Once you finish reading this article, you’ll know the answer to "What is the discount rate? You'll also know how to calculate it and why these rates are key factors in where to invest your money.

What is Discount Rate?

Discount rate refers to when a business uses discounted cash flow analysis to determine the present value of future cash flow. For investors, discounted cash flow analysis determines how valuable a company is today based on future projected revenue. It’s a key factor in investment valuation and capital budgeting decisions.

Understanding the Discount Rate

The discount rate has two meanings in finance. It's either the interest rate charged by the Federal Reserve Banks to financial institutions or a measurement used for cash flow analysis. Let's explore each of these separately.

Supply and demand usually determine interest rates. The discount rate is an exception because it comes from the board of directors of 12 Federal Reserve Banks. At the close of business, some banks must borrow extra money to meet their reserve requirement. This is where the discount rate comes in. It applies to short-term loans the Fed provides to these banks. The discount rate is higher than the benchmark Federal funds rate, as it's considered a last-resort option.

The discount rate comprises three different rates. Banks with good credit get the primary rate, one percentage point above the federal funds rate. Banks not qualifying for the primary rate get a secondary rate set 50 basis points higher. The third rate is called the seasonal credit rate. It changes every 14 days, based on the average of the three-month CD rate and daily effective federal funds rate.

Many businesses have predictable revenue streams that they can project into the future. The problem for investors and analysts is that projecting a dollar of future revenue, including hundreds of thousands of dollars in new revenue, are just projections. It's almost impossible to predict market conditions, particularly when these forecasts are five to 10 years in the future.

So, to account for that cash flow, it must first be discounted using a rate. How companies may come up with the exact discount rate is beyond the scope of this article. Still, it considers the time frame, future expectations for revenue growth and future free cash flow estimates.

For example, if a business projects $1,000 in revenue for next year from a new customer, they have to forecast a present value of that money. If the discount rate they apply is 10%, that $1,000 would be valued at $909.09 using the discounting rate formula = 1,000 / (1+0.1).

If a business projected $1,000 in revenue to occur in two years, it would be valued at $826.45 using the same formula.

The Role of the Discount Rate in Finance

Under the first definition, the Federal Reserve Banks sets the discount rate. This rate historically has been one point above the Federal funds rate. However, during the 2007 financial crisis, the rate lowered to 0.5% to help inject liquidity into the financial markets. As of October 2023, the spread between the discount and Federal funds rates has lessened considerably.

Although the market does not dictate it, the discount rate impacts several key interest rates that can affect investors and consumers. On a macroeconomic level, the discount rate can indicate the current direction of United States monetary policy. During times of financial volatility, the discount rate is one tool that the Federal Reserve can use to expand monetary supply.

The discount rate also determines a company’s discounted cash flow analysis, one of many ways to determine an accurate future value for a company based on its projected revenue and free cash flow.

The Importance of Time Value of Money

The time value of money states that a dollar today is worth more than a dollar tomorrow due to its potential to generate additional income or growth over time. This concept comes from the idea that most of us would prefer to receive a given amount of money today rather than wait some unspecified time to receive the same amount. The time value of money helps make decisions by evaluating future investment opportunities based on present value.

We can also use the time value of money when making decisions about borrowing or lending. When borrowing, you need to consider the interest rate and how long it will take to pay back the loan with interest. For lenders, the discount rate helps them determine the present value of the future cash flows they can expect. By discounting these cash flows at a certain rate, lenders can evaluate the risk and return of lending money to a borrower. The higher the discount rate, the higher the perceived risk of lending money to that person.

Factors Affecting Discount Rate Calculation

The discount rate calculation considers several factors, including risk, inflation, liquidity and opportunity cost.

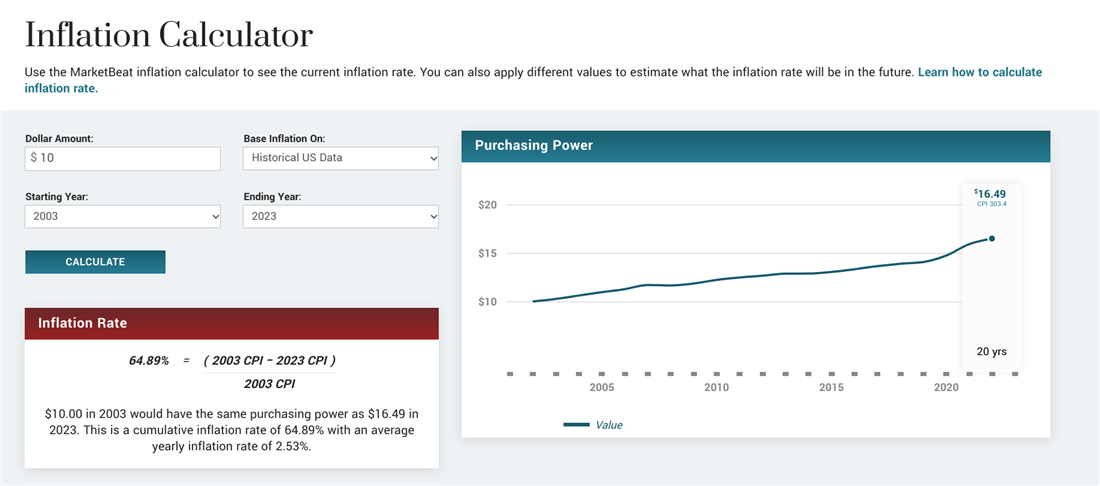

Risk reflects the degree of uncertainty associated with future cash flows. A high-risk investment requires a higher discount rate than a low-risk alternative. Inflation also affects the calculation by increasing the cost of goods and services over time; thus, a higher discount rate may compensate for expected price increases.

Liquidity, meanwhile, reflects how quickly an investment can convert into cash. The greater liquidity of an asset means it can be sold quickly with minimal loss of value; thus, more liquid investments may require a lower discount rate. Finally, an implicit opportunity cost is always associated with not investing in another viable alternative.

Example of Calculating the Discount Rate

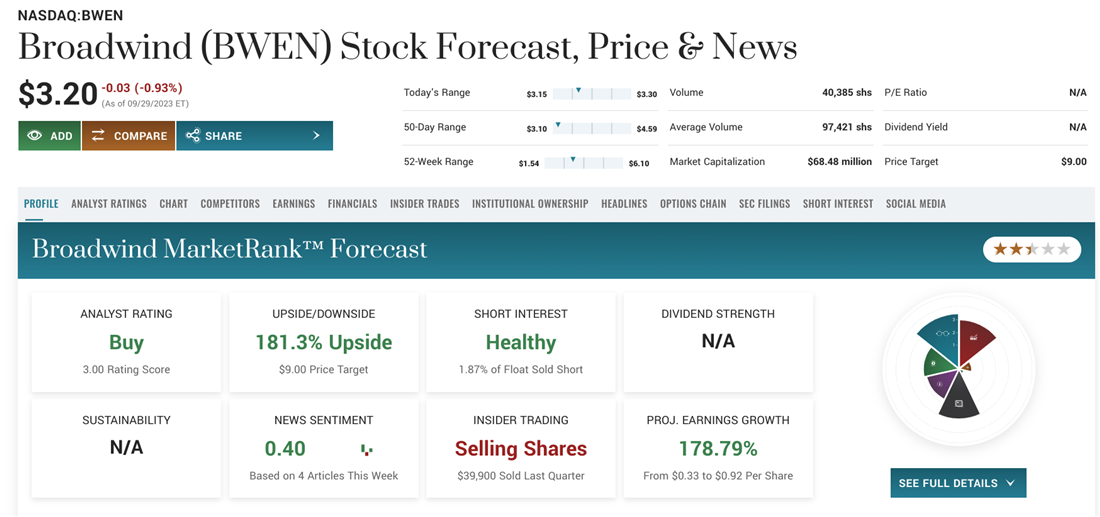

For example, Broadwind Inc. NASDAQ: BWEN projects its future revenue and free cash flow five years into the future:

Year 1: $400,000 revenue / Free cash flow = $250,000

Year 2: $425,000 revenue / Free cash flow = $265,625

Year 3: $450,000 revenue/ Free cash flow = $281,250

Year 4: $500,000 revenue/ Free cash flow = $322,500

Year 5: $600,000 revenue/ Free cash flow = $400,000

We would need to consider various factors to calculate the discount rate for these projections.

First, we would want to consider the risk of investing in the company. If the Broadwind chart shows the company has a steady growth and profitability history, the risk may be relatively low, and we could apply a lower discount rate. However, if the company operates in a volatile industry or has shown inconsistent financial performance, a higher discount rate may be necessary to account for increased risk.

Next, we would want to consider inflation and how it will affect future cash flows. If inflation will be high over the next five years, we would need to apply a higher discount rate to adjust for the decreasing value of money over time. On the other hand, if inflation remains low, we could apply a lower discount rate.

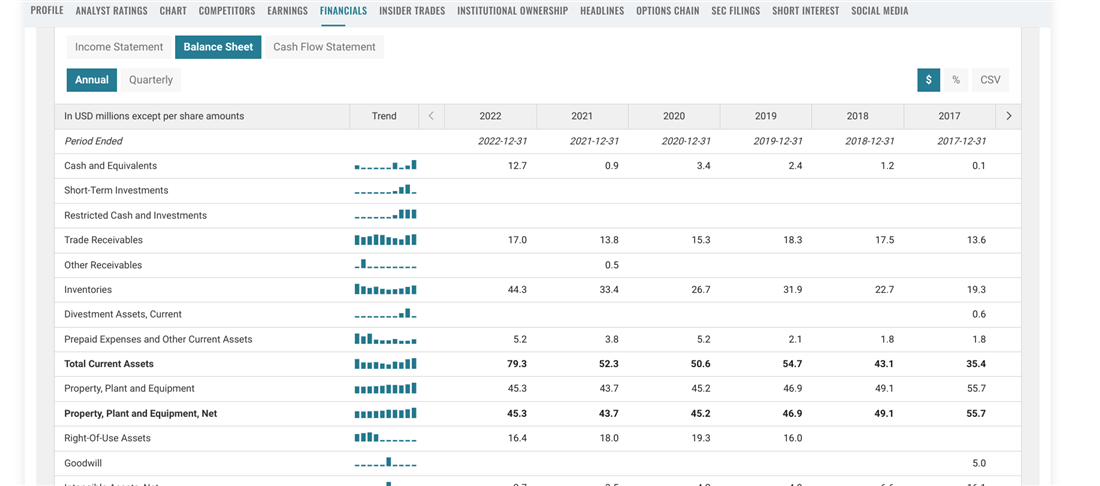

We would also want to consider the liquidity of the investments, which you can find at the top of the balance sheet under Broadwind financials. If the company can sell investments quickly without significant loss of value, we could apply a lower discount rate. However, if the investments are illiquid and cannot easily convert to cash, a higher discount rate may be necessary to account for the additional risk.

Once we've considered these factors, we can calculate the appropriate discount rate for our projections. Let’s assume that after considering all of these factors, we decide on a discount rate of 10%. Using this rate, we can calculate the present value of the future cash flows.

Year 1: $250,000 / (1 + 0.10) = $227,273

Year 2: $265,625 / (1 + 0.10)^2 = $210,937

Year 3: $281,250 / (1 + 0.10)^3 = $196,330

Year 4: $322,500 / (1 + 0.10)^4 = $221,240

Year 5: $400,000 / (1 + 0.10)^5 = $248,398

Adding up these present values gives us a total value of $1,104,178 for Broadwind's future cash flows.

Discount Rate in Investment Valuation

The concept of time value of money is also applied when determining return on investment (ROI), which compares the profitability generated from an investment relative to its total cost over a specified period. For example, if you invest $1,000 in stock and your portfolio has grown to $1,200 after one year, you've earned an annual return on investment (ROI) equal to 20% ($200/$1,000).

The Discount Rate's Role in Capital Budgeting

The discount rate plays a big role in determining how viable a potential investment is. It can determine the present value of future cash flows associated with an investment project, which helps compare different investments on an apples-to-apples basis. To do this, select an appropriate discount rate that reflects the risk associated with the project and factors in inflation and liquidity.

Bond Pricing and the Discount Rate

Bond prices are determined by the present value of the expected future cash flows discounted back at the appropriate interest rate, also called the discount rate.

The discount rate used to price a bond should reflect the risk associated with it, with higher-risk bonds needing to be discounted at higher rates to compensate for their increased risk. The term structure of interest rates is also important. Generally, longer-term bonds should have higher coupon rates than shorter-term bonds to be competitive in the market.

When pricing a bond, investors typically use a benchmark yield curve such as the Treasury yield curve or a swap yield curve to set an appropriate discount rate for each duration of bonds. In addition, investors may also use fundamental and technical analysis to gauge market sentiment and potential future movements of interest rates.

Net Present Value (NPV) and Discount Rate

A project's net present value (NPV) is the difference between the present value of its expected cash flows minus its initial cost. For example, if a company decides to invest $100 today in an investment project that will generate $150 in one year, then you'd calculate its NPV as $50 ($150 – $100). The NPV calculation considers the time value of money by discounting future cash flows back to their present values.

Challenges in Choosing the Right Discount Rate

The discount rate is a critical component of financial analysis. Unfortunately, it can be difficult to determine the appropriate discount rate for a given situation. When choosing a discount rate, analysts look at several factors:

- Interpreting risk: Different levels of risk can impact the expected ROI. For example, an investor may decide to increase their required return for investments that carry more risk than investments with lower risks.

- Comparing discount rates: Many investors use benchmark rates such as U.S. Treasury yields or LIBOR as guides when selecting discounted rates. However, these rates often do not reflect current market conditions or individual investor preferences and, in some cases, may even be outdated.

- Accounting for inflation: As inflation rises, money's purchasing power decreases, and future cash flows become less valuable than present cash flows. To account for this effect, investors often use higher discount rates when evaluating investments with long-term horizons and when they expect significant inflation over time.

Discount Rate, Major Impact

The discount rate impacts various key rates and indicates the direction of the nation's monetary policy. You can use it to analyze a company's future cash flow. While choosing the right discount rate for a given situation can be tough, it remains one of our most useful tools in financial decision-making, so take the time to understand it so it pays off.

Before you consider Broadwind Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Broadwind Energy wasn't on the list.

While Broadwind Energy currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.