Wendy’s

NASDAQ: WEN shares were sold off when markets started tanking in February, going from around $23 to $6.80 in less than a month. But shares quickly rebounded, approaching $20 a share just a month after hitting the lows. Since then, the stock has sat in a tight base between $20 and $22 a share.

The restaurant industry has been one of the worst performers during the pandemic.

But Wendy’s has outperformed as reflected by its share price performance. How has Wendy’s managed to do it and does the stock have another leg-up in it?

Bounce Back

Wendy’s business was strong just before the pandemic started to spread worldwide. Global same-restaurant sales were up around 4% through February. In the first week of March, comparable sales increased 15%, largely due to the successful launch of breakfast – more on that in a bit.

But Wendy’s would face a lot of challenges in the early innings of the pandemic.

The widespread requirement to stop offering dine-in led to a same-restaurant sales decrease of 30% during the last week of March.

On top of that, Wendy’s faced pressure on its margins, which decreased by 490 basis points yoy to 10.1%. The primary drivers were higher labor rates, commodity costs, breakfast training expenses, and maintenance costs. Much of the operating margin dip was directly attributable to COVID-19. Beef cost was largely responsible for the commodity inflation (of around 3.9%) due to disruptions in the supply chain caused by the pandemic.

Now for the good news:

Wendy’s hasn’t had to completely close down many stores. During the onset of the pandemic, Wendy’s reported that 96% of its global restaurants and 99% of its US restaurants remained open. While dine-in is still restricted, at best, due to social distancing rules, Wendy’s improving digital business has blunted the impact. Digital now accounts for 5.5% of sales, up from 2.5% in 2019. These transactions have been completed by drive-through and delivery.

The aforementioned breakfast launch has been another bright spot. Wendy’s marketing campaigns achieved a fantastic 50% awareness for the launch, which has driven impressive results. As of April, breakfast sales are accounting for 8% of total US sales. People returning to the office bodes well for additional growth in the breakfast segment going into 2021.

Wendy’s business has seen substantial improvement since the 30% sales decrease in the last week of March. Longbow analyst Alan Stump’s conversations with Wendy’s franchisees indicated that they saw a 15% decline in April, but that comps have turned positive in May.

Stump believes that Wendy’s will outperform its peers in the post-pandemic world and increased his price target to $25 a share from $24.

Valuation

Wendy’s is trading at around 39x projected 2020 earnings and approximately 31x projected 2021 earnings.

The company decreased its Q2 dividend to $0.05 per share as it decided to conserve cash in the uncertain economic environment. Wendy’s is also putting its stock buyback program on hold.

Furthermore, Wendy’s cut capital expenditures by around $20 million and G&A by around $10 million for 2020. As of May 3, the company has a cash balance of $365 million.

There is a great chance that Wendy’s will be cash-flow positive for as long as the pandemic lasts, but its prudent to be conservative in this unprecedented landscape.

The valuation on Wendy’s is a little high on a P/E basis, but I think it’s a good value at these levels. The company appears set for solid growth over the next few years. This isn’t the type of stock that will turn into a 10-bagger, but it could give you double-digit annualized gains over the next 3-5 years.

Now let’s turn our attention to the chart and look for an entry point.

Technicals

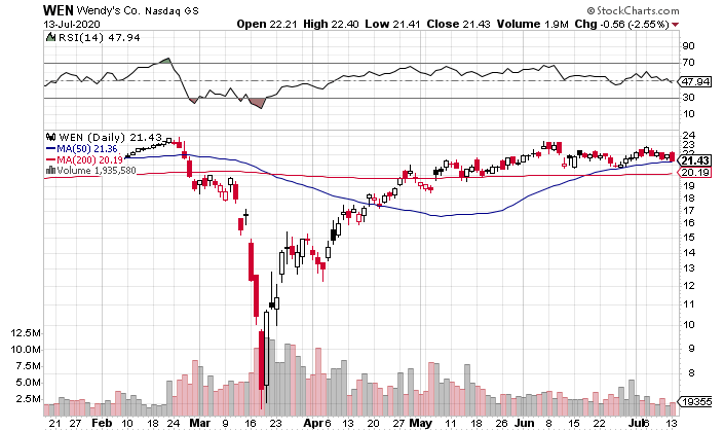

As touched on earlier, Wendy’s had one of the deepest V-shaped moves in the market in the early stages of the pandemic.

Since then, shares have spent around two months in a tight base between $20 and $22 a share on light volume. This is a bullish sign as it shows that investors are content to hold onto their positions while the stock digests its recent gains.

Shares briefly broke above $23 a share in June, before settling back into the base. The stock previously hit $23 (also briefly) in February. The $23-$24 level is the highest that shares have been since before the financial crisis.

WEN now sits right on the 50-day moving average, which recently crossed over the 200-day moving average. These are also good signs, as they show the stock isn’t extended.

If Wendy’s breaks $24 a share on high volume, there’s a good chance it will have another leg-up. Keep a close eye on WEN going forward.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report