This Is One Hot Stock

This Is One Hot Stock

Vroom (NYSE: VRM) has been a seriously hot stock in the month since its IPO. The company, a pure-play on automotive eCommerce, offers a platform buying and selling used cars on-line as well as financing and other options. Over the last 30 days, fueled by results from the likes of Carmax and others, the stock has risen about 50% and looks like the run will keep going.

Carmax (NYSE:KMX) , perhaps the nations leading seller of used cars, says sales trends have shown consistently improving comps since hitting bottom with many stores reporting positive YOY comps. Sonic Automotive (NYSE: SAH), a seller of both new and used cars, has given two updates on business since the market bottomed this spring. According to Sonic management, sales of used cars at their Echo Park locations is actually higher than it was last year while sales of new cars are also rebounding. The bottom line, the market in which Vroom operates is doing just fine. In fact, it may have IPO’d at just the right time.

The Analysts Like This Stock

Believe it or not, Vroom garnered its first analyst rating on the first day of trading. Analyst at Benchmark felt it prudent to front-run the market in order to capitalize on what they viewed as a compelling value.

"We are initiating coverage in an attempt to get out in front of a pricing opportunity in the early days of trading. Used vehicle sales in the US have recovered at a faster than expected pace, industry feedback suggests used vehicle prices have stabilized, and the virus-related shutdown resulted in an expansion of selling vehicles on-line. Vroom's eCommerce Segment offers access to consumers through any device, providing transparent pricing, real-time financing, and home delivery throughout the US using independent drivers. Revenue in 2020 is targeted at $1.7 billion, up 42%, despite the three-month economic shutdown."

In today’s news, Vroom got not one but another 6 analysts nods and only one of them isn’t bullish. The sole neutral rating comes from Goldman Sachs but should be viewed for what it is, a cautious buy rating. The analyst wouldn’t have begun coverage if not interested in the stock and a neutral weight is as good as market-perform or hold from another management firm.

The other analyst’s ratings amount to a strong buy. Stifel, JMP Securities, Baird, Wedbush, and Wells Fargo all initiated with a Buy, Outperform, or Overweight rating implying more than a little love for this stock. The consensus price target among the six (including Goldman Sachs) is $65.6, well above Benchmark’s initial $55 target and about a 12% upside from today’s pricing. Looking forward, we can expect a few more analysts to get on board with this company over the coming quarters. There are 8 covering Sonic and 17 covering Carmax and this company is sure to affect if not disrupt business for both.

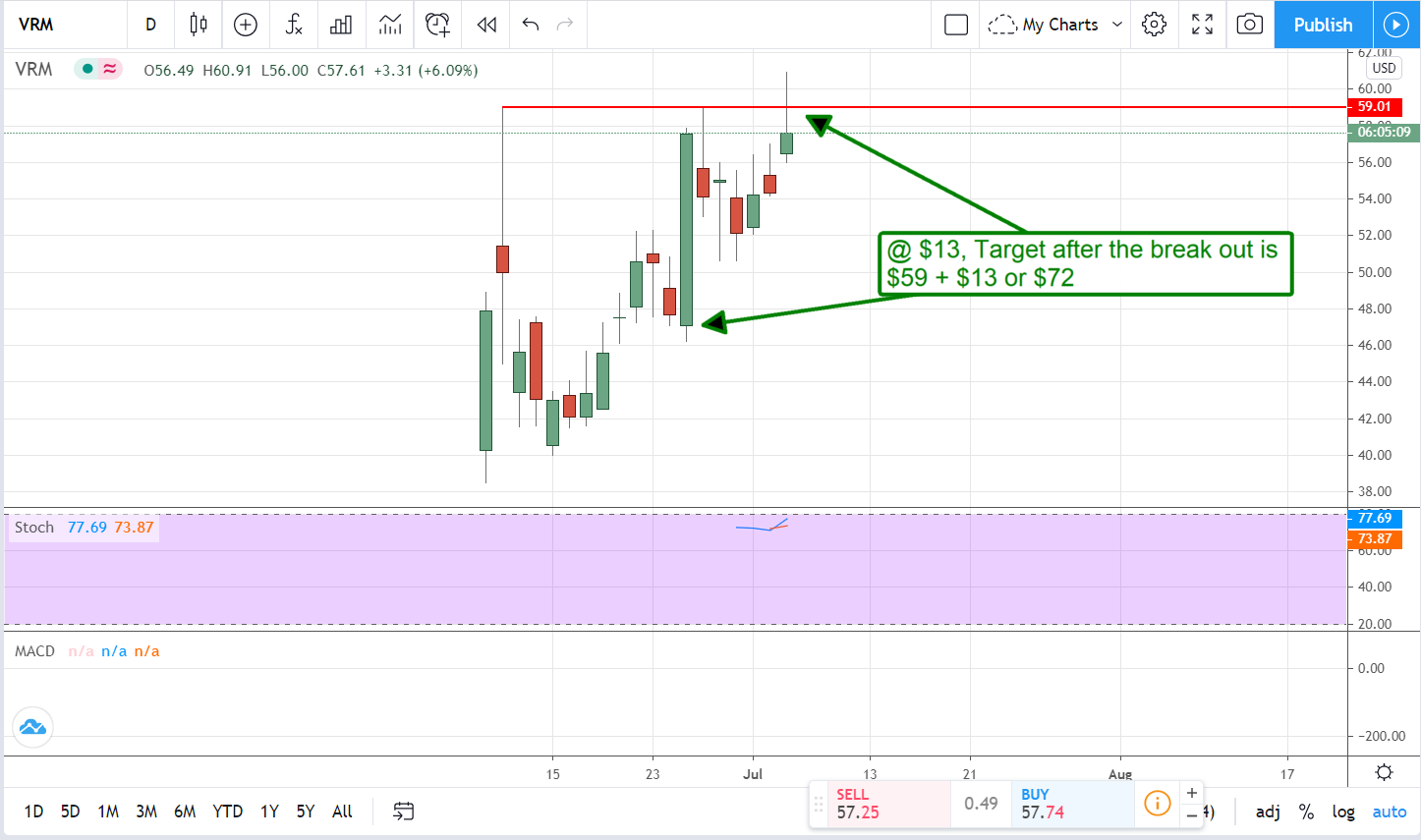

The Technical Outlook: Bullish, New Highs Were Just Set

The technical outlook for Vroom is bullish and getting more bullish by the day. Today’s news not only sent share prices up to a new all-time high it ensures a whole new host of investors are about to get into this market. The caveat is that resistance at the previous all-time high has price action in check during the early morning trading. This level could contain prices in the near-term but I don’t think it will last long. With the analysts target now 10% above the previous high anyone selling at that level is better-served waiting for prices move higher.

Looking at the chart and using the rally from $46 upward as a reference point, my target for this stock upon its break to new highs is near $72. That is above the high-end of what is now “consensus” for Vroom but not the end of this stocks rally I think. Once it delivers results for the quarter and provides an outlook for the year I expect we’ll see the estimates and price targets begin to creep higher. Vroom is slated to report on 8/16 and is expected to deliver $382 million in revenue.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.