Read on to discover the eco-friendly investments that can make a difference. We'll provide you with the knowledge you need to navigate the world of green investing successfully and achieve your desired outcome: a portfolio that yields financial returns and contributes to a more sustainable and eco-friendly future.

Overview of Green Investing

What is green investment, and why is it gaining traction among environmentally conscious investors like yourself?

Environmental investment, often called green investing, is an investment strategy that aligns your investment portfolio with your commitment to a sustainable and eco-friendly future.

How Green Investing Works

Now that you understand what green investment is and its significance, let's dig into how it works. Understanding the mechanics of environmental investment is crucial for making informed decisions and creating a well-rounded portfolio of eco-friendly investments. At the heart of green investing is selecting eco-friendly investments, which involves identifying companies and projects that align with your sustainability criteria. Consider the following factors:

- Environmental impact: Look for companies actively conserving natural resources, reducing pollution and promoting renewable energy sources. These businesses are at the forefront of environmental investment.

- Social responsibility: Assess whether the companies you're interested in prioritize social justice and ethical practices. Many green investors seek businesses committed to fair labor practices and diversity.

- Sustainable practices: Evaluate a company's commitment to sustainable business practices, such as efficient resource utilization, waste reduction and environmentally friendly product development.

A crucial tool for many green investors is using sustainability ratings and environmental, social and governance (ESG) scores to inform their investment choices. These scores offer valuable insights into a company's environmental and social performance, aiding investors in aligning their investments with their values. For added convenience, platforms like MarketBeat streamline this process by incorporating sustainability data directly into the profiles of companies committed to sustainability initiatives.

Types of Green Investing

Types of Green Investing

As we dig deeper into green investing, we must explore the diverse categories and types of eco-friendly investments available.

Each investment avenue offers a unique opportunity to support sustainability while potentially growing wealth. Let’s take a few minutes to navigate the various types of green investing, providing insights into how you can make eco-friendly choices within your investment portfolio.

Green Equities

Green equities involve purchasing shares in companies actively engaged in environmentally friendly or sustainable activities. These companies prioritize eco-friendly practices and often focus on renewable energy, carbon reduction and sustainable business operations. Investing in green equities supports businesses committed to environmental sustainability. This approach allows you to become a shareholder in companies that share your green values, potentially benefiting from their growth while contributing to a more sustainable future.

Green Bonds

Green bonds are fixed-income securities with a specific purpose: raising capital for climate and environmental projects. When you invest in green bonds, you earmark funds for initiatives such as renewable energy projects, sustainable infrastructure development or efforts to reduce pollution.

These bonds provide a reliable way to channel your investment towards eco-friendly causes, all while earning interest on your investment. Green bonds offer a unique opportunity to combine financial gain with environmental impact.

Green Funds

Green funds are investment vehicles primarily focusing on green and socially responsible companies. These funds pool investments from numerous individuals, offering diversification and risk reduction.

Investing in green funds indirectly supports a diversified portfolio of eco-friendly companies. This approach is accessible and impactful for green investors who seek to align their investments with sustainability goals without extensive research and management.

Renewable Energy Investments

Investing in renewable energy involves supporting companies developing, constructing and operating sustainable energy sources. This category encompasses investments in solar, wind, hydropower and geothermal power. By investing in renewable energy initiatives, you not only promote clean and sustainable energy but also potentially benefit from the growing demand for environmentally friendly power sources. It's an opportunity to be part of the solution to climate change while diversifying your portfolio.

Energy Efficiency and Conservation Investments

Energy efficiency and conservation investments revolve around companies optimizing energy consumption and reducing waste. These businesses may specialize in green building construction, developing smart grid technologies, or creating energy-efficient appliances.

Investing in energy efficiency contributes to resource conservation, aligning with sustainability goals and can also provide financial returns as energy-efficient technologies gain prominence.

Sustainable Agriculture and Forestry Investments

Sustainable agriculture and forestry investments support projects and companies involved in environmentally responsible farming and forestry practices. This category includes investments in organic farming, agroforestry, reforestation and afforestation.

Investing in sustainable agriculture and forestry promotes practices that balance environmental conservation with productive land use. It's a way to manage environmentally friendly land while potentially diversifying your investment portfolio.

Waste Management and Recycling Investments

Investments in waste management and recycling companies focus on reducing waste and minimizing its environmental impact. These companies may be involved in recycling programs, waste reduction initiatives, or sustainable waste disposal methods.

Investing in waste management and recycling supports eco-friendly solutions to one of the planet's pressing challenges. It offers a chance to contribute to a cleaner environment while considering potential financial returns.

Green Savings Accounts

Green savings accounts, offered by banks, utilize deposited funds to finance environmentally friendly projects. These accounts provide a way to earn interest on your savings while knowing that your money actively contributes to green initiatives. It's a simple yet impactful way to make your savings work for the environment.

Green Money Market Accounts

Like green savings accounts, green money market accounts use deposited funds to finance eco-friendly projects. These accounts typically offer higher interest rates than regular savings accounts, making them an attractive option for eco-conscious savers. With green money market accounts, you can earn competitive returns while supporting sustainability efforts.

Green Certificates of Deposit

Green certificates of deposit (CDs) are time deposit accounts offered by banks, with the deposited funds dedicated to financing green projects. While your money is locked in a CD for a specified period, it helps fund sustainability initiatives, making it a secure and impactful way to invest in environmental causes. Green CDs offer the stability of traditional CDs combined with the satisfaction of contributing to a greener world.

Each of these types of green investing presents a unique opportunity for eco-conscious investors to align their financial goals with their environmental and social values. As you explore these options, consider how they fit into your overall investment strategy and personal sustainability objectives. Whether you seek direct involvement through equities or prefer the convenience of funds and bonds, green investing empowers you to positively impact the world while potentially growing your wealth.

Green Investing Categories

Let’s look at the various green investing categories, each offering distinct opportunities to align your investment portfolio with eco-friendly initiatives. Understanding these categories will empower you to make informed decisions that resonate with your commitment to sustainability.

Aquaculture

Aquaculture focuses on sustainable fishing practices, addressing the pressing issue of overfished oceans and their impact on the global food chain. Investing in aquaculture supports responsible fish farming methods that help maintain a balanced marine ecosystem. This category contributes to food security while promoting sustainable fishing practices.

Eco-Tourism

Eco-tourism encourages responsible travel to natural areas that prioritize environmental conservation, support local communities and provide educational experiences. Investing in eco-tourism ventures aligns with a commitment to sustainable travel. These investments contribute to preserving natural habitats, promoting local economies and raising awareness about environmental protection.

Energy Efficiency

Energy efficiency investments focus on companies and technologies that optimize energy consumption and reduce waste. This category includes businesses specializing in green building construction, the development of smart grid technologies and the creation of energy-efficient appliances. Investing in energy efficiency supports resource conservation and the transition to sustainable energy practices.

Geothermal

Geothermal energy companies harness the Earth's heat to develop clean and sustainable energy sources. These investments revolve around using the natural heat from the Earth's subsurface to generate electricity or provide heating and cooling solutions. Geothermal investments contribute to clean energy production and reduce reliance on fossil fuels.

Green Construction

Green construction investments involve companies committed to designing, constructing and operating resource-efficient and environmentally responsible buildings. These investments promote sustainable building practices, including energy-efficient designs, eco-friendly materials and green certifications. Green construction aligns with environmental conservation while catering to the growing demand for sustainable real estate.

Green Power

Green power investments primarily focus on companies engaged in power generation that rely on renewable energy sources, such as wind, solar and hydroelectric power. Investing in green power supports the transition from fossil fuels and contributes to a cleaner and more sustainable energy landscape.

Organics

Organics investments center on organic farms that prioritize pesticide-free and sustainable farming practices. Investing in organics supports environmentally responsible agriculture while promoting healthier food products for consumers and the planet.

Pollution Controls

Pollution control investments target companies specializing in technologies and practices that reduce greenhouse gas emissions and minimize pollution. These investments contribute to a cleaner environment by addressing pollution from industrial power plants, transportation systems and more.

Sustainable Agriculture

Sustainable agriculture investments support projects and companies involved in environmentally responsible farming practices. This category includes investments in organic farming, agroforestry, reforestation and afforestation. Investing in sustainable agriculture promotes the responsible use of land and resources while enhancing food security.

Sustainable Forestry

Sustainable forestry investments prioritize forest management practices that balance environmental conservation, wildlife preservation and responsible forest community development. These investments contribute to protecting valuable forest ecosystems while supporting sustainable timber production.

Transportation

Electric vehicle manufacturers like Tesla might come to mind when you think of transportation investments. However, this category encompasses a range of companies dedicated to developing and implementing environmentally friendly transportation solutions. From electric vehicles to public transit systems, investing in transportation contributes to reducing the carbon footprint of the global transportation sector.

Waste Reduction

Waste reduction investments broadly focus on companies dedicated to reducing waste and minimizing its environmental impact. These companies may develop and implement recycling and composting programs, efficient waste disposal methods and sustainable waste management practices. Investing in waste reduction supports eco-friendly solutions to one of the planet's pressing challenges.

Water Conservation

Water conservation investments target projects and companies addressing water scarcity and promoting responsible water management. This category encompasses investments in water-saving technologies, wastewater treatment and initiatives that ensure the sustainable use of this vital resource.

As you explore these green investing categories, consider how they align with your sustainability goals and risk tolerance. Each category offers a unique avenue to invest in eco-friendly initiatives, contributing to a more sustainable and responsible future while potentially diversifying your investment portfolio.

Example of a Green Investment

Evaluating green opportunities becomes crucial as you align your investments with environmental and social values. Green investing offers a unique path to contribute to a more sustainable future while potentially growing wealth. You need a comprehensive strategy to make informed decisions in this exciting field. Let's delve into the steps for evaluating green investments, ensuring that your financial portfolio generates returns and promotes positive environmental and social impact.

Define Your Sustainability Goals

Begin by clearly defining your environmental and social objectives. Are you passionate about renewable energy, sustainable agriculture or eco-friendly technology? Understanding your values will guide your investment choices.

Research Potential Investments

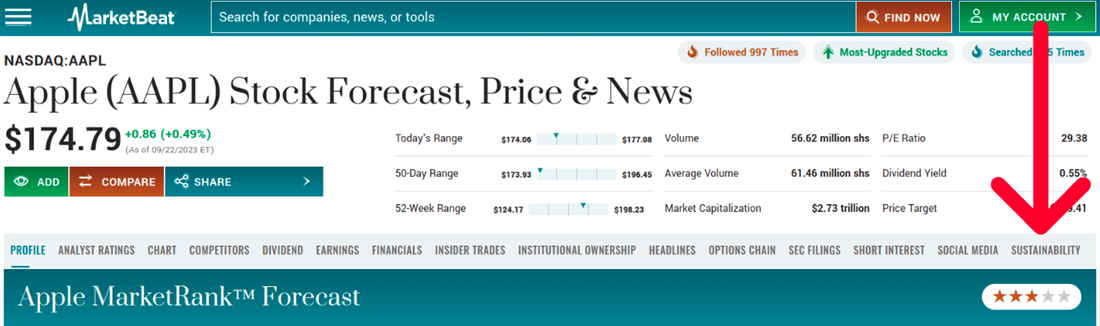

Conduct extensive research to identify companies that align with your sustainability goals. Platforms like MarketBeat provide a valuable starting point by highlighting environmentally conscious businesses. MarketBeat does this by providing sustainability information on applicable stocks. Use this information to investigate a company's sustainability efforts by examining its ESG ratings.

Companies often publish sustainability reports detailing their initiatives and environmental and social responsibility progress. Carefully review these reports to ensure transparency and goal alignment.

Assess Environmental and Social Impact

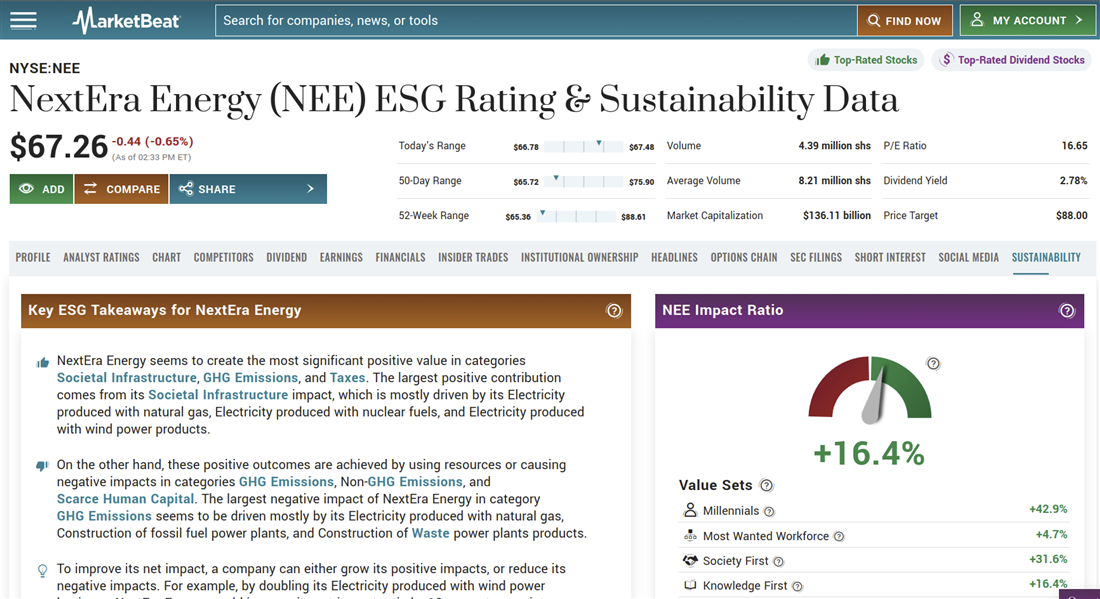

Your next step is to assess the environmental and social impacts. For this step, let's use NextEra Energy as our example. NextEra Energy NYSE: NEE is a prominent player in the energy sector and is the world's largest producer of renewable energy. The company operates a diverse portfolio of energy assets, including wind and solar power plants, alongside nuclear power facilities. Regarding green investing, NextEra Energy significantly contributes to environmental and social well-being.

Reviewing NextEra Energy’s Sustainability Scores reveals that NextEra Energy's most noteworthy environmental impact comes from its substantial reduction in greenhouse gas (GHG) emissions. The company significantly curtails GHG emissions by actively producing electricity using natural gas and nuclear fuels and harnessing wind power. This positive contribution underscores its commitment to combatting climate change and promoting clean energy alternatives.

Moreover, NextEra Energy takes commendable steps in reducing non-GHG emissions, making strides in curbing pollutants beyond carbon dioxide. This aspect of its environmental stewardship showcases a holistic approach to minimizing air pollutants and safeguarding air quality. While the company's impact on scarce natural resources remains minimal, its efforts to protect biodiversity and manage waste reflect a commitment to responsible resource management and ecological preservation.

NextEra Energy's societal impact extends beyond its environmental achievements. The company plays a pivotal role in enhancing societal infrastructure by providing reliable and sustainable sources of electricity. It positively impacts communities by ensuring a stable energy supply. NextEra Energy also contributes to job creation and generates tax revenue, bolstering local economies. These financial resources, channeled into community development and public services, have a far-reaching impact on societal stability.

The company's commitment to equality and human rights is evident in its societal impact. While minor negative aspects exist, NextEra Energy's dedication to promoting equal opportunities and human rights remains a notable feature of its social responsibility.

Analyze Financial Health

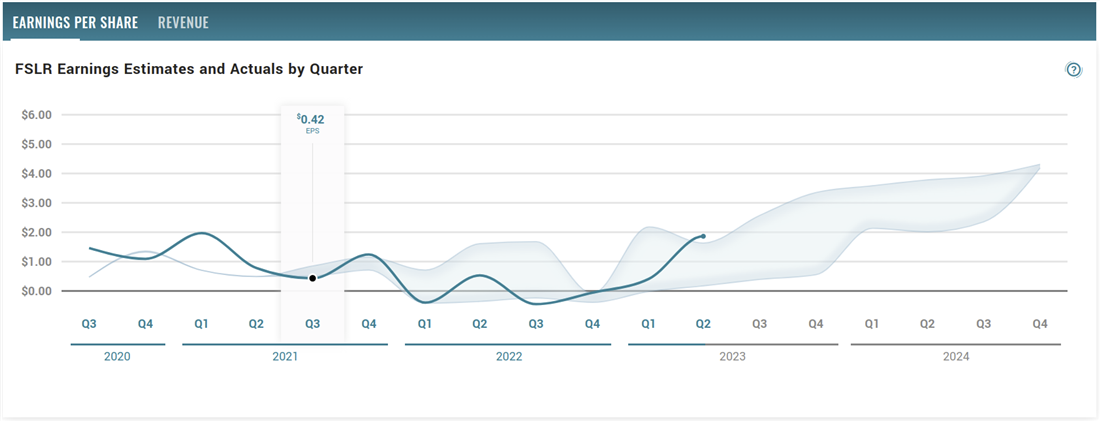

Assessing the financial health of your investments is imperative. Let’s take a moment to review how to evaluate a company's financial health. We will use First Solar, Inc. NASDAQ: FSLR for this example.

First Solar is a global leader in providing complete photovoltaic (PV) solar energy solutions. The company is headquartered in Tempe, Arizona, and aims to create lasting value by enabling a world powered by clean, affordable solar electricity. Its commitment to delivering sustainable energy solutions that minimize environmental impact aligns with the goals of eco-conscious investors.

One of the fundamental aspects to evaluate is the company's profitability. First Solar’s earnings have consistently demonstrated strong financial performance over recent years. Its profit margins have remained robust, which reflects efficient operations and effective cost management strategies. Profitability is a crucial indicator of a company's financial strength and ability to generate shareholder returns.

A healthy balance sheet is critical for a company's stability. First Solar’s balance sheet has been consistently healthy, with assets sufficiently covering its long-term debt. This financial strength ensures the company has the resources to meet its financial obligations, invest in research and development, expand production capacity and pursue strategic initiatives.

First Solar's stock performance has been impressive recently, reaching all-time highs during favorable industry conditions and strong earnings announcements. Investors must monitor the stock's performance and stay informed about relevant news and events. It's worth noting that, like any publicly traded company, First Solar is subject to market volatility, which can result from various factors, including changes in broader market conditions, geopolitical events or investor sentiment towards the renewable energy sector.

Consider Innovation and Market Demand

Look for companies that innovate in the field of sustainability. Those with a competitive edge in meeting the growing market demand for eco-friendly products and services may have significant growth potential.

Review Regulatory Compliance

Review regulatory filings, typically found in annual reports submitted to government agencies, to ensure a company's compliance with environmental regulations and standards.

Companies often publish sustainability reports on their websites, providing insights into environmental performance and compliance efforts. Additionally, seek out third-party assessments and scores from organizations like the Carbon Disclosure Project and Dow Jones Sustainability Index to gauge a company's environmental commitment relative to industry peers. Investigate past or ongoing environmental regulatory actions or violations in public records or legal databases. Companies engaged in environmental compliance may partner with environmental organizations and showcase their commitments in official policies and certifications.

As an eco-conscious investor, your financial decisions can drive positive change. By meticulously following these steps to evaluate green investments, you can confidently invest in companies that promise financial returns and actively contribute to environmental conservation, social justice and a more sustainable future. Remember, green investing is not just about profit; it's about making a meaningful impact while securing your financial well-being.

Are Green Investments Profitable?

Green investments have gained traction in recent years, and several factors suggest their potential for profitability. The market for sustainable and environmentally friendly products and services is rising. As global awareness of climate change and environmental issues grows, the demand for green solutions increases. This heightened demand can translate into strong market performance for companies operating in the green sector.

Government support is another crucial driver of profitability in green investments. Governments worldwide incentivize green initiatives through subsidies, tax breaks and regulations favoring eco-friendly practices. These measures can provide financial advantages to companies committed to sustainability, potentially leading to higher profitability.

Consumer preferences are shifting toward environmentally conscious products and services. Companies that align with these preferences often experience increased sales and market share. Investing in such companies can be financially rewarding as they cater to a growing customer base.

Innovation and efficiency are fundamental to many green investments. Eco-friendly companies often employ innovative technologies and practices to improve resource efficiency and reduce costs. This commitment to efficiency can enhance profitability by minimizing waste, lowering energy expenses and optimizing operations.

Furthermore, green investments tend to focus on long-term sustainability. While short-term market fluctuations can impact any investment, companies that address pressing environmental challenges position themselves for enduring success. Over time, this dedication to sustainability can lead to stable and profitable businesses.

Green investments have the potential to be profitable. Combining market growth, government support, shifting consumer preferences, innovation, long-term sustainability and diversification opportunities suggests that eco-friendly investments can align with financial and environmental goals. However, like all investments, it's crucial to conduct thorough research, consider your risk tolerance and seek professional advice to make informed investment decisions in the green sector.

Are Green Investments Sustainable?

Sustainability in the context of green investments encompasses their capacity to endure, adapt and consistently generate positive environmental and social impacts. At the core of sustainable, eco-friendly investments is their profound ecological impact. These investments are geared toward addressing critical environmental challenges. They strive to reduce greenhouse gas emissions, conserve natural resources and propel the adoption of clean and renewable energy sources.

A sustainable eco-friendly investment doesn't just aim for short-term gains but persists in its commitment to these environmental goals over the long term.

Moreover, eco-friendly investments often extend their sustainability initiatives to encompass social responsibility. Companies engaged in eco-friendly endeavors frequently uphold fair labor practices, actively engage with their local communities and dedicate themselves to enhancing societal well-being. Sustainable eco-friendly investments go beyond mere financial returns; they actively promote these social aspects, ensuring their continued and meaningful contribution to society.

Sustainability in eco-friendly investments is also closely linked to adaptability. The ability to adjust to evolving market dynamics, environmental regulations and technological advancements is crucial for long-term viability. Companies that flexibly align their strategies with shifting landscapes are more likely to maintain their eco-friendly status over time.

Transparency and reporting play a pivotal role in sustainability. Eco-friendly investments committed to long-term sustainability prioritize transparency in operations and reporting practices. They provide clear and comprehensive information about their environmental and social impact, allowing investors to assess their sustainability efforts. Consistent reporting and adherence to recognized sustainability standards enhance the long-term credibility of these investments.

Government policies and support are instrumental in bolstering the sustainability of green investments. Incentives, regulations and funding for sustainability initiatives from governments can significantly impact the long-term prospects of eco-friendly investments.

Consumer demand is another vital component of sustainability. The sustained demand for environmentally friendly products and services drives the long-term viability of green investments. Companies responding to and fulfilling these consumer preferences are more likely to remain sustainable in the ever-changing market landscape.

Lastly, risk management is an essential part of sustainability in eco-friendly investments. These investments often integrate robust risk management practices that proactively address environmental risks, such as climate change-associated ones. By securing their long-term operations and profitability, they ensure their ongoing sustainability.

Pros and Cons of Green Investments

As you evaluate green investing as a potential part of your portfolio, carefully weigh the advantages and disadvantages. Green investments, which revolve around environmentally friendly and socially responsible principles, offer unique opportunities and challenges that every investor should know. Let’s explore the pros and cons of green investments to help you make informed decisions on your sustainable investment journey.

Pros

- Positive environmental impact: Green investments contribute to a cleaner environment by supporting companies and projects focusing on renewable energy, resource conservation and eco-friendly practices to mitigate climate change, reduce pollution and protect natural ecosystems.

- Alignment with values: Green investments allow investors to align their portfolios with personal values and ethical beliefs. This sense of purpose can provide a deeper level of satisfaction and fulfillment.

- Long-term sustainability: Companies committed to green initiatives often prioritize long-term sustainability. This can lead to more stable and enduring returns for investors, as these companies are less likely to be affected by environmental risks and regulatory changes.

- Market resilience: Green investments can be more resilient to market downturns and economic crises. Some sustainable sectors, such as renewable energy, have shown consistent growth and resilience in challenging economic conditions.

- Government support: Many governments worldwide offer incentives, subsidies and tax breaks for green investments. These government initiatives can enhance the financial attractiveness of eco-friendly investments.

- Innovation and technological advancements: Green investments often support companies at the forefront of innovation in clean energy, sustainable agriculture and environmental technology. These innovations can lead to breakthroughs and potential for significant returns.

- Diversification: Including green investments in your portfolio can diversify your holdings across different sectors and asset classes. This diversification can help reduce overall investment risk.

- Consumer demand: The growing global awareness of environmental issues has increased consumer demand for eco-friendly products and services. Companies meeting this demand can experience strong growth, benefiting investors.

Cons

- Potentially lower returns: While green investments can provide stable returns, they may not always match the high returns of more traditional investments, particularly in the short term. Investors should be prepared for potentially lower immediate gains.

- Risk of greenwashing: Some companies may falsely claim to be environmentally friendly, engaging in "greenwashing." This can mislead investors who believe they are supporting sustainable businesses when, in reality, they are not.

- Limited investment options: Green investments may have a narrower selection of investment opportunities than traditional markets. This limited choice can make it challenging to build a diversified green portfolio.

- Regulatory changes: The regulatory landscape for green investments is subject to change, potentially affecting the profitability and viability of certain projects and companies. Investors must stay informed about evolving regulations.

- Volatility in emerging sectors: Some green sectors, like renewable energy, are still emerging and can be subject to higher volatility. Investors should prepare for these sectors' market fluctuations and potential risks.

- Higher initial costs: Many green investments, such as solar installations or energy-efficient infrastructure, may require higher initial capital expenditures. While these investments can pay off over time, they may pose a financial barrier for some investors.

- Lack of standardization: Green investing lacks standardized definitions and criteria for what constitutes "green" or "sustainable." This can make it challenging to evaluate and compare different green investment options.

- Limited historical data: Compared to traditional investments, green investments may have a shorter track record, making assessing their historical performance and risk profiles difficult.

Green Investing: Putting Your Money Where Your Values Are

Green investing offers a distinctive opportunity to purposefully align your financial goals with your environmental and social values. This eco-conscious approach enables you to contribute to a cleaner, more sustainable world while potentially growing wealth. However, it's crucial to navigate the world of green investments with a balanced perspective, considering both the advantages and challenges. While green investments can provide a positive environmental impact, long-term sustainability and government support, they may also involve potentially lower immediate returns, limited investment options and the risk of greenwashing.

Despite these considerations, green investments promise diversification and exposure to innovative sectors such as renewable energy, sustainable agriculture and eco-friendly technology. These sectors continue to evolve, offering potential for growth and stability. As you consider your green investment journey, remember that it's not just about where you allocate your funds; it's about the positive impact your investments can have on the world. By carefully weighing the pros and cons, you can make informed decisions that resonate with your commitment to sustainability and responsible investing.

Before you consider Citigroup, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Citigroup wasn't on the list.

While Citigroup currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.