Online pet products and services platform

Chewy, Inc. NASDAQ: CHWY stock rocketed up to $120 from $21.68 lows during the

pandemic as stay at home mandates favored contactless delivery of pet supplies. The reopening phase has seen its shares sell-off coupled by the

sell-off in the benchmark indexes caused a collapse in shares down to $36.70 before attempting a bounce. Investors are questioning whether the good times are in the rear view mirror for this stock. While growth has slowed from its tepid pace during the pandemic, they still reported 24% growth in its Q3 2021 earnings report despite facing the transitory headwinds of

higher inflation,

supply chain disruptions, and labor shortages. The pandemic created more pet owners and enduring customers for pet supplies. New and

active customers have shown to spend 12% more than pre-pandemic customers. The average order value for new customer was 6% higher than Q3 2020 and 19% higher than Q3 2019. This is illustrated by the 15% growth in net sales per active customer (NSPAC) to $419. The exclusive suite of Chewy Health pet health insurance, wellness and preventative plans will be launching in spring of 2022. Prudent investors looking for exposure in the thriving remote pet supply segment can watch for opportunistic pullbacks in shares of Chewy.

Q3 Fiscal 2021 Earnings Release

Chewy released its Q3 2021 earnings ending October 2021, on Dec. 9, 2021. The Company reported earnings-per-share losses of (-$0.08) versus consensus analyst estimates for (-$0.04), a (-$0.04) miss. Net losses were (-$32.2 million) including $19.1 million in share based compensation. Revenues grew 24.1% year-over-year (YoY) to $2.21 billion meeting consensus estimates for $2.21 billion. Adjusted EBITDA was $6 million and adjusted EBITDA margin was flat at 0.3%. Demand and customer engagement remained strong as the company customer base grew to 20.4 million, a 15% YoY increase. Chewy issued in-line guidance for Q4 2021 with revenues for $2.4 billion to $2.44 billion versus $2.44 billion consensus analyst estimates. Chewy CEO Sumit Singh commented, “Our sustained growth this year shows the soundness of our growth strategy, the uniqueness of Chewy’s value proposition, and the durability of the pet category. At the same time, our third-quarter profitability reflects the impact of ongoing supply chain disruptions, labor shortages, and higher inflation. As we work through these macro uncertainties, we remain squarely focused on the long term and on building an enduring franchise to serve millions of loyal pets, pet parents, and partners.”

Conference Call Takeaways

CEO Singh stressed the 24% YoY growth despite the disruptive headwinds stemming from inflation, supply chain and labor. This illustrates the durability of the business. As the Company grew its customer base by 15% to 20.4 million, the quality of new and active customers continues to impress, ”For example, we estimate that the expected lifetime values of the Q3 2021 new customer cohort is 12% higher than the pre-pandemic counterpart. Additionally, third quarter Autoship customer sales as a percent of net sales increased 140 basis points to 70.6%, reaching a new company high. And last, but not least, the average order value for new to Chewy customers was 6% and 13% higher than the Q3 2020 and Q3 2019 cohorts, respectively.” Innovations like Chewy Health and Practice Hub, a complete e-commerce solution for veterinarians integrated into existing management software, will help drive growth. Practice Hub enables vets to earn commissions from customer orders placed through the clinic or at home while Chewy fulfills. The Company is receiving great feedback from the initial rollout with over 50 clinics in an invitation only basis with hundreds of interested clinics in the pipeline.

