Diversified energy materials development company

Westwater Resources, Inc. NASDAQ: WWR stock has recently surged on the electric vehicle (EV) stock mania. Shares are looking to wildly outperform the benchmark

S&P 500 index NYSEARCA: SPY. As money flows into EV related companies ranging from cars, parts, charging to materials, the impact is real. While EV leader

Tesla NASDAQ: TSLA started the craze, it’s spread with the

momentum from Chinese EV makers like

Nio NYSE: NIO,

Xpeng NYSE: XPEV and

Li Auto NYSE: LI. U.S. penetration being led by

Kandi Technologies Group NASDAQ: KNDI with its launch of a

sub $10,000 EV, after federal and state subsidies. The common thread amongst EVs are the need for sustainable battery power to even operate the vehicles. West Water’s rare-earth minerals including lithium are the raw materials needed to power EVs. High risk-tolerant and nimble investors looking to play the EV mania can look to seek exposure at opportunistic pullback levels in West Water Resources.

Conference Call Takeaways

The Company had a Q3 a conference call on Nov. 12, 2020. Westwater CEO, Chris Jones and CFO Jeff Vigil presided over the conference call. The Company plans to operate in Germany, New York and Illinois. The Company has $53 million in cash which is enough to finance base business operations through 2022. CEO Jones states, “Westwater has prevailed in a key decision in its case for compensation from the Republic of Turkey. Our hearing is scheduled to Sept. 21, 2021, and we request $36.5 million-plus fees.” CFO Vigil pointed out a timeline of events that caused the Company shares to skyrocket. On Sept. 28, 2020, Tesla CEO, Elon Musk, had projected a shortage of battery materials in the next five years while EV demand grows exponentially during its Battery Day. This was followed by the announcement by Piedmont Lithium of a supply contract with Tesla for its North Carolina based lithium project. The Company entered into an agreement to sell its uranium business to encore Energy Corp in exchange for $2 million in stock and a royalty interest in the New Mexico uranium properties being sold. It enables the Company to reallocate $4.5 million annual uranium budget to the graphite business.

Executive Order Expanding U.S. Rare-Earth Minerals Production

On Sept. 28, 2020, President Trump signed an executive order seeking to increase domestic production of rare-earth minerals as a national emergency. The order directs the Interior Department to use the Defense Production Acts to speed up the development of mines. The move is aimed at reducing reliance on China for rare-metals that are critical to many manufacturing industries. This news spiked up shares of Westwater to highest levels not seen in years peaking at $14.50. The European Commission is also moving towards forming a rare-earths minerals alliance by the end of the year to also be less reliant on imports.

Westwater Battery Graphite

Westwater has created three trademarked battery-grade products: ULTRA-PMG, ULTRA-SPG and ULTRA-DEXDG. In collaboration with Dorfner Anzaplan of Germany, the Company plans to advance the development of processes needed to purify graphite concentrates to produce Westwater’s batter grade products. The Company expects its Alabama-based Coosa Project to be the first U.S. domestic processor of battery graphite materials.

Graphite Pilot Plant Program

On Oct. 9, 2020, Westwater announced the receipt of 30 metric tonnes of natural graphite concentrate at its Dorfner Anzaplan’s facility in Germany. The materials will be utilized in its pilot plant in Germany and the U.S. to produce 10 metric tonnes of three trademarked graphite products estimated by the end of Q1 2021. Westwater will conclude its Bankable Feasibility Study by mid-year 2021, which includes the final design plans for the commercial production facility from mid-2021 to 2022. The Company expects the plant to be commissioned by Q4 2022. A Provisional Patent was filed with the U.S. Patent and Trademark Office for its proprietary graphite purification technology. The shift to graphite processing for battery products makes this a compelling play for high risk-tolerant investors and nimble traders at opportunistic pullback levels.

