Shares of copper miner

Freeport-McMoRan Inc. NYSE: FCX have been in rally mode lately, getting a further boost from the company’s third-quarter report despite a decline in profit attributed to lower copper prices.

However, the company topped Wall Street expectations and the company offered an optimistic outlook for sales.

Freeport-McMoRan stock attempted to rally out of a base earlier this year, but shares cratered nearly 10% in April, following Freeport-McMoRan’s first-quarter report. Year-to-date, the stock is down 18.67%, but shorter-term rolling time frames show increases:

- One week: 17.56%

- One month: 26.38%

- Three months: 19.91%

Since the third-quarter report on October 20, shares are up 17.13%.

In the earnings conference call, CEO Richard Adkerson expressed confidence in the company’s ability to weather the current economic downturn.

The company said it expects growing rising demand for copper, which is used in renewable energy products, many of which will benefit from tax incentives from the Inflation Reduction Act, which could spur sales for Freeport-McMoRan.

Input Costs Higher

As of Thursday, copper prices were well off their highs from earlier this year but up from two weeks ago.

Fetching higher prices, at least in the short term, can help the company’s business for the foreseeable future. As with many other companies, production inputs such as labor, fuel and equipment, have all risen. That could cut into the company's bottom line.

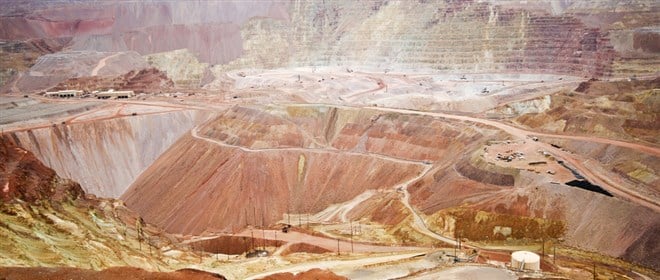

Freeport-McMoRan operates mining operations in North and South America. Properties include the Morenci minerals area in Arizona and Cerro Verde in Peru. News broke late Wednesday that the company was in talks to acquire an Arizona smelter from Grupo Mexico OTCPK: GMBXF. It’s a move on Freeport-McMoRan’s part to expand U.S. processing capabilities.

Wall Street expects earnings to decline this year and next, although the company will likely continue extending its profitable streak, which goes back to 2016. You can track the company’s net income and revenue history using MarketBeat earnings data.

Aaron Dessen, a certified financial planner at Payne Capital Management, believes the long-term valuation on copper is still intact, in part due to its usage in electric vehicles, global trends and renewable energy.

Copper Sales Forecast to Grow

Dessen cites analyst forecasts calling for full-year copper sales of 4.2 billion pounds, which is up 10% year over year. He notes that demand from China will also be a growth driver.

“China's the largest demand center for industrial metals and commodities. As the COVID lockdowns hopefully start to ease and go away in the near future, that’s definitely going to be a boon for demand,” he says.

Dessen also points to the stock’s dividend as an attractive feature. The current yield is 1.80%.

“It’s not the strongest dividend, but a big focus for Freeport has really been a reduction in debt,” Dessen says. “They've brought their debt down from $20 billion to $1 billion since 2016 and they're really focused on leveraging a long-term recovery in the global economy. I think as cash flow improves, you could see that reflected in the dividend.”

As noted above, the recent uptrends in the stock price are encouraging and it’s been able to hold above its recent structure low of $24.80 on July 14. You can also compare its performance to that of its index, the S&P 500, which is down only slightly more year-to-date, posting a decline of 19.82%.

For investors who base decisions on the technicals, Freeport-McMoRan has some work to do. Its 50-day moving average is currently below the longer-term 200-day line, which is not a sign of strength. However, as with many aspects of chart reading, there is also a more positive sign: Its short-term 10- and 21-day averages are beginning to trend higher, which could signal a nascent rally.

Before you consider Freeport-McMoRan, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Freeport-McMoRan wasn't on the list.

While Freeport-McMoRan currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.