CHWY Trajectories and Pullbacks

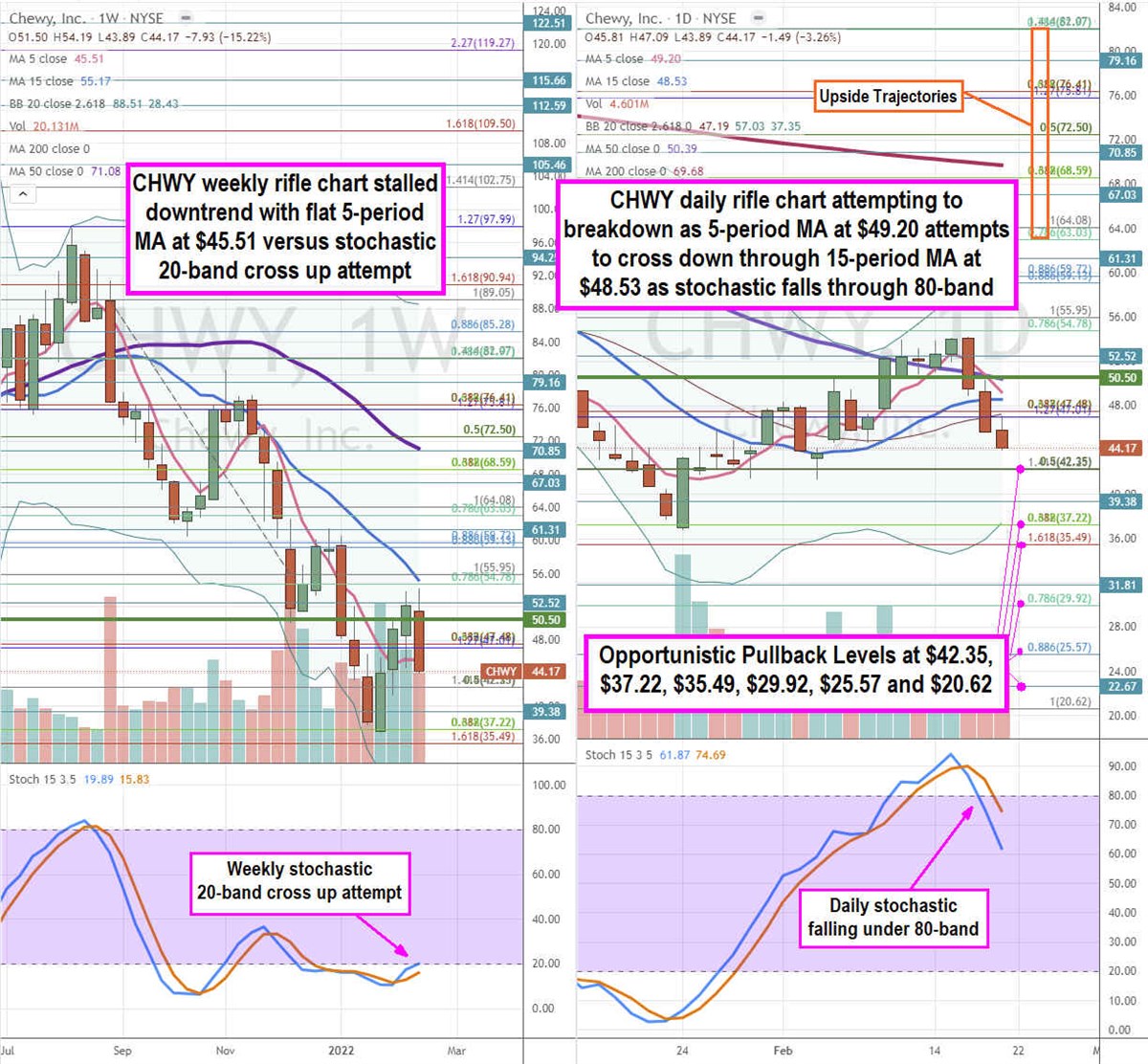

Using the rifle charts on weekly and daily time frame provides a precision view of the landscape for CHWY stock. The weekly rifle chart can trigger a market structure low (MSL) buy signal on a breakout through $50.50. Shares attempted a bottom near the $37.22 Fibonacci (fib) level. The weekly rifle chart is in a make or break as the downtrend stalls with a flattening 5-period moving average (MA) at $45.51 followed by the falling 15-period MA at $55.17. The weekly stochastic crossed up again as it attempts to cross up through the 20-band. The weekly 50-period MA sits at $71.08. The daily rifle chart uptrend lost steam as shares collapsed through both the 5-period MA at $49.20 and 15-period MA support at $48.53. The daily stochastic peaked and fell back under the 80-band. The daily lower Bollinger Bands (BBs) sit near the $37.22 fib. Prudent investors can watch for opportunistic pullback entries at the $42.35 fib, $37.22 fib, $35.49 fib, $29.92 fib, $25.57 fib, and the $20.62 fib level. Upside trajectories range from the $63.03 fib up towards the $82.07 fib level.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.