Shares of Samsara NYSE: IOT have demonstrated remarkable resilience over the past year, showcasing an impressive 80% rise, outpacing the broader tech sector. While year-to-date performance shows a modest 5% increase, the stock's recent consolidation within a tight range sets the stage for a potentially bullish breakout, especially as earnings loom.

So, with an attractive setup looming in a stock with a near-term catalyst, let's take a deep dive into Samsara.

What is Samsara?

Samsara is renowned for providing Industrial Internet of Things (IoT) solutions, specializing in fleet management, safety, and compliance. The company's core mission is optimizing operational efficiency and ensuring customer security by implementing cutting-edge IoT technology. Its offerings include GPS tracking, ELD compliance, video telematics, and environmental monitoring services.

In December 2021, Samsara debuted on the NYSE under the ticker IOT, offering 35 million shares at $23 each, resulting in a total capital raise of $805 million. Following its initial listing, the stock exhibited significant volatility, surging to $31.41 in late December 2021, only to embark on a prolonged downtrend, reaching fresh lows near $9 in November 2022. However, this downward trajectory was not indefinite, as the stock rebounded impressively, achieving nearly 80% growth over the past year while maintaining a consistent uptrend.

The Technical Setup in IOT

Since December last year, Samsara's stock has been consolidating within a narrow range, with $32 as a robust support level and $36 as a significant resistance barrier. This consolidation pattern, coupled with the stock's position above rising key Simple Moving Averages (SMAs), mainly the 50-day SMA aligning with support, indicates a bullish formation.

If Samsara manages to break above the $36 resistance level before or after earnings and sustains this move convincingly, it could trigger a substantial upward trajectory. This scenario is supported by the stock's current technical setup, which suggests a favorable risk-reward profile for investors.

Samsara Has a Near-Term Catalyst

Samsara last reported its quarterly earnings on November 30, 2023, surpassing analysts' expectations with ($0.08) earnings per share, beating estimates by $0.02. The company reported revenues of $237.53 million, outperforming analyst forecasts of $225.36 million. Over the past year, Samsara has posted diluted earnings per share of ($0.42).

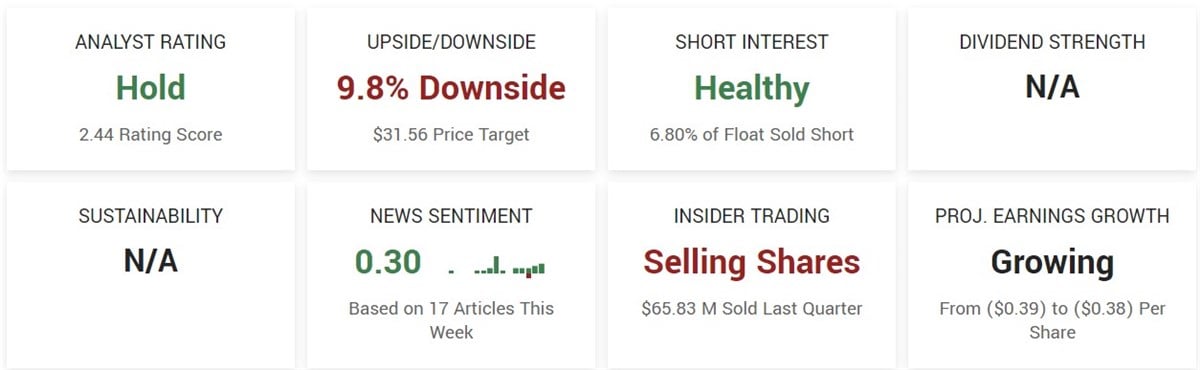

Looking forward, earnings for Samsara are anticipated to improve in the upcoming year, with expectations of growth from ($0.39) to ($0.38) per share. The company is scheduled to release its next quarterly earnings report on Thursday, March 7, after the market closes.

Analyst Ratings, Short Interest, and Insider Selling

Samsara holds a Hold rating based on nine analyst ratings, with a consensus price target suggesting a nearly 9% potential downside. Despite this, the stock maintains an intriguing setup for potential upside, particularly given its technical strength and upcoming earnings catalyst.

As earnings approach, the stock also carries a 6.8% short interest, which could act as a significant driver of volatility in the short term. Should Samsara deliver robust earnings results and offer optimistic guidance during its upcoming earnings call, it could potentially trigger a short squeeze scenario, further amplifying upward momentum.

The steady insider selling and lack of buying over the previous twelve months could be perceived as a negative for shareholders. Ten insiders have sold stock during the last twelve months, with zero insider buying. In total, during this period, almost $300 million worth of Samsara stock was sold by insiders. Most recently, the CEO of Samsara sold 80,342 shares on February 27.

Is Samsara a Buy?

Samsara offers an enticing prospect for investors and momentum traders, particularly given its recent consolidation signaling a potential bullish breakout, especially as it approaches the upcoming earnings release. However, it's crucial to acknowledge recent insider selling and short-term market underperformance. Despite cautious sentiment among analysts, the stock's strong technical setup and improving earnings outlook provide compelling reasons for close monitoring during the earnings season. Nevertheless, Investors should proceed cautiously, awaiting confirmation of a breakout before making significant commitments.

Before you consider Samsara, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Samsara wasn't on the list.

While Samsara currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.