The meme stock craze of 2021, led by GameStop NYSE: GME and AMC Entertainment NYSE: AMC, saw retail investors from online forums like Reddit's WallStreetBets challenge institutional short-sellers, causing a significant short squeeze and sparking debates on market manipulation and finance democratization. This collective action demonstrated the power of retail investors and changed how we view and engage in the stock market. A similar theme has been emerging in recent weeks.

With the market recently putting in a fresh 52-week high, speculative capital has reentered the market after lying dormant for the most part since the beginning of 2022. This has led the way to a meme-type run in several stocks. Undoubtedly, the largest and most impressive mover has been Tupperware Brands Corporation NYSE: TUP, which has surged 342% over the last month. With its newfound retail following, could TUP be on the road to recovery, or will this euphoric surge higher be short-lived?

Tupperware Brands Corporation

Tupperware Brands Corporation is a global consumer products company specializing in kitchen and home solutions, including cookware, storage products, and water-filtration items. It operates in around 70 countries through an independent sales force and was founded in 1946, with its headquarters in Orlando, Florida.

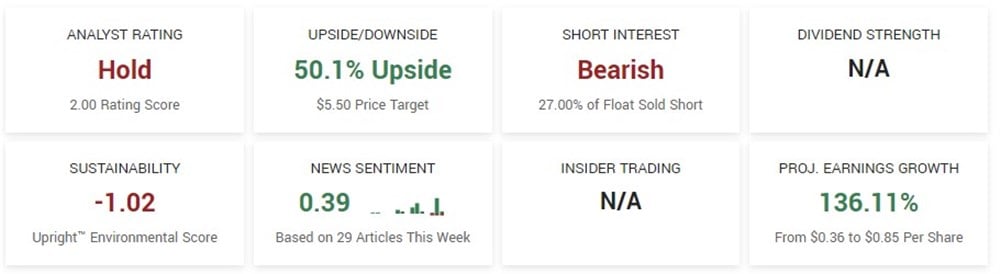

The company has a market capitalization of $163 million, short interest of 27%, and a 52-week range of $0.61 - $12.86.

Institutional Ownership And Insider Activity

Current institutional ownership stands at 65.6% in TUP, with $45.38 million in total inflows over the previous twelve months compared to $50.35 million in outflows. The two largest institutional owners of TUP are Vanguard Group, with 6.742% ownership, and BlackRock, with 6.501% ownership in TUP.

Current insider ownership is 2.19%; notably, there has been no insider selling over the previous twelve months. During the same period, two insiders purchased stock for a total of $1.10 million.

A Closer Look At TUP

Analyst coverage is slim, with just two analyst ratings (DA Davidson, Citigroup). The consensus rating is Hold, and the stock has a consensus price target of $5.50, unchanged from three months ago.

Despite the lack of any significant news, TUP has experienced a substantial surge in its stock. However, this type of action isn’t new. One just has to look back at previous meme stocks and, in some cases, how the meme-fueled surge higher resulted in a major change in the company's fundamentals. Traders previously rallied around Tupperware based on rumors of a takeover by GameStop's Ryan Cohen in April. Despite concerns about Tupperware's financial stability and late filing of required documents, some investors remain hopeful for a turnaround.

However, the company's declining revenue and cash balance raise questions about its future prospects. While the meme-stock rally may temporarily boost compliance with stock exchange requirements, uncertainty looms over Tupperware's long-term outlook.

Before you consider Tupperware Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tupperware Brands wasn't on the list.

While Tupperware Brands currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.