Shares of ZipRecruiter

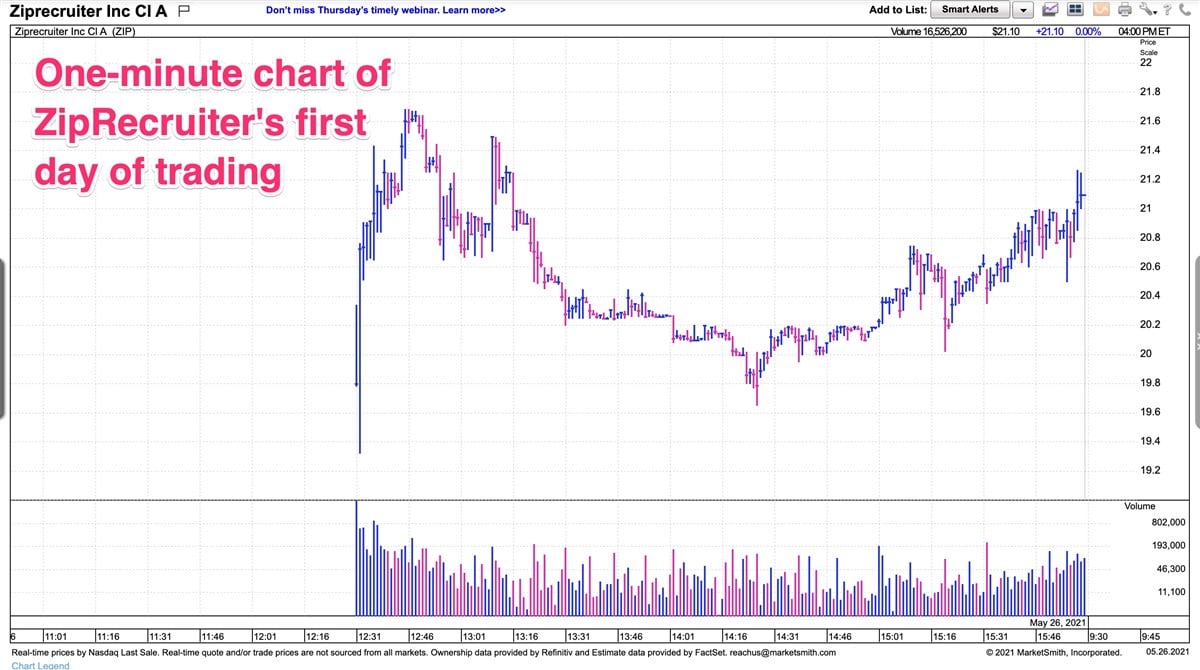

NYSE: ZIP ended their first day of trading at $21.10, up 17.22% from their reference price of $18.

The stock went public with a direct listing, rather than a traditional IPO. It opened at $19.80 and rallied to a session high of $21.69 within its first hour.

It ended the day with a market capitalization of $2.207 billion. A total of 16,526,200 shares changed hands in the session.

In addition to the shares currently outstanding, the company also has 30.8 million Class B common shares outstanding. Those shares are not currently listed on the New York Stock Exchange but may be converted to Class A shares at any time.

The search engine that connects employers with job seekers launched in 2010. It uses artificial intelligence technology to match candidates and employers. CEO Ian Siegel was among the company’s founders.

ZipRecruiter released first-quarter results on May 17. Earnings per share came in at $0.13 per share, up from a loss of $0.11 a year ago.

Revenue was $125.4 million, an increase of 11%.

The company posted a profit of $0.82 per share in 2020, following a loss of $0.06 per share in 2019.

In the statement accompanying last week’s report, Siegel said, “In our first public earnings report, ZipRecruiter delivered record revenue in Q1. We are issuing guidance for the year that maps to the strong signs of recovery in the U.S. hiring market.”

He added, “We believe that we are in the early stages of a significant resurgence of job growth during the once-in-a-lifetime reopening of the economy after the pandemic. We are well-positioned to take advantage of this moment as we continue to actively connect people to their next great opportunity. ZipRecruiter is helping America get back to work, and we are in the very early stages of our long-term growth opportunity.”

ZipRecruiter said it expects second-quarter revenue between $157 and $163 million, an increase between 79% and 86% from the year-ago quarter. It would represent sequential growth of 25% to 30%.

For the full year, ZipRecruiter sees revenue coming in between $580 million and $600 million, which would mark an increase of 39% to 44% from the year-earlier quarter.

The company joined other tech firms that recently turned to a direct listing instead of a typical IPO.

The big difference between a direct listing and an IPO is that in a direct listing, employees and early backers, such as venture capitalists and angel investors, sell their existing shares to the public. In an IPO, the company issues new shares.

Companies directly listing their shares on the public markets are not raising capital to pursue new projects. For example, ZipRecruiter does not have to pay underwriters, although Goldman Sachs and JPMorgan Chase were advisors on the deal.

A direct listing also avoids dilution of shares, which enables existing shareholders to maintain more of their value in the company. In addition, there’s no typical post-IPO lockup period, which restricts shareholders from selling within a specified period of time, usually 90 to 180 days.

Other companies using the direct listing recently include Palantir NYSE: PLTR, Roblox NYSE: RBLX, Squarespace NYSE: SQSP and Coinbase NASDAQ: COIN.

ZipRecruiter is not the only competitor in the online job-search space. LinkedIn and Indeed.com are major players. In its regulatory filings before going public, ZipRecruiter said its technology positions it as more of a “matchmaker” and opportunity “curator.”

Those functions are at the heart of ZipRecruiter’s technology, which allows employers to send a job listing to more than 100 sites. For job searchers, the database makes it simple to locate jobs that match one’s skills.

In media interviews prior to the public debut, Siegel explained that he had worked at various Internet startups, and understood first-hand the difficulty in matching his recruitment needs with job seekers. At firms too small to have human resources departments, managers were forced to post the same job listing on multiple sites, a time-consuming activity.

That, combined with other headaches from the hiring process, such as sifting through paper resumes, led Siegel to assemble the team that developed ZipRecruiter’s algorithms.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report