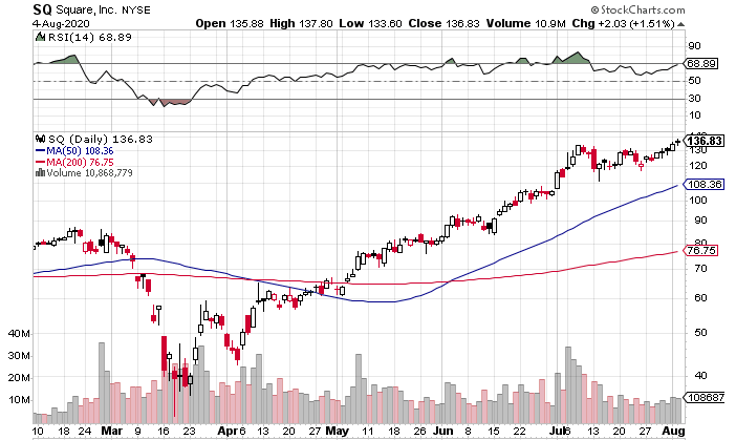

Square NYSE: SQ

Square NYSE: SQ released earnings a day earlier than expected and investors cheered the results, bidding shares up to over $150 in after-hours trading.

The mobile payment processor has now nearly 5x’ed off its mid-March lows, and trades at nearly double its 2019 highs.

Square is still losing money; its net loss widened to $11 million after coming in at $7 million in Q2 2019.

But investors focused on its $1.9 billion in revenue, up 64% yoy and well above consensus estimates of $1.1 billion. The fantastic performance of Cash App – and its Bitcoin feature in particular – was largely responsible for the revenue beat.

Bitcoin Takes Cash App to New Heights

Square disclosed that Cash App had around 24 million users in December, but that number has now reached more than 30 million.

Square offered a revenue breakdown for its segments for the first time, showing $1.2 billion in Cash App revenue. Bitcoin accounted for $875 million of that amount, up a staggering 600% yoy, and blowing away consensus estimates of $278 million.

While the Bitcoin revenue is undoubtedly impressive, it led to $17 million in gross profit, which is up more than 700% yoy, but quite low.

Furthermore, with Bitcoin roughly doubling off of March lows, there is naturally going to be a bump in interest – a bump that may not be sustainable once this rally peters out.

And there is certainly a widespread increase in stock and cryptocurrency speculation since the onset of the pandemic. With many people forced to stay at home, and a lack of sports gambling opportunities, many have turned to stocks and cryptocurrency to satisfy their gambling urges and fill their free time.

So although this increase likely has some staying power, it wouldn’t be wise to expect growth to continue at around 600% - or anywhere close to that number.

Square Revenue Excluding Bitcoin Was Roughly Flat

Gross payment volume dipped 15% yoy to $22.8 billion. The decrease reflects Square’s high exposure to brick-and-mortar companies, many of which were forced to shut down or scale down operations in the face of the pandemic.

That said, Square noted that volume increased as the quarter progressed – with July actually increasing 5% yoy.

Though the virus will remain a factor for the foreseeable future, it seems that brick-and-mortar companies will be able to adjust their operations to the “new-normal.”

Square Valuation Remains Steep

Square shares were expensive when I covered the company back in June – and its valuation is even loftier now.

In that piece, I alluded to the high projected growth in the mobile payments market over the next five years – and Square’s position as an industry leader.

The only significant upside surprise in the Q2 earnings report was the Bitcoin segment. The company saw nice growth in Cash App users, but that was merely a continuation of recent trends. And it predictably saw payments volume dip due to its reliance on brick-and-mortar companies.

Back then, I recommended you initiate a small position if shares pulled back a bit or consolidated for a month before breaking out – neither one of those scenarios came to fruition.

Now, shares are 50% more expensive and it’s unclear just how much the company’s long-term picture has improved.

Keep an Eye on Square’s Price Action

Square was extended in late June – and it’s even more extended now.

So where does that leave you?

Again, I’d look for it to put in a one-month base and breakout, or wait for a pullback, perhaps to the 50-day moving average.

It’s easy to fall victim to FOMO on a stock like Square and get in right now. But I think it’s better to sit tight and let things play out a bit.

I’m not convinced that shares will rocket to $200 over the next week. Better to wait for an attractive set-up and risk not getting in than to expose yourself to a high downside (or be forced to put a stop-order at an arbitrary level).

Square Stock - The Final Word

Square remains a uniquely well-positioned company in the fast-growing mobile payments industry. But the company’s lofty valuation – and unclear path to solid earnings – makes it hard to invest a lot into Square.

Therefore, if Square presents an attractive entry point, invest what you can afford to lose – or put in a tight stop-order to limit your downside.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report