Mobile videogame producer

Zinga NASDAQ: ZNGA shares have benefit from the pandemic induced stay-at-home isolation mandates, but the economic restarts have caused shares to top out. Despite strong topline growth, Zinga shares are diverging with the rising

S&P 500 index NYSEARCA: SPY.. As consumers return to work, they will have less time to engage with mobile gaming. Investors should consider unwinding profits and trimming positions at rebound levels as the return to normalcy narrative may continue to drive prices lower.

Q2 FY 2020 Earnings Release

On Aug. 5, 2020, Zinga released its second-quarter fiscal 2020 results for the quarter ending June 2020. The Company reported a loss of (-$0.16) per share versus consensus analyst estimates for a profit of $0.07 per share, missing estimates by (-$0.23) per share. Revenues surged 47.4% year-over-year (YoY) to $451.69 million beating analyst estimates by $434.09 million. The Company issued downside earnings guidance of (-$0.15) per share versus consensus estimates for a profit of $0.09 per share. The Company also lowered full-year guidance for a loss of (-$0.54) per shares versus a profit of $0.35 per share but raises full-year revenue forecasts to a range of $1.8 billion versus analyst forecasts of $1.86 billion. Zinga also announced the acquisition of mobile hyper-casual game producer Rollic.

The Company noted the recent acquisition of Peak added two top-charting games, Toon Blast and Toy Blast, which have over 12 million mobile daily active users (DAU) and 26 million mobile active users (MAU). These popular games expand the Company’s “forever franchises” to eight. GAAP operating expenses surged to $161 million up 67% YoY driven by “higher contingent consideration expense, marketing investments and acquisition-related expenses.” The Company reported net losses of (-$150 million) due to higher contingent consideration expense. Seriously?

Rollic Acquisition

Zinga announced the acquisition of Istanbul-based Rollic for $168 million for 80% of the company with plans to acquire the remaining 20% in three equal valuation-based installments. Rollic is on track to reach $100 million in revenues on booking. The Rollic acquisition brings on board the top two most downloaded mobile games in Go Knots 3D and Tangle Master 3D entering Zinga into the hyper-casual market. These advertisement driven games to bring 5 million mobile DAUs and 65 million MAUs to Zinga. The Company has growth by acquisition of top games which has ended up diluting shares as the timing of acquisitions tend to be near the peak of popularity. This goes back to their $53.3 million acquisition of Words With Friends game maker New Toy in 2011 but eventually became a model for their forever franchises.

Lowered Guidance

Zinga expects gross margins to be down significantly YoY due to a higher net increase in deferred revenues and GAAP operating expenses to rise YoY. The Company also expects a net loss of (-$160 million) in Q3 2019 compared to net income of $230 million YoY, which came as a result of a one-time $314 million gain on the sale of their San Francisco building. In other words, they can’t seem to find a way to make money. Shareholders should take advantage of still elevated share prices to unwind positions while the market is still keeping shares elevated.