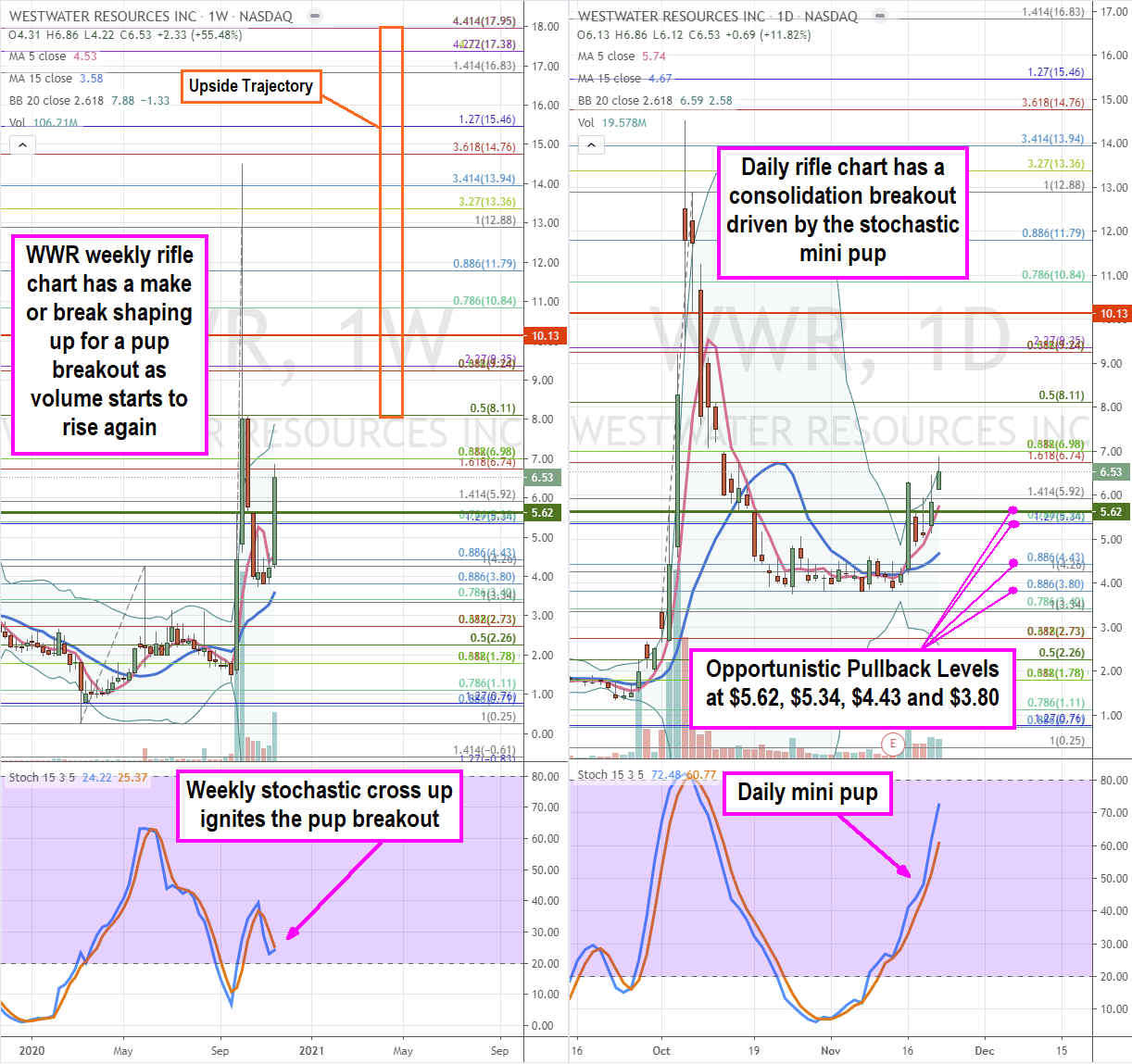

WWR Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames provides a precise view of the landscape for WWR stock. The weekly rifle chart broke out into an uptrend on the weekly market structure low (MSL) buy trigger above $5.62 in October 2020. The massive October spike peaked out just below the $14.76 Fibonacci (fib) level as shares collapsed back down to the $3.80 fib. This sharp drop caused the weekly stochastic to cross back down but the weekly 5-period moving average (MA) support at $4.53 held firm. This bought enough time for the daily rifle chart to trigger a mini pup breakout forming a grinding uptrend already overshooting the daily upper Bollinger Bands (BBs) at $6.59. With the weekly stochastic stalled and a high band daily stochastic, it sets up for opportunistic pullback levels at the $5.62 weekly MSL, $6.53 fib, $5.34 fib, $4.43 fib and $3.80 fib. The Company is still a developmental mining operator, so investors need to allocate accordingly for speculative potential. Upside trajectories can range from the $8.11 fib upwards to the $17.95 fib.

Before you consider Westwater Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Westwater Resources wasn't on the list.

While Westwater Resources currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.