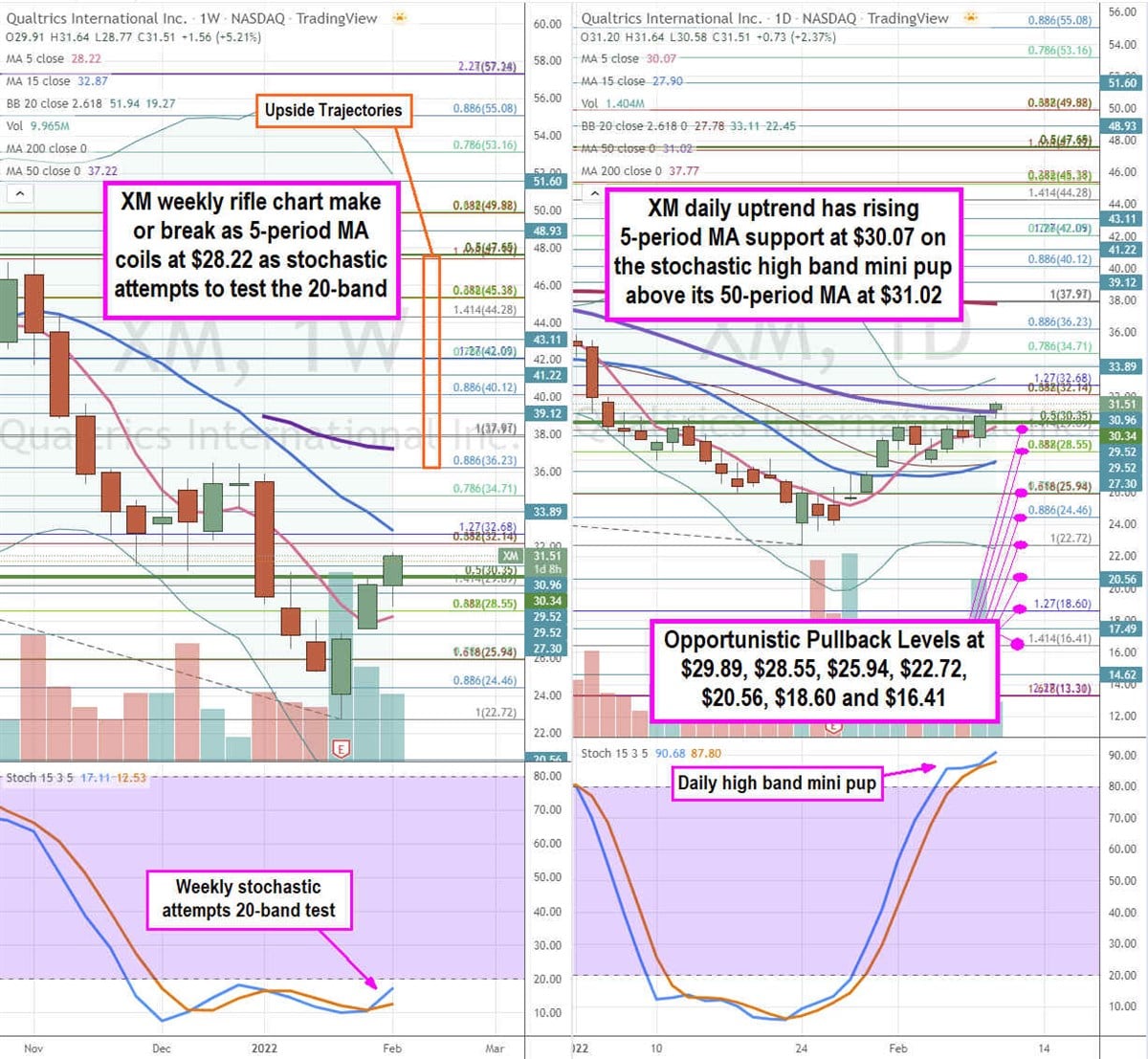

XM Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for XM stock. The weekly rifle chart peaked near the $36.23 Fibonacci (fib) level. Shares sold off to the $22.72 fib before forming a bounce. The weekly 5-period moving average (MA) is starting to slope up at $28.22 support as it attempts a channel tightening to the weekly 15-period MA at $32.87. The weekly stochastic has coiled again to retest the 20-band. The weekly market structure low (MSL) buy triggers on the breakout through $$30.34. The weekly 5-period MA sit at $37.22. The daily rifle chart has made a full oscillation up and attempting to forma high band stochastic mini pup above the 90-band. The daily 5-period MA is rising at $30.07 as shares test the 50-period MA at $31.02 as the 15-period continues to catch up rising at $27.90. The daily upper Bollinger Bands (BBs) sit at $33.11.Prudent investors can wait for opportunistic pullback levels at the $29.89 fib, $28.55 fib, $25.94 fib, $22.72 fib, $20.56 fib, $18.60 fib, and the $16.41 fib level. Upside trajectories range from the $36.23 fib level up towards the $47.65 fib level.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.