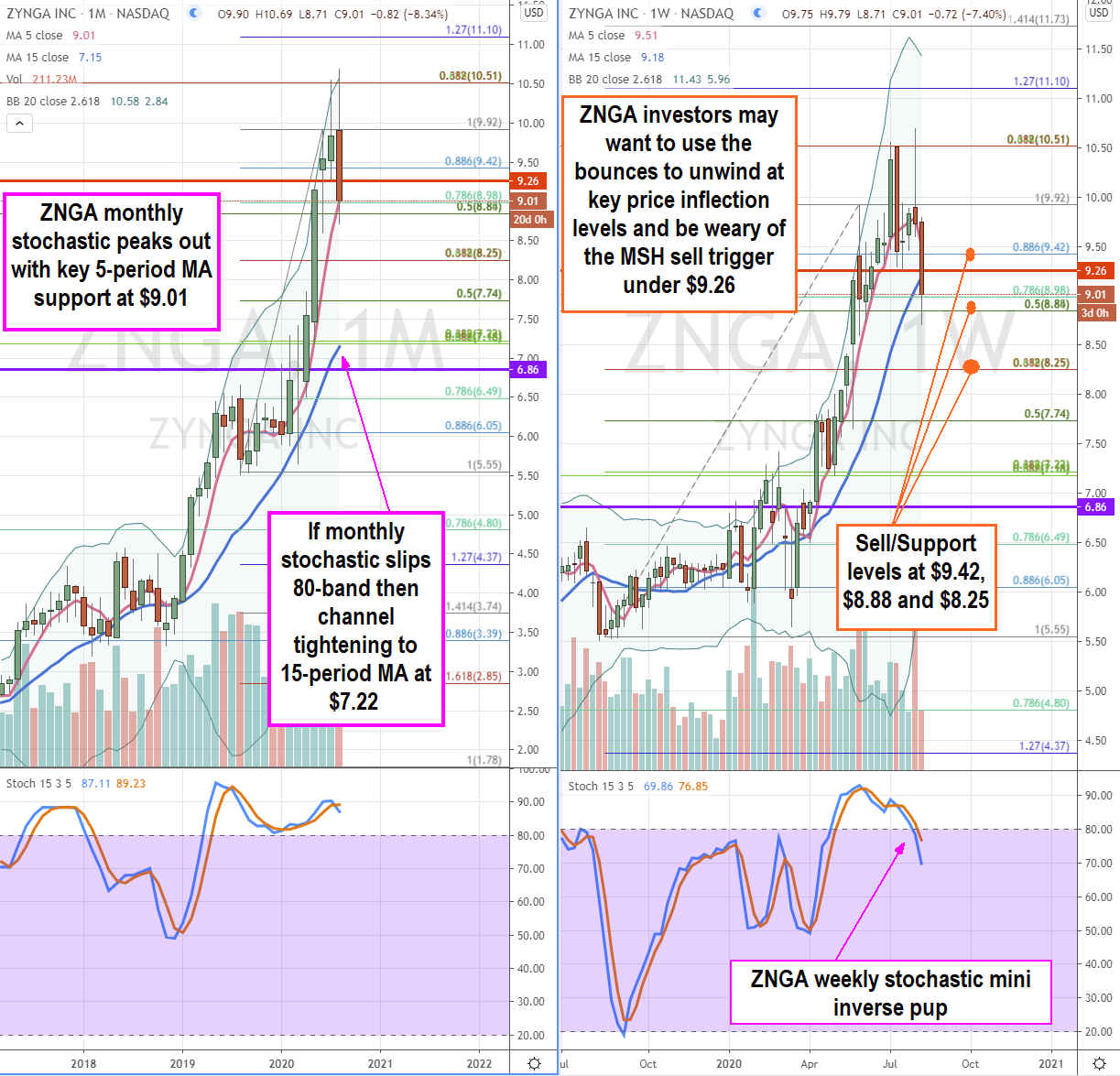

ZNGA Price Trajectories

Using the rifle charts on the monthly and weekly time frames provides a broader view of the landscape for ZNGA stock. The monthly stochastic has peaked out after shares peaked off the $10.51 Fibonacci (fib) level. The monthly 5-period moving average (MA) support sits at $9.01. If the stochastic slips the 80-band then a sell-off towards the 15-period MA at $7.22 and the weekly market structure low (MSL) buy trigger at $6.86 are the next legs down. The weekly stochastic formed a mini inverse pup to slip the 80-band stochastic through the 15-period MA. A reversion bounce back to the $9.42 fib is a prime opportunity to wind down positions. If the weekly stochastic continues an oscillation down, then the $8.88 fib and $8.25 fibs will be the final liquidity pocket supports to continue trimming down or keep stop losses. Traders can also watch competitor Glu Mobile NASDAQ: GLUU to gauge sentiment and direction for the mobile app video game producers. Glu also missed earnings bringing momentum to a sudden stop and reversal. Despite the impressive bump in revenues and bookings, the losses continue to mount as does the ambiguity and proliferation of quirky accounting terms (IE: contingent consideration expense?

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.