The stock market has always been unpredictable, but unprecedented world events have made the market even more unpredictable during the last few years. Between the COVID-19 pandemic, unprecedented government stimulus, simultaneous wars in Ukraine and Israel, and stubbornly high inflation, the idea of a normal market environment has all but disappeared.

The only thing that we can do is look at historical averages to see where today’s market fits in the grand scheme of things. The DOW is still trading over 35,000 and S&P 500 companies are trading at nearly 25 times their annual earnings, well above the historical average of 15 times earnings.

At the same time, we find ourselves in a rapidly changing interest rate environment. Fixed income investments have increased in yield in the last few years, but it’s hard to predict how long the Federal Reserve will keep rates elevated for. S&P 500 stocks continue to yield under 2% and some investors think it's too challenging to find safe and affordable securities that pay 4%, 5%, and even 6% yields.

Searching for yield isn't easy in an environment where historically high asset prices and stimulus from the Fed have driven down yields. This doesn't leave many options for investors looking for retirement income or a decent dividend yield on their stocks, but there are a handful of cheap dividend stocks to buy that are still yielding 3%-6%.

We've put together some of the best dividend stocks that are trading under their value and at lower P/E ratios than their peers. These stocks are true bargains in the dividend world right now.

Let's review some of the best cheap dividend stocks in the market today in this slideshow.

#1 - Wells Fargo & Company (NYSE:WFC)

- Share Price

- $80.17

- Dividend Yield

- 2.01%

- Track Record

- 4 Years of Consecutive Dividend Growth

- Payout Ratio

- 28.7%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $77.98 (2.7% Downside)

About Wells Fargo & Company

Wells Fargo & Co is a diversified and community-based financial services company, which engages in the provision of banking, insurance, investments, mortgage, and consumer and commercial finance products and services. It operates through the following segments: Consumer Banking and Lending, Commercial Banking, Corporate and Investment Banking, and Wealth and Investment Management.

More about Wells Fargo & Company

- Share Price

- $279.21

- Dividend Yield

- 3.44%

- Track Record

- 14 Years of Consecutive Dividend Growth

- Payout Ratio

- 86.9%

- Consensus Rating

- Hold

- Consensus Price Target

- $307.82 (10.2% Upside)

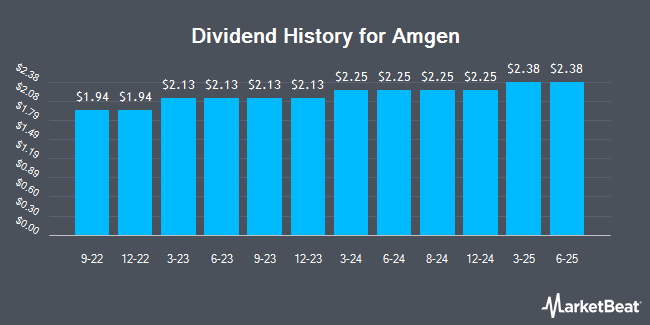

About Amgen

Amgen Inc discovers, develops, manufactures, and delivers human therapeutics worldwide. The company's principal products include Enbrel to treat plaque psoriasis, rheumatoid arthritis, and psoriatic arthritis; Otezla for the treatment of adult patients with plaque psoriasis, psoriatic arthritis, and oral ulcers associated with Behçet's disease; Prolia to treat postmenopausal women with osteoporosis; XGEVA for skeletal-related events prevention; Repatha, which reduces the risks of myocardial infarction, stroke, and coronary revascularization; Nplate for the treatment of patients with immune thrombocytopenia; KYPROLIS to treat patients with relapsed or refractory multiple myeloma; Aranesp to treat a lower-than-normal number of red blood cells and anemia; EVENITY for the treatment of osteoporosis in postmenopausal for men and women; Vectibix to treat patients with wild-type RAS metastatic colorectal cancer; BLINCYTO for the treatment of patients with acute lymphoblastic leukemia; TEPEZZA to treat thyroid eye disease; and KRYSTEXXA for the treatment of chronic refractory gout.

More about Amgen

- Share Price

- $24.27

- Dividend Yield

- 7.11%

- Track Record

- 16 Years of Consecutive Dividend Growth

- Payout Ratio

- 124.6%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $29.17 (20.2% Upside)

About Pfizer

Pfizer Inc discovers, develops, manufactures, markets, distributes, and sells biopharmaceutical products in the United States, Europe, and internationally. The company offers medicines and vaccines in various therapeutic areas, including cardiovascular metabolic, migraine, and women's health under the Eliquis, Nurtec ODT/Vydura, Zavzpret, and the Premarin family brands; infectious diseases with unmet medical needs under the Prevnar family, Abrysvo, Nimenrix, FSME/IMMUN-TicoVac, and Trumenba brands; and COVID-19 prevention and treatment, and potential future mRNA and antiviral products under the Comirnaty and Paxlovid brands.

More about Pfizer

#4 - GE Aerospace (NYSE:GE)

- Share Price

- $257.34

- Dividend Yield

- 0.57%

- Track Record

- 2 Years of Consecutive Dividend Growth

- Payout Ratio

- 22.4%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $223.75 (13.1% Downside)

About GE Aerospace

GE Aerospace (also known as General Electric) is a company that specializes in providing aerospace products and services. It operates through two reportable segments: Commercial Engines and Services and Defense and Propulsion Technologies. It offers jet and turboprop engines, as well as integrated systems for commercial, military, business, and general aviation aircraft.

More about GE Aerospace

#5 - Enterprise Products Partners (NYSE:EPD)

- Share Price

- $30.98

- Dividend Yield

- 6.89%

- Track Record

- 28 Years of Consecutive Dividend Growth

- Payout Ratio

- 80.1%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $36.67 (18.4% Upside)

About Enterprise Products Partners

Enterprise Products Partners L.P. provides midstream energy services to producers and consumers of natural gas, natural gas liquids (NGLs), crude oil, petrochemicals, and refined products. It operates in four segments: NGL Pipelines & Services, Crude Oil Pipelines & Services, Natural Gas Pipelines & Services, and Petrochemical & Refined Products Services.

More about Enterprise Products Partners

#6 - Emerson Electric (NYSE:EMR)

- Share Price

- $133.45

- Dividend Yield

- 1.58%

- Track Record

- 68 Years of Consecutive Dividend Growth

- Payout Ratio

- 50.5%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $136.47 (2.3% Upside)

About Emerson Electric

Emerson Electric Co, a technology and software company, provides various solutions for customers in industrial, commercial, and consumer markets in the Americas, Asia, the Middle East, Africa, and Europe. It operates in six segments: Final Control, Control Systems & Software, Measurement & Analytical, AspenTech, Discrete Automation, and Safety & Productivity.

More about Emerson Electric

#7 - Procter & Gamble (NYSE:PG)

- Share Price

- $159.29

- Dividend Yield

- 2.64%

- Track Record

- 70 Years of Consecutive Dividend Growth

- Payout Ratio

- 67.1%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $178.45 (12.0% Upside)

About Procter & Gamble

Procter & Gamble Co engages in the provision of branded consumer packaged goods. It operates through the following segments: Beauty, Grooming, Health Care, Fabric and Home Care, and Baby, Feminine and Family Care. The Beauty segment offers hair, skin, and personal care. The Grooming segment consists of shave care like female and male blades and razors, pre and post shave products, and appliances.

More about Procter & Gamble

#8 - United Parcel Service (NYSE:UPS)

- Share Price

- $100.95

- Dividend Yield

- 6.48%

- Track Record

- 16 Years of Consecutive Dividend Growth

- Payout Ratio

- 95.6%

- Consensus Rating

- Hold

- Consensus Price Target

- $120.26 (19.1% Upside)

About United Parcel Service

United Parcel Service, Inc, a package delivery company, provides transportation and delivery, distribution, contract logistics, ocean freight, airfreight, customs brokerage, and insurance services. It operates through two segments, U.S. Domestic Package and International Package. The U.S. Domestic Package segment offers time-definite delivery of express letters, documents, small packages, and palletized freight through air and ground services in the United States.

More about United Parcel Service

#9 - Verizon Communications (NYSE:VZ)

- Share Price

- $43.30

- Dividend Yield

- 6.44%

- Track Record

- 20 Years of Consecutive Dividend Growth

- Payout Ratio

- 64.5%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $47.41 (9.5% Upside)

About Verizon Communications

Verizon Communications Inc, through its subsidiaries, engages in the provision of communications, technology, information, and entertainment products and services to consumers, businesses, and governmental entities worldwide. It operates in two segments, Verizon Consumer Group (Consumer) and Verizon Business Group (Business).

More about Verizon Communications

#10 - General Mills (NYSE:GIS)

- Share Price

- $51.86

- Dividend Yield

- 4.75%

- Track Record

- 5 Years of Consecutive Dividend Growth

- Payout Ratio

- 52.7%

- Consensus Rating

- Hold

- Consensus Price Target

- $59.73 (15.2% Upside)

About General Mills

General Mills, Inc manufactures and markets branded consumer foods worldwide. The company operates through four segments: North America Retail; International; Pet; and North America Foodservice. It offers grain, ready-to-eat cereals, refrigerated yogurt, soup, meal kits, refrigerated and frozen dough products, dessert and baking mixes, bakery flour, frozen pizza and pizza snacks, snack bars, fruit and savory snacks, ice cream and frozen desserts, unbaked and fully baked frozen dough products, frozen hot snacks, ethnic meals, side dish mixes, frozen breakfast and entrees, nutrition bars, and frozen and shelf-stable vegetables.

More about General Mills

More Investing Slideshows: