Stock prices and interest rates are inexorably linked. The Federal Reserve sets what is called the

Federal Funds Rate, which basically sets the rate at which banks loan money to each other. It sounds confusing, but it’s important because it trickles down to the rest of the economy.

Put simply, banks are in the business of loaning money that their customers deposit with them, but they can’t loan all of their customer's deposits due to regulations. So they borrow it too. And the Fed Funds Rate sets the price at which they borrow at. Any credit they extend above that rate is basically profit to them.

The Federal Funds Rate trickles down to all other financing rates; bond yields, mortgage rates, credit card rate, student loan rates, etc.

We should think about the interest rate’s effect on the stock market as a game of incentives, and there are basically two main incentives at play here.

The first is that when interest rates are low, companies can borrow money cheaply. They can finance riskier, high-growth projects. As interest rates rise, companies have to become more conservative with their use of debt. The focus goes from capital accumulation to capital preservation.

The second is the risk-free rate or the rate that the US government will pay you to lend them money. When people refer to the risk-free rate, they’re generally referring to the Treasury bill yield that matches your time horizon.

The higher the risk-free rate, the less likely investors are to invest in stocks, which are riskier. When the risk-free rate is at historic lows, like it is today, investors overweight their portfolios in stocks in the pursuit of yield. This pushes the prices stocks up across the board.

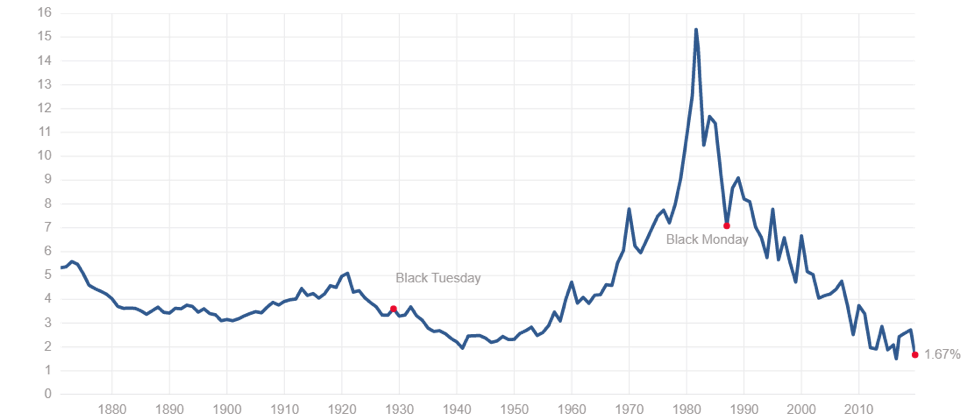

Today, the risk-free rate, we’ll use the 10-year Treasury bill, is at historic lows. In exchange for lending the US government your money, they will pay you 1.67% per year, which is less than inflation. In real terms, you’re still losing a few basis points per year lending to the US government.

10-year US Treasury Bill Yield

US Inflation Rate:

In a predicament like this, what are you to do? Other low-risk yields like bonds and CDs are also barely beating inflation, so unless you want close to zero capital growth over time, you’re forced to take more risk on your investments, aka buy stocks.

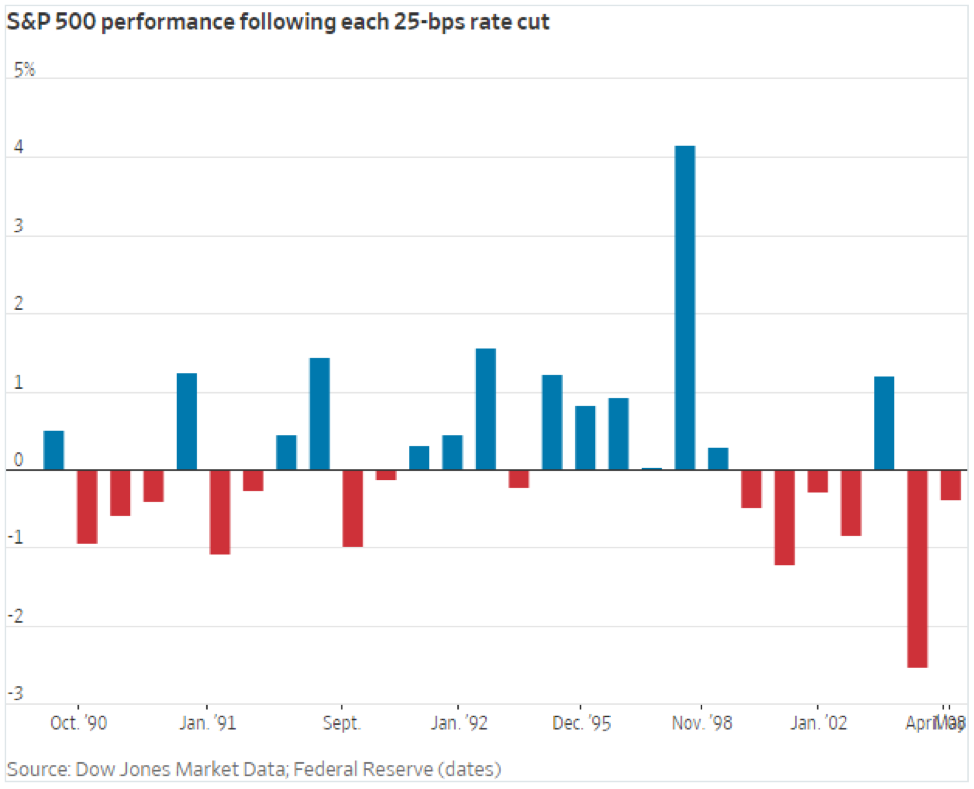

Here’s how the market has reacted historically to a 25 basis point cut in the Federal Funds Rate:

So what will a rate cut do today’s stock market? It’s hard to say, but as we’ve discussed, a rate cut tends to push stock prices. But rate cuts don’t happen in a vacuum. The language used in the FOMC meeting, the economic context, and market sentiment also determine how the market will react to a rate cut.

The Fed may cut rates as a last-ditch effort to stimulate the economy, but if the market doesn’t see the reaction as appropriate, it’s quite possible that stock prices could drop following a rate cut.

Because we’re in a period of historically low-interest rates, some market commentators see further rate cuts as a huge mistake, that it will make a potential credit crunch down the line more painful.

To summarize, in the big picture, stock price increases tend to follow rate cuts due to money being more easily and cheaply available, and because it makes lower-risk investments less attractive. However, one must always pay attention to the market cycle as well. If you determine that we’re in the later phases of a bull market, a stock price increase due to rate cuts might be the final “head fake” before a trend reversal.